Bullish Sentiment Builds in Light of $6B Crypto Options Expiring Today

During this week of the year, the cryptocurrency market has continued its path of volatility. While the most coin prices have mostly moved sideways, bitcoin fell approximately $10K from its all-time high, creating a short wave of panic selling.

The bearish sentiment is mostly out of the way now, with buy walls being eaten through on most major cryptocurrency exchanges. Furthermore, $6B in crypto options are destined to expire today, instilling expectations for price growth, especially given the fact that historically, April has almost always been a bullish month.

In the case of bitcoin, a price peak of $59,700 was reported this week, followed by a low of $50,500. At press time, bitcoin is trading at $53,294, positioning itself on the path to recovery and possibly higher prices.

The total cryptocurrency market cap is currently reported at $1.52 trillion. .

ETH is currently trading at $1,622, XRP at $0.55, ADA at $1.21, LTC at $175, QTUM at $8.67, and BNB at $248.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

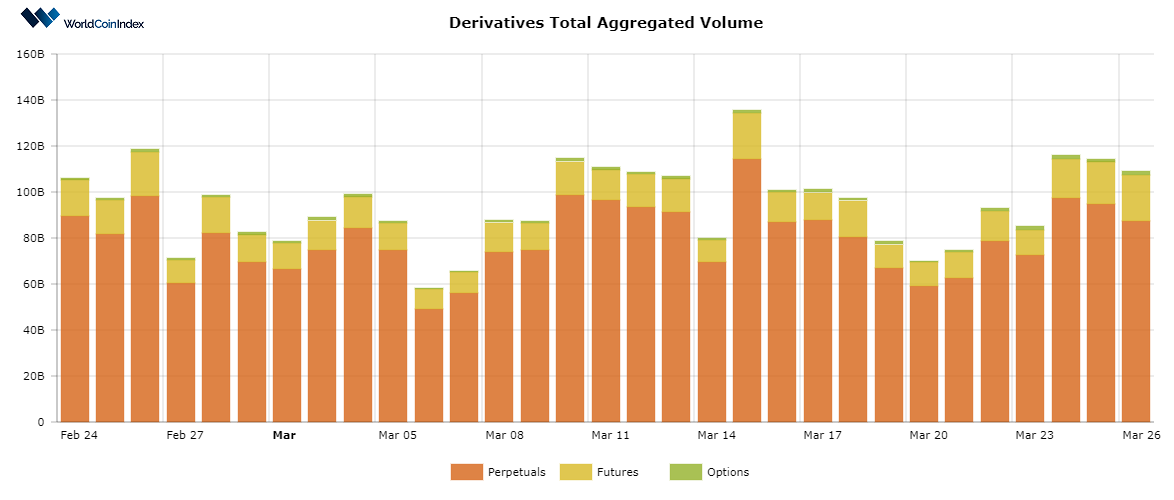

First off, the crypto derivatives aggregated volume has remained relatively stable at $107.7B, as opposed to last week’s $110.68B.

