Cryptocurrency Market Continues Bull Run as BTC Reaches New ATH; Derivatives Prove Steady

WorldCoinIndex Derivatives Report Week 7 2021 ,during this week of the year, bitcoin has managed to surpass all expectations, thereby breaking the $50,000 mark and settling above this threshold. Bears have been proven wrong once again, as many believed that BTC’s price will dip as long-term holders rush to take profits.

Not only has BTC not dipped, but it just reached a new all-time high of $52,901. As it surpasses $50,000, many believe that bitcoin is now on the road to $100K, an important psychological barrier that will likely shape the future of the cryptocurrency market.

Other coins are also proving strong, given that ETH is trading at $1,929, BNB at $262, LTC at $232, DOGE at $0.056, XRP at $0.54, and EOS at $5.30.

Overall, the cryptocurrency market cap is reported at over $1.53T. A few weeks ago, the market cap surpasses the $1T mark for the first time ever, but now it seems likely that a $2T record is incoming rather quickly.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

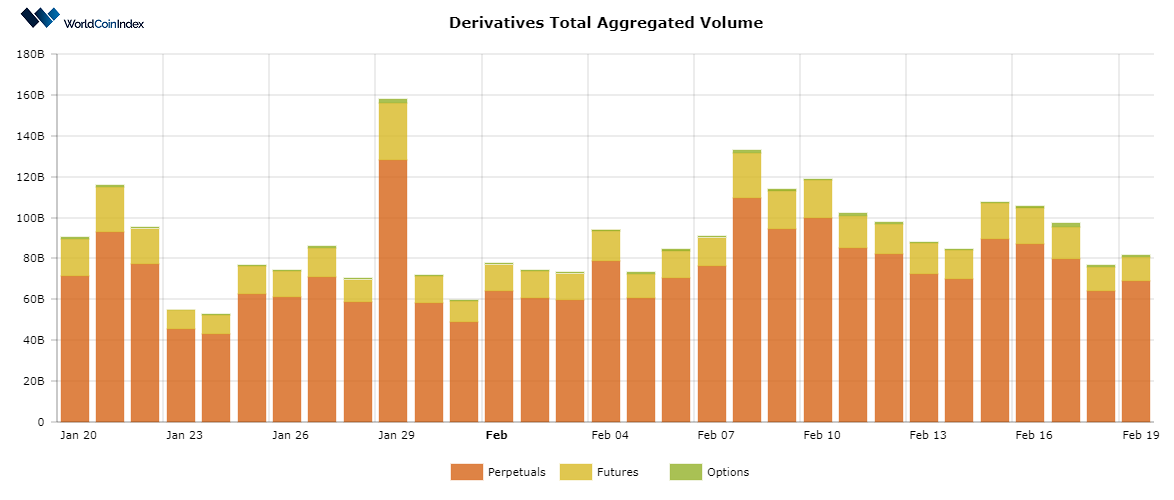

First off, the crypto derivatives aggregated volume has faced a drop from $100B last week, to $83.65B today.

This is nothing to worry about; rather, it’s a normal evolution in derivatives trading volumes that remains above the values reported in many of the previous months.

Here’s a brief look at trading volumes by derivatives category:

