Bitcoin Breaks Previous All-Time High, Derivatives Volume Remains Stable

During this week of the year, bitcoin’s massive bull run continued, concluding in a new all-time high. With this in mind, bitcoin saw a price peak of $29,509, considerably higher when compared to the high attained during the previous week, estimated at $24,463. The quick price ascension of the cryptocurrency is fascinating, as it had minimal negative volatility throughout the week, bringing yields to all traders who have longed bitcoin.

Most other digital currencies are also in the green, despite achieving a lower growth rate. At press time, ETH is trading at $739, XRP at $0.23, LTC at 128.11, EOS at $2.66, Polkadot at $8.97, and Chainlink at $12.40.

The total cryptocurrency market cap is currently reported at $758 billion, roughly $100 billion more when compared to the previous week.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

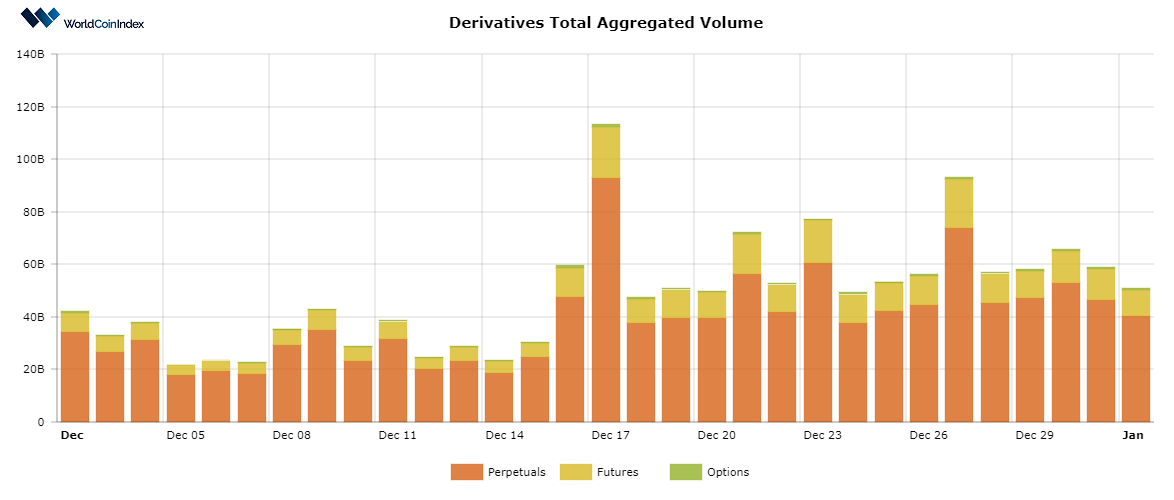

First off, the crypto derivatives aggregated volume has risen from $46.30B to $50.27B.

Albeit being a small increase, it is likely that derivative trading volumes will further increase throughout the month of January, as numerous contracts have recently expired. Given the on-going bull run, some experts predict record-high crypto derivative volumes.

Here’s a brief look at trading volumes by derivatives category:

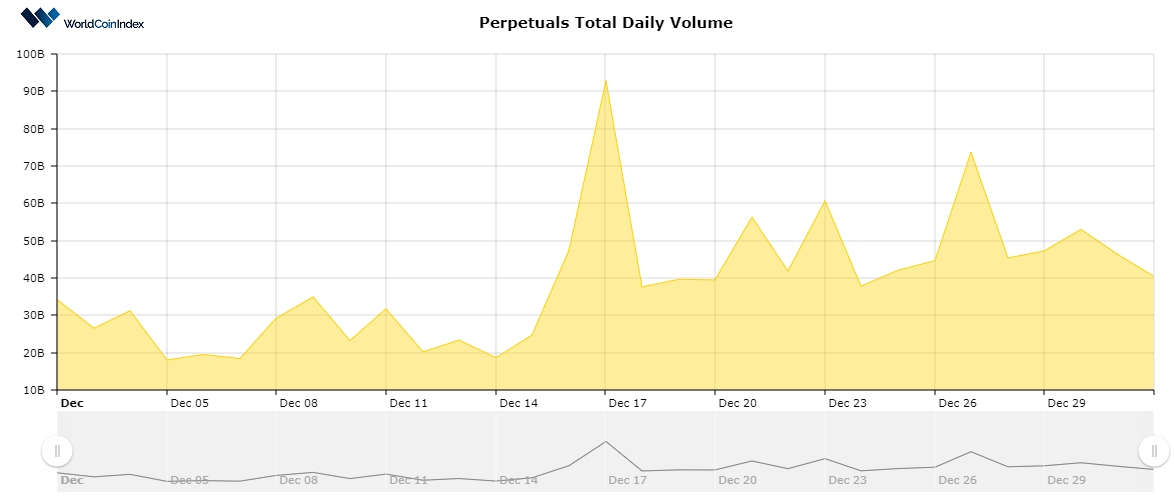

- The perpetuals trading volume is reported at $39.95B, on the rise from last week’s $35.52B

- The futures trading volume has slightly decreased from $10.11B last week to $9.71B today.

