BRICS Banks Come Together For Blockchain Research

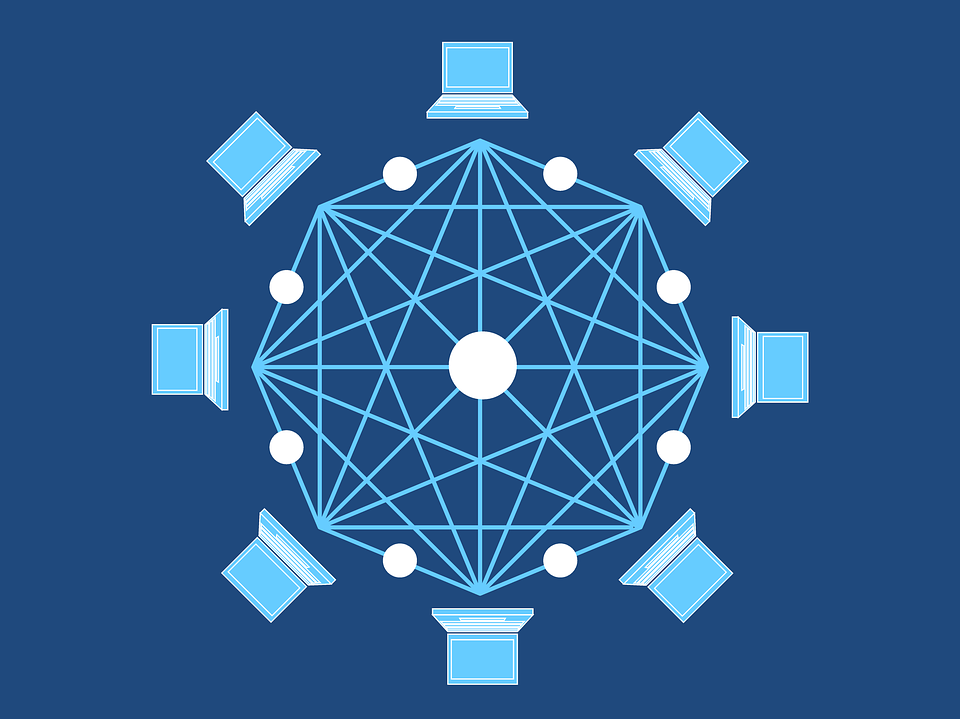

There is no doubt to it that blockchain technology is currently disrupting the existing banking payment systems, with several banking financial institutions turning towards this low-cost and fast payment processing DLT technology.

Major banking institutions from each of the five BRICS nations have come together to sign a Memorandum of Understanding (MoU) for the development of Distributed Ledger Technology (DLT).

BRICS countries’ leaders usually meet every year to discuss issues on several aspects like cultural, political and economic cooperation between the member states. During the 10 International BRICS summit recently conducted in Johannesburg, banking institutions of each of these five emerging economies agreed to carry a profound research on the use of blockchain technology “in the interests of the development of the digital economy.”

The five banking institutions to sign the MoU include the Brazilian National Bank for Economic and Social Development (BNDES), the China Development Bank, the Export-Import Bank of India, the State Corporation Bank for Development and Foreign Economic Affairs (Vnesheconombank), and the Development Bank of Southern Africa (DBSA).

While commenting on the new development, Mikhail Poluboyarinov, First Deputy Chairman - Member of the Board of Vnesheconombank said: "Vnesheconombank works with the development banks of BRICS countries in a range of key areas, including financial cooperation, developing credit financing in national currencies and implementation of innovations. This joint work opens new opportunities for Russian exporters, operators of large industrial projects, recipients of investments. The current agreement allows the development banks of BRICS countries to study the applications of innovative technologies in infrastructure finance and bank products optimization.”

Several banking institutions from around the globe are working on solutions to integrate the blockchain technology to their banking systems. A recent report shows that UK’s central bank - Bank of England (BoE) plans a complete overhaul of its RTGS payment system using the blockchain technology wherein it can integrate several fintech firms in UK’s booming blockchain market.

To test its revamped RTGS system, the Central bank has tied up with several DLT startups like R3, Baton Systems, Token and Clearmatics Technologies. The newly published report shows that all these participants have expressed confidence and were easily able to connect to the banks RTGS systems for transaction settlements.

The statement from BoE reads: “All participants confirmed that the functionality offered by the renewed RTGS service would enable their systems to connect and to achieve a settlement in central bank money. A number of recommendations were received to ensure optimal access to central bank money.”