Cryptocurrencies Show Volatility, but Remain Above Resistance; Derivatives Volumes Drop

WorldCoinIndex Derivatives Report Week 9 2021, during this week of the year, most of the cryptocurrency market has experienced quite a high degree of volatility, with prices encountering multiple swings, both in upwards and downwards directions. However, most popular coins have remained above their key resistance points, thereby retaining most of the value obtained during the bull run.

Experts predict that as a whole, the market isn’t going to lose too much value moving forward. In fact, many believe that we find ourselves in the middle of a super cycle that may have more positive surprises in store for everyone.

In the case of bitcoin, a price peak of $52,500 was reported this week, alongside a price low a little above the $43,000 threshold. At press time, the largest cryptocurrency by market cap is trading at $48,105.

At press time, ETH is trading at $1,557, ADA at $1.12, LTC at $180, DOT at $33.33, BNB at $225, and Chainlink at $27.17.

The total cryptocurrency market cap is currently reported at $1.38 trillion.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

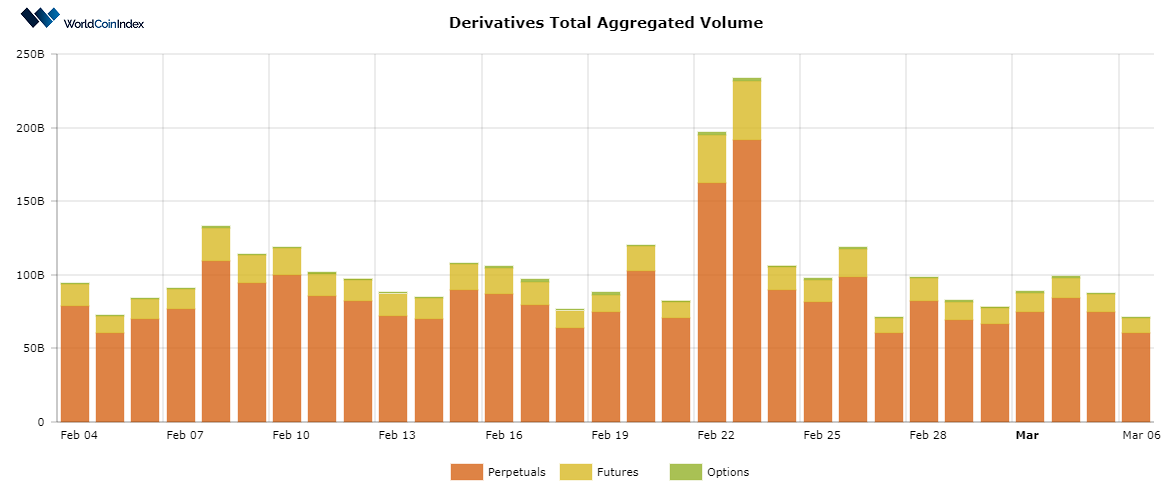

First off, the crypto derivatives aggregated volume has seen quite a considerable drop, from last week’s $125B, to $71.62B today.

This is normal however, given the fact derivative volumes often surge at the end of the month, and then drop abruptly as a new month begins.