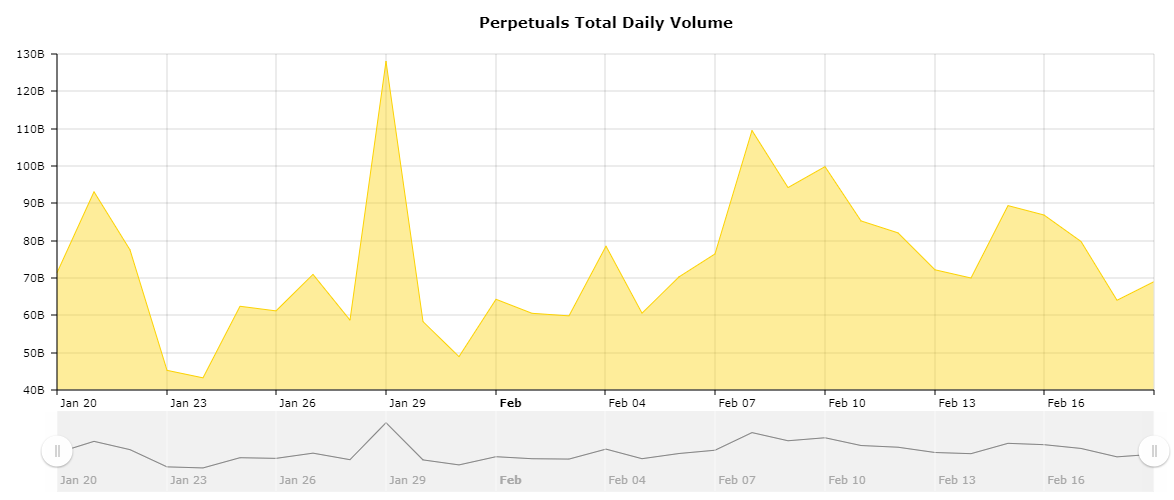

- The perpetuals trading volume is situated at $70.43B, slightly lower than last week’s $84.9B

