Crypto Derivative Volumes Face Steady Early-Month Increase

WorldCoinIndex Derivatives Report 2020 Week 40 - During the 40th week of this year, cryptocurrency prices attempted yet another resistance break, yet they were quickly slowed down by several worldwide events – the CFCTC initiated legal action against the BitMEX exchange, whereas President Donald Trump recently confirmed that he was infected with Covid-19. The derivatives market saw a steady growth throughout the week, as highlighted below.

With these aspects in mind, the bitcoin price saw a price high of $10,953 this week, which quickly fell to a low of $10,418. This crash happened over the span of one day, therefore once again proving that cryptocurrency volatility is no joke. Despite this aspect, most experts believe that cryptocurrency prices will quickly recover and move onto a lengthy uptrend.

At press time, BTC is trading at $10,457, ETH at $339, XRP at $0.231, LTC at $44.73, EOS at $2.47, Uniswap at $3.84, and Chainlink at $8.98.

The total cryptocurrency market cap is currently reported at $332.29 billion.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

First off, the crypto derivatives aggregated volume has slightly increased from $24.31B last week, to $26.47B today. It is expected that this volume will continue to grow, since we’re in early October and numerous derivatives contracts are generally signed at this time of the month.

Here’s a brief look at trading volumes by derivatives category:

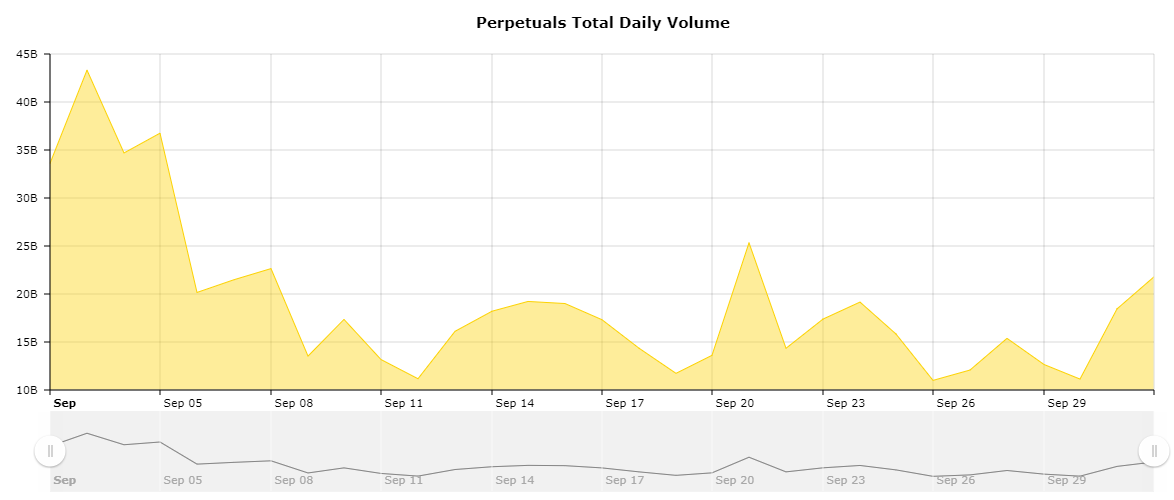

- The perpetuals trading volume is reported at $21.07B, higher than last week’s $18.96B