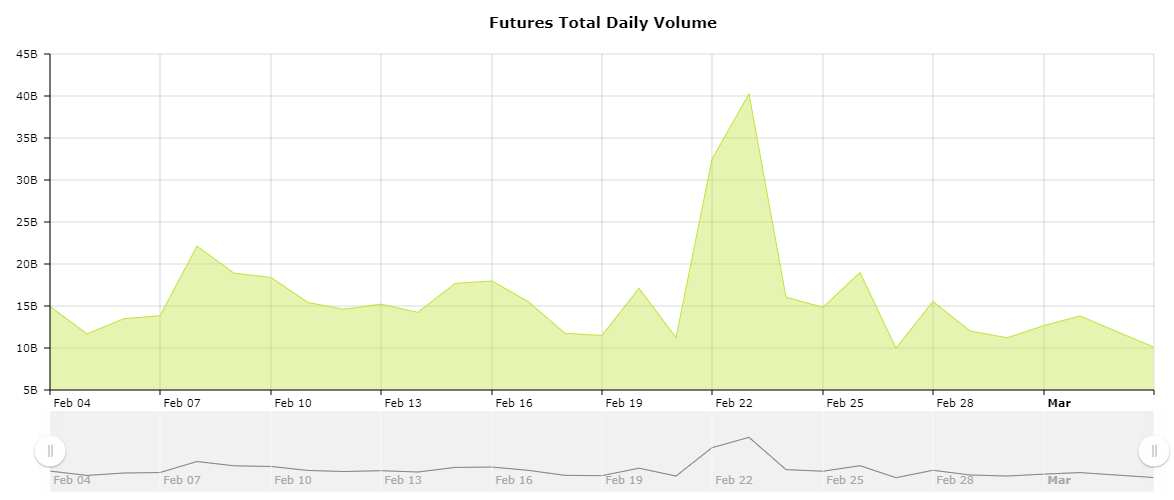

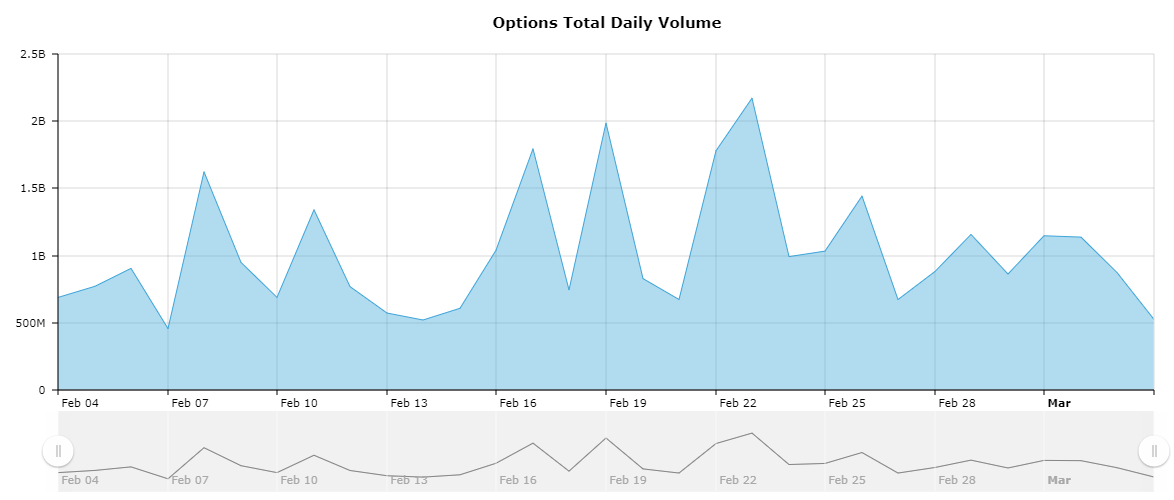

Here’s a brief look at trading volumes by derivatives category:

- The perpetuals trading volume is situated at $61.07B, as opposed to last week’s $104B

- The futures trading volume has dropped from $20.24B last week to 10B today.

- The options trading volume has also seen a drop from $1.12B to $515M, half of the previous value.

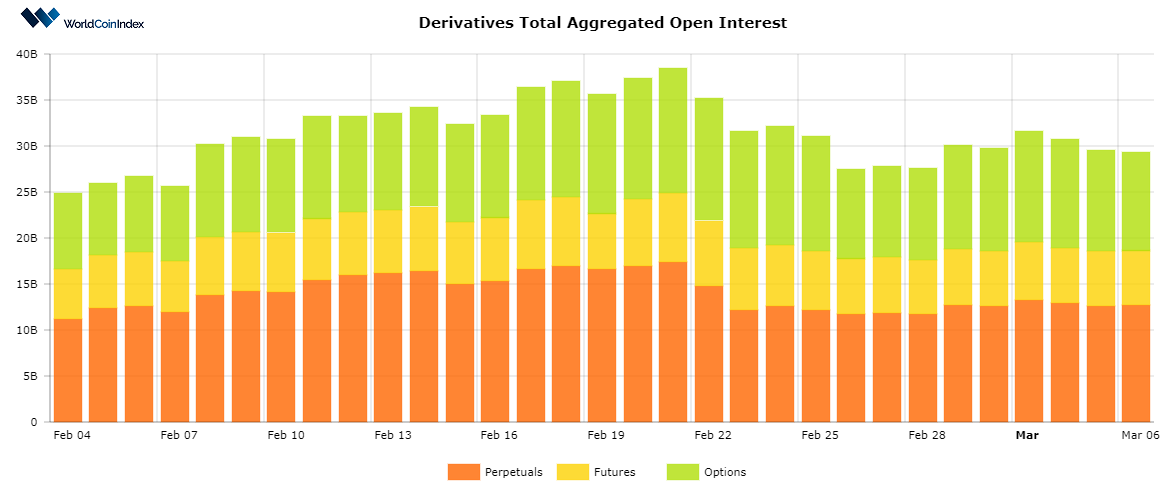

A quick look into the current open interest rates

At this point in time, the total aggregated open interest volume is situated at $29.53B, a mostly similar value when considering last week’s data.

From a category standpoint, perpetuals report an open interest of $12.71B, followed by $5.99B for futures, and $10.82B for options.

Relevant cryptocurrency derivatives news

- LedgerX announces the launch of a crypto derivatives exchange licensed by the CFTC

- CloseCross announces they’re the first blockchain derivatives trading service to obtain a European Union MIFID license.

- FTX derivatives trading platform now supports deposits via PayPal

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.