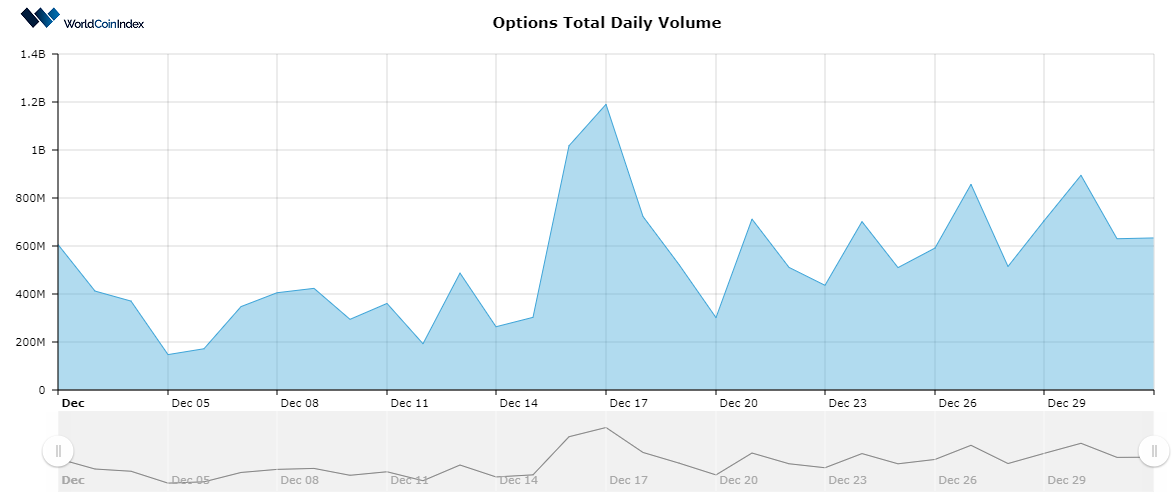

- The options trading volume has slightly dropped from $661.91M to $607.26M.

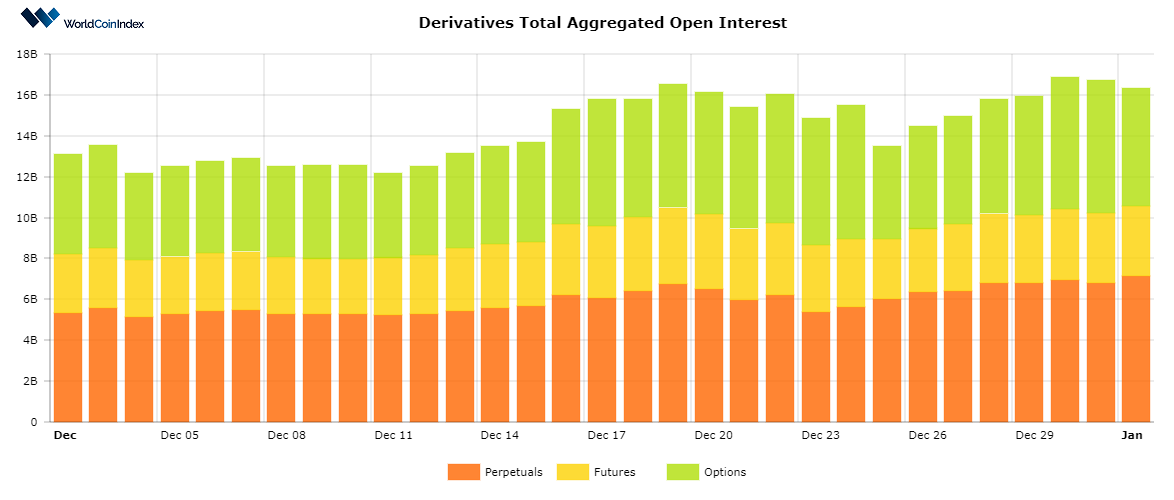

A quick look into the current open interest rates

At this point in time, the total aggregated open interest volume is situated at $16.71, thereby showcasing an increase to last week’s $13.50B.

From a category standpoint, perpetuals report an open interest of $7.06B, followed by $3.40B for futures, and $5.70B for options.

Relevant cryptocurrency derivatives news

- Binance officially launches bitcoin options, marking an expansion of its derivatives catalogue

- Following FCA’s retail crypto derivative sales ban, FXOpen delists crypto CFDs in the UK

- CME Group ranks first in derivative market capitalization for bitcoin futures

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.