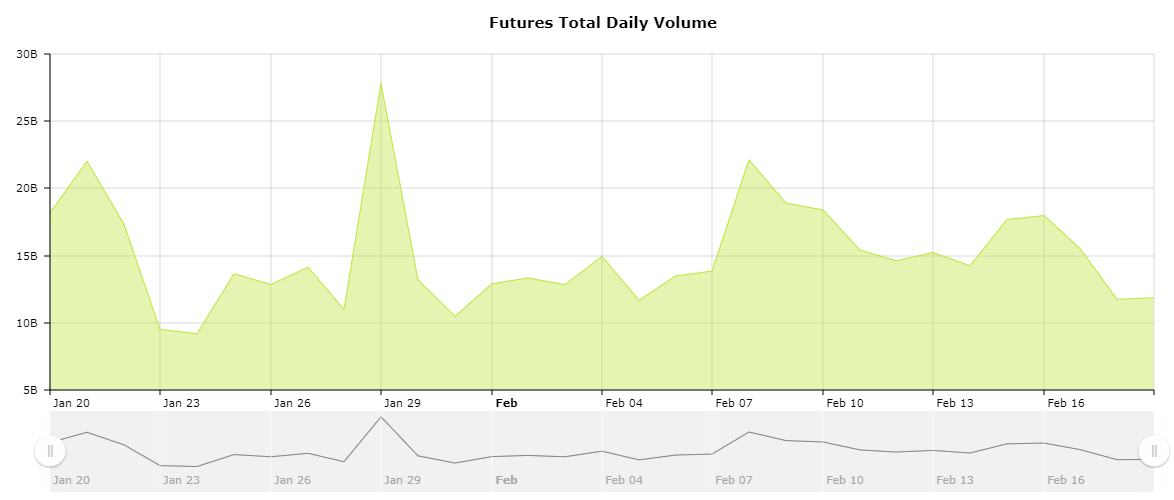

- The futures trading volume has also dropped from $14.67B to $12.18B

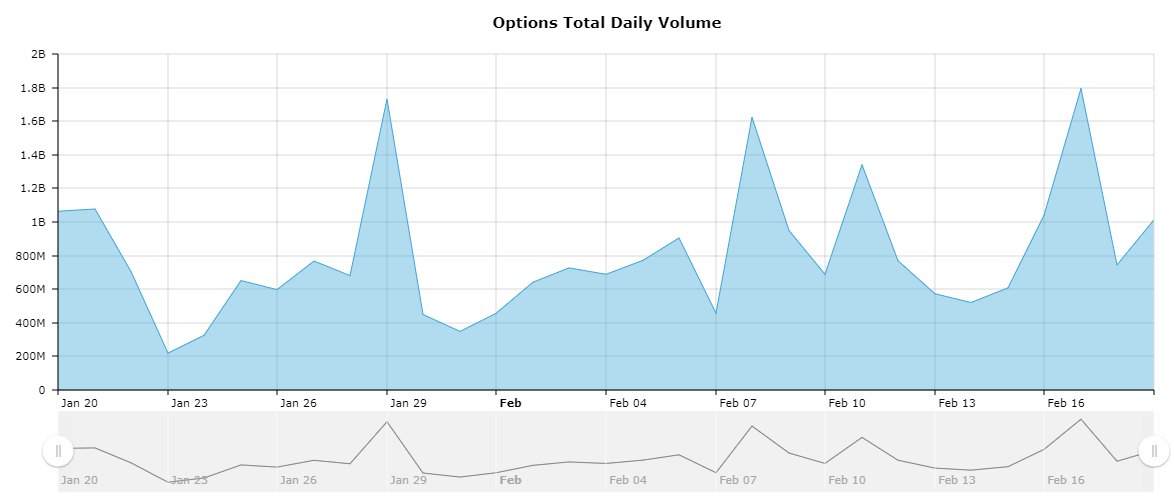

- The options trading volume on the other hand, has increased from $662M last week to slightly over $1B now.

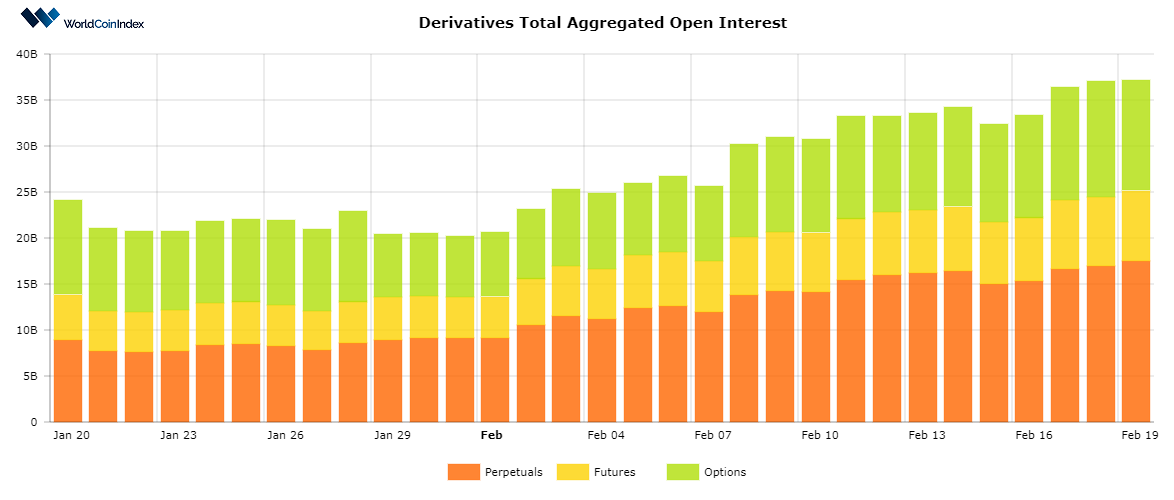

A quick look into the current open interest rates

At this point in time, the total aggregated open interest volume is situated at $37.09B, facing only a slight increase as opposed to last week’s $32.85B.

From a category standpoint, perpetuals report an open interest of $17.5B, followed by $7.6B for futures, and $11.98B for options.

Relevant cryptocurrency derivatives news

- Enigma’s crypto derivatives securities trading to be powered by Mercury Digital Assets

- Ether reported as overleveraged as the coin gets near to a $2,000 ATH

- Crypto.com announces the launch of its crypto derivatives exchange