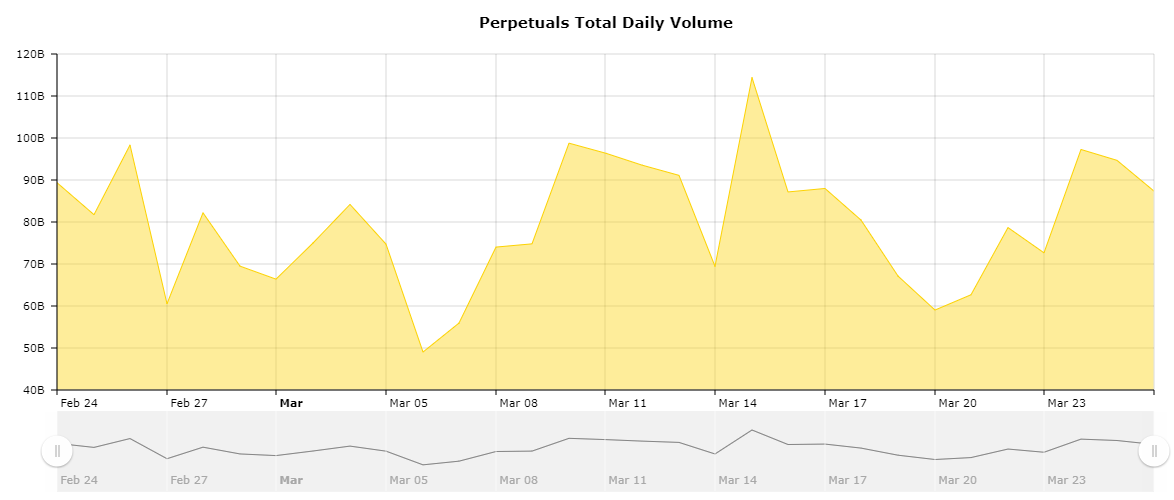

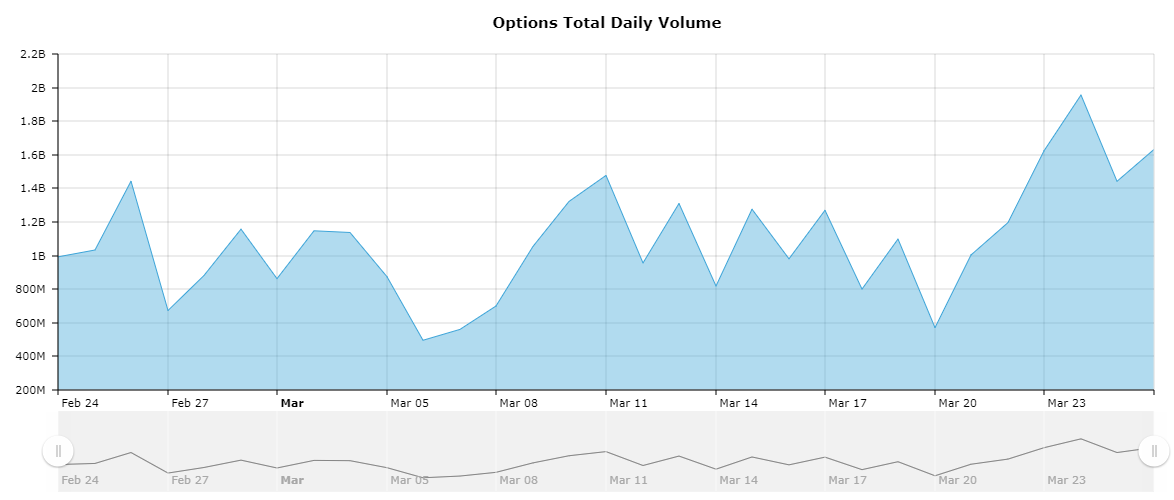

Here’s a brief look at trading volumes by derivatives category:

- The perpetuals trading volume is reported at $86.31B, about $10B less than last week’s $95B valuation.

- The futures trading volume is situated at $19.79B, growing from last week’s $13.43B

- The options trading volume is estimated at $1.59B, remaining stable relative to last week’s volume of $1.41B.

A quick look into the current open interest rates

At this point in time, the total aggregated open interest volume is situated at $32B, dropping slightly from last week’s $32.05B.

From a category standpoint, perpetuals report an open interest of $15.92B, followed by $6.2B for futures, and $9.92B for options, with roughly $6B worth of options due for expiry today.

Relevant cryptocurrency derivatives news

- Xsigma, a subsidiary of ZK International has announced the upcoming launch of a trading platform for crypto derivatives and CFDs

- $2.4 billion worth of futures contracts have been liquidated in under 24 hours during this week

- Robinhood trading platform places more focus on cryptocurrencies, announcing a huge team expansion.

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.