WorldCoinIndex Derivatives Report 2020 – Week 33

The cryptocurrency market has had yet another interesting week, characterized by several price swings and trading volume modifications. Most coins went through some price drops, but price spikes followed shortly after, thereby stabilizing the value while also pushing the upper resistance.

This is the case with bitcoin, which is currently trading at $11,738. During the last week, our favourite cryptocurrency has seen a maximum low of $11,161, alongside a high of $12,047. Unfortunately, despite breaking the resistance, the BTC price did not stabilize above the $12K threshold.

At this point in time, it seems like Ethereum is enjoying quite a bit of popularity amongst traders. In fact, the cryptocurrency managed to reach a 24h volume of $8.83B, thus surpassing bitcoin’s $8.52B.

The total cryptocurrency market cap is currently reported at $367.82B.

ETH is currently trading at $426, XRP at $0.29, LTC at $56, EOS at $3.13, Chainlink at $17.04, and BCH at $292.36.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

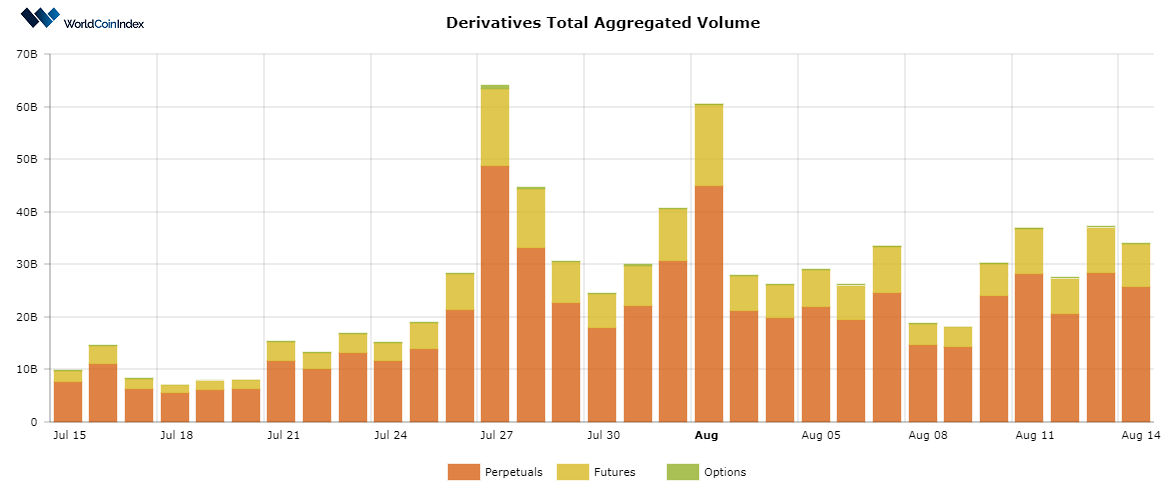

First off, the crypto derivatives aggregated volume has increased considerably from $26.40B to $34.11B, thus showcasing what a great week derivatives have had.

Here’s a brief look at trading volumes by derivatives category:

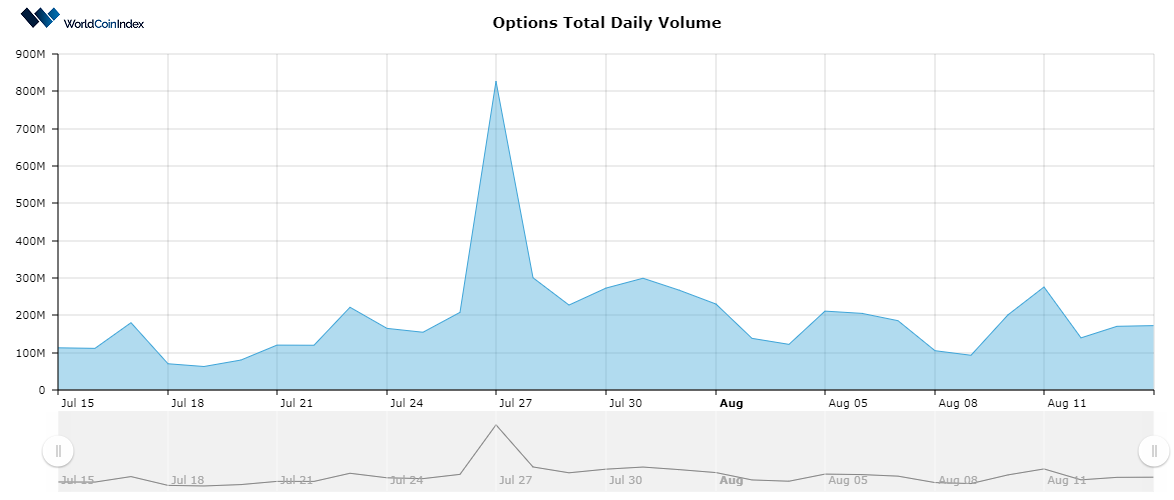

The options trading volume is situated at $171.2M, lower than last week’s $188.49M.

