Crypto Derivatives See Huge Value Boom; DOGE Rallying Against All Odds

During this week of the year, the cryptocurrency market has shown great volatility for most of the high-caps, alongside significant gains for some of the lower caps.

To kick things off, Dogecoin is by far the main coin placed under the spotlight this week. Whilst it is not yet clear whether Elon Musk’s support of DOGE is serious or a joke, the meme coin has seen a monumental boost, growing from a mere $0.07 price point, all the way up to $0.3. In fact, WorldCoinIndex reports that it’s the no. 1 coin in terms of trading volume right now. Most analysts suggest an imminent dump due to the mediocre fundamentals, but that remains to be seen.

On the other hand, bitcoin has reached a new all-time high of $64,764 this week, although it’s now facing a correction, having dropped to $60,772.

The total cryptocurrency market cap is currently reported at $2.08 trillion.

At press time, ETH is trading $2,397, XRP at $1.63, LTC at $279, EOS at $7.63, BNB at $528, and Tron at $0.15.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

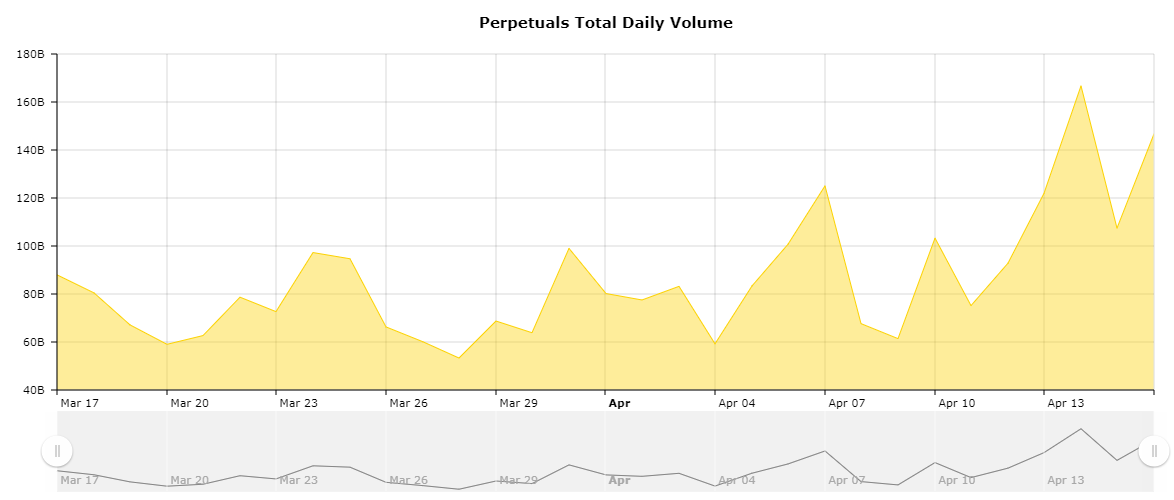

First off, the crypto derivatives aggregated volume has risen from $100B two weeks ago, all the way up to $166B today.

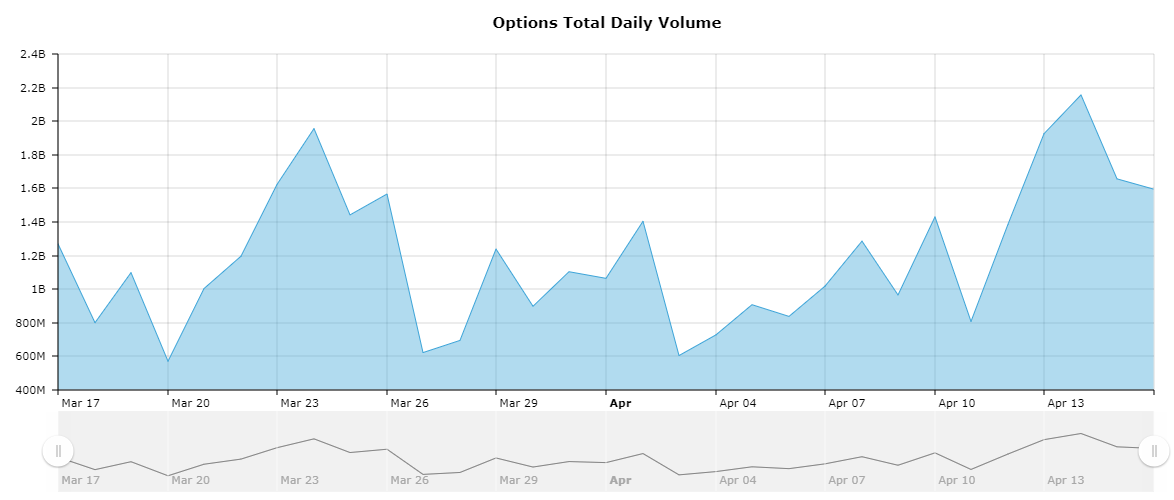

Here’s a brief look at trading volumes by derivatives category:

- The perpetuals trading volume is now reported at $145B, a significant growth when compared to previous trading volumes

- The futures trading volume is currently approximated at $18.82B

- The options trading volume has also risen towards the $1.58B threshold.

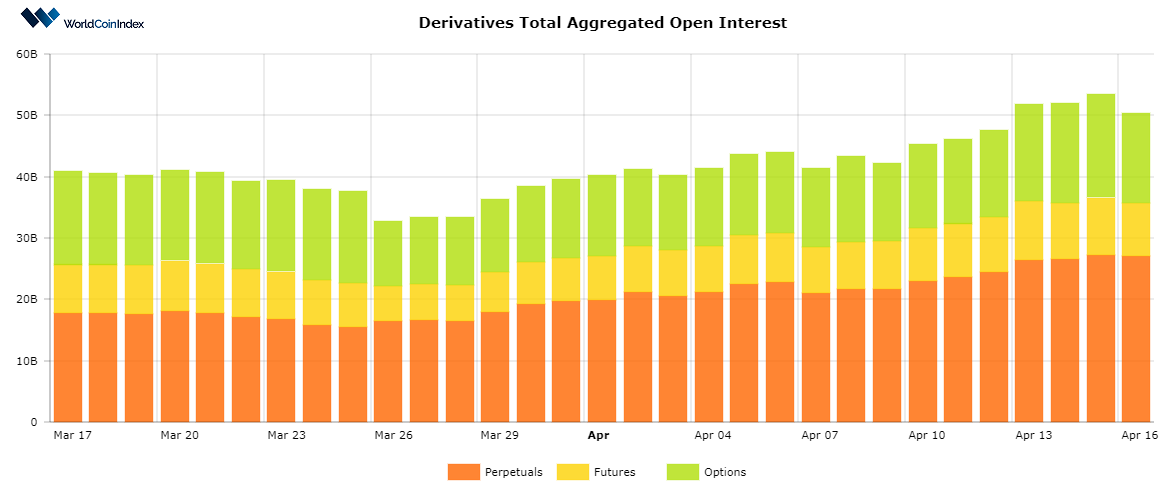

A quick look into the current open interest rates

At this point in time, the total aggregated open interest volume is situated at $50B.

From a category standpoint, perpetuals report an open interest of $26.88B, followed by $8.68B for futures, and $14.85B for options.

Relevant cryptocurrency derivatives news

- Experts predict Coinbase IPO may lead to higher derivatives volumes for cryptocurrencies

- PowerTrade announces imminent release of crypto options

- Open interest for bitcoin futures has crossed the record of $27B, right before the Coinbase listing.