Bitcoin Is Dangerously Close to ‘Death Cross’ on Charts, Analysts Still Remain Hopeful

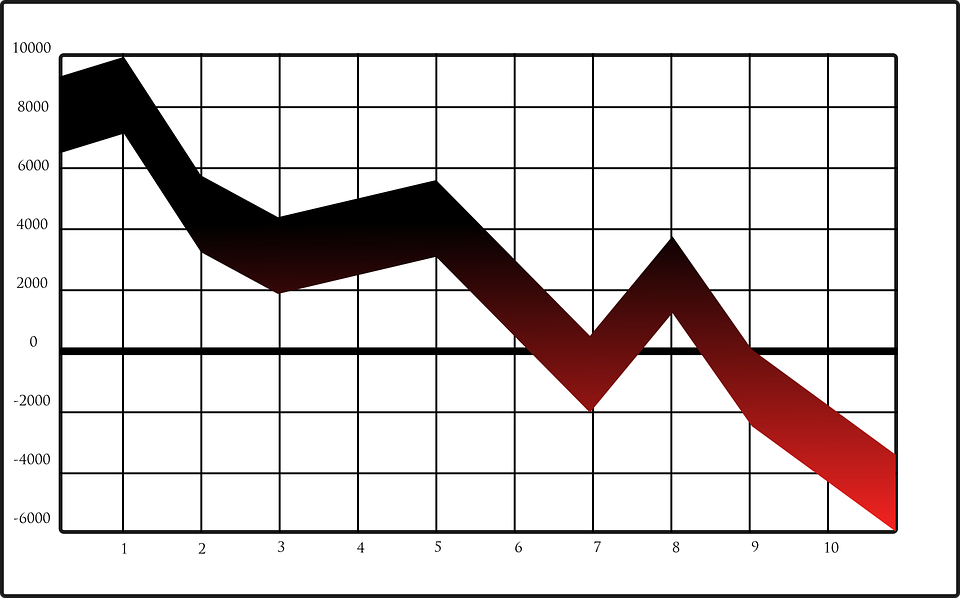

The crypto market meltdown is further inflicting more pain on the portfolios of crypto investors as the overall market valuations significantly slide below $300 billion. More importantly, the BTC price correction below $7,500 is more worrisome as the charts show Bitcoin approaching dangerously close to the “death cross”.

The “death cross” is a technical chart indicator based on the 50-day and 200-day moving averages. The “death cross” is a bearish indicator stating that the 50-day moving average is now moving below the 200-day moving average, which could mean a further deep decline in the coming time.

Jim Iuorio of TJM Institutional Services wrote to CNBC that "When we are talking about bitcoin, I think it's important to remember that we don't have much history to go off of to identify long term trends. That being said, any time the 50-day crosses the 200-day, it should flash a warning…and when you couple that with the fact that bitcoin has been trending steadily lower since the launch of futures, I think that it is a major negative.”

However, many analysts believe that the “death cross” can end up turning a big bear trap as it has potentially failed to trigger a big sell-off in the last two of the three events and could happen for the third time also.

As reported by Forbes, in one of the latest reports, Morgan Stanley has recently compared the price decline of Bitcoin with the Nasdaq tech bubble of the 1990s. However, the main difference in that the Bitcoin retreat has occurred at 15 times the rate of the tech bubble.

Morgan Stanley thus brings some cheer to Bitcoin supporters stating that the 70% erosion in the value is “nothing out of the ordinary” and usually, such corrections “have historically preceded rallies.” The investment banking giant further says that just as Nasdaq managed to gain in the subsequent years of the tech bubble, Bitcoin could pose a similar strong recovery ahead.

Another New York-based research firm Fundstrat believes that in addition to Bitcoin, other cryptocurrencies too have likely found a bottom and are poised for a recovery. Fundstrat, headed by strategist Thomas Lee, told its investors last week that pain of correction could be “largely over” even though the bull market might not be necessarily underway at this moment.

However, Lee told the investors that if they are at all considering to invest in altcoins they should stick with cryptocurrencies with strong fundamentals like Ethereum and Ripple.