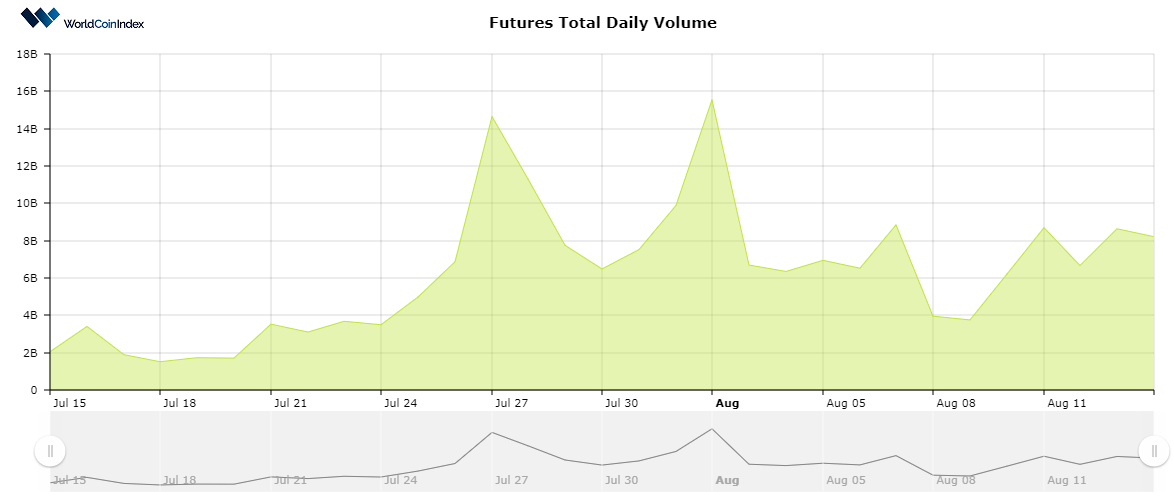

The futures trading volume has increased to $8.25B from $6.69B 7 days ago.

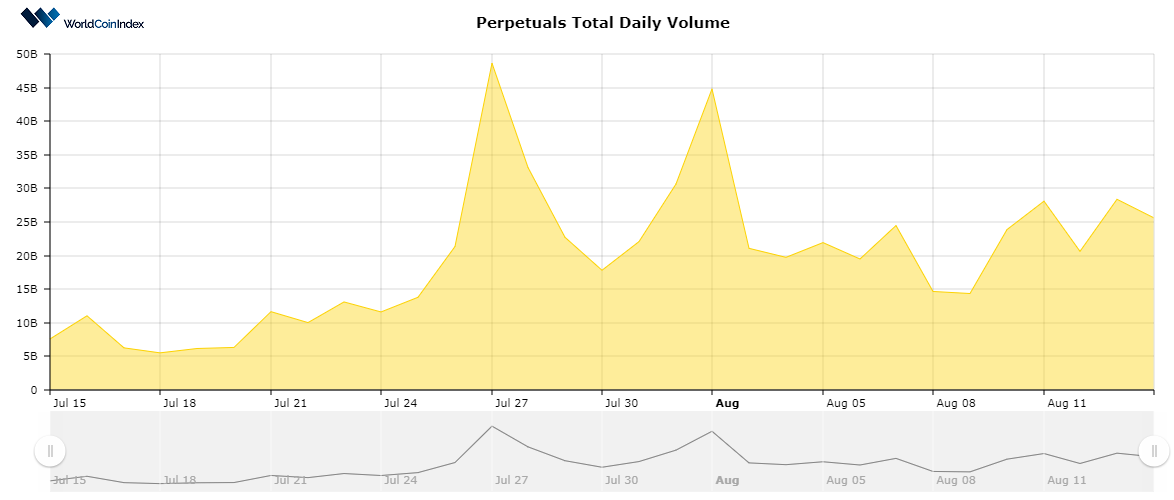

The perpetuals trading volume is currently estimated at $25.68B, thus being $6B higher than last week’s $19.51B.

Over a longer time-frame, it becomes quite clear that the cryptocurrency derivatives market has managed to rise above the Covid-19 pandemic, and is no longer majorly affected by the economic slowdown. If a similar trend is sustained, chances are that more exponential growth can be attained, as a larger number of investors begin considering these instruments.

A quick look into the current open interest rates

At press time, the total aggregated open interest volume is situated at $9.37B, which is quite similar to last week’s value.

From a category standpoint, perpetuals report an open interest of $4.40B, followed by $3.01B for futures, and $1.94B for options.

Other relevant market data

The last couple of days have brought along increased market traction for a number of decentralized finance projects (DEFIs). This market is actively consolidating while attracting the interest of fintech, blockchain and cryptocurrency enthusiasts worldwide.

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.