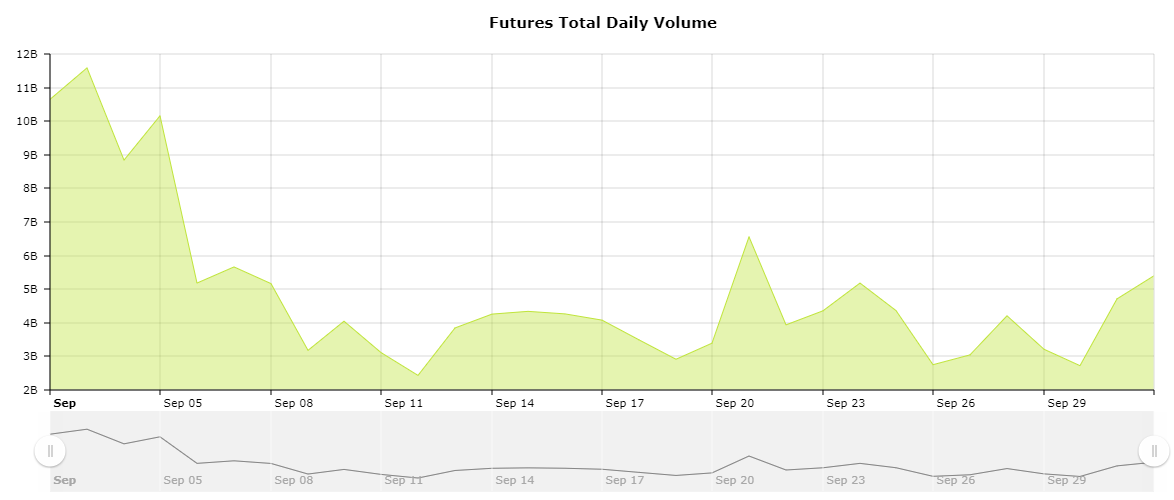

- The futures trading volume has also slightly increased to $5.25B from $5.12B

- The options trading volume has decreased from $223.11M to $150.12M

A quick look into the current open interest rates

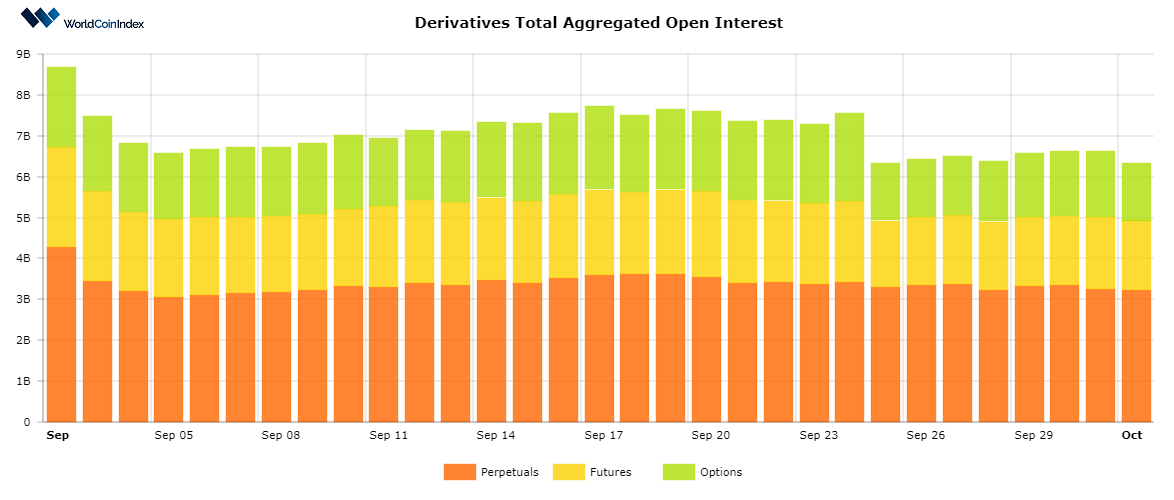

At this point in time, the total aggregated open interest volume is situated at $6.37B.

From a category standpoint, perpetuals report an open interest of $3.25B, followed by $1.7B for futures, and $1.41B for options.

Relevant cryptocurrency derivatives news

- The popular BitMEX derivatives exchange has been accused by the CFTC of failing to comply with the US anti-money laundering regulations, by choosing to not introduce a KYC procedure – furthermore, the exchange is also being accused of knowingly facilitating money laundering.

- Bittrex Global exchange receives worldwide operational license from the Bermuda Monetary Authority

- Experts state that reduced bitcoin futures volume may predict an upcoming bullish trend.

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.