WorldCoinIndex Derivatives Report 2020 - Week 23

General weekly stats

The cryptocurrency market has faced a good deal of volatility during the last week. Bitcoin has finally managed to surpass the $10,000 threshold during a rapid bull run that led to a $500 value increase during a few hours. A flash crash then followed, yet the cryptocurrency quickly regained its price. At this time, bitcoin is trading at values that are higher comparing to those in week 22.

According to experts, the recent volatility is being caused by economic uncertainty in the United States and the street protests.

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market:

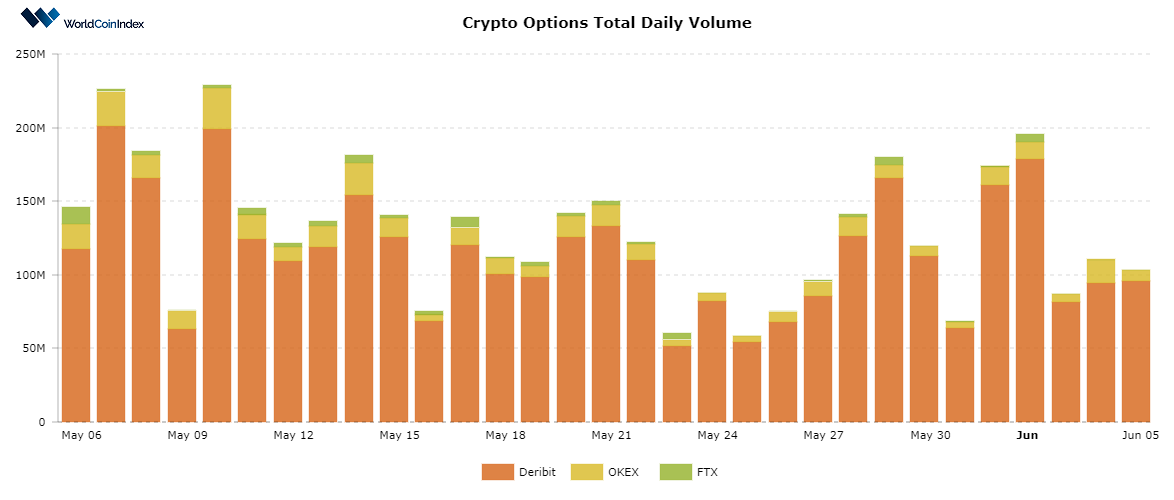

Between the 29th of May and 5th of June, options volume went through a sharp drop, from $180.09M, all the way down to $109.99M.

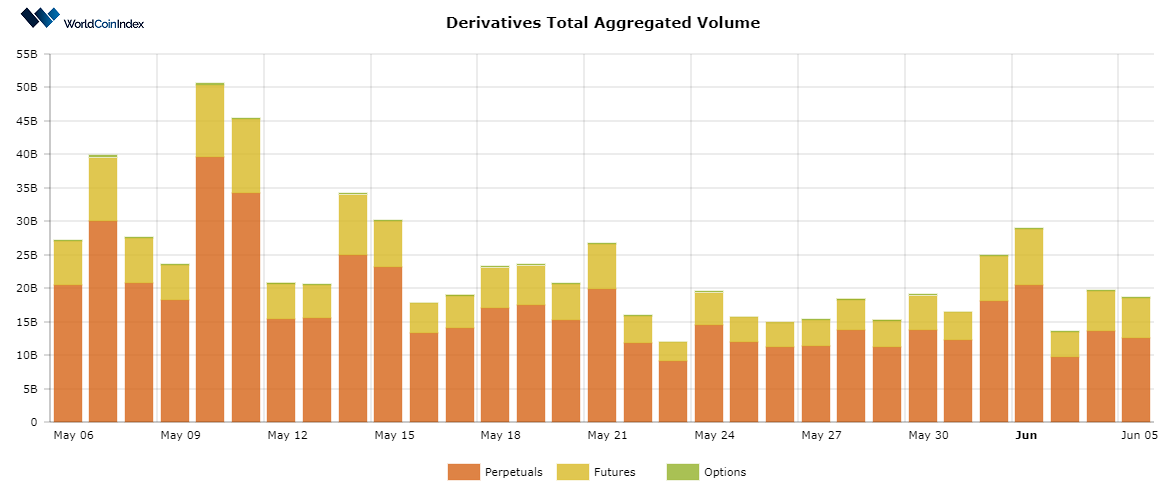

Futures increased from $3.98B to $6.47B, whereas perpetuals changed from $11.17B to $13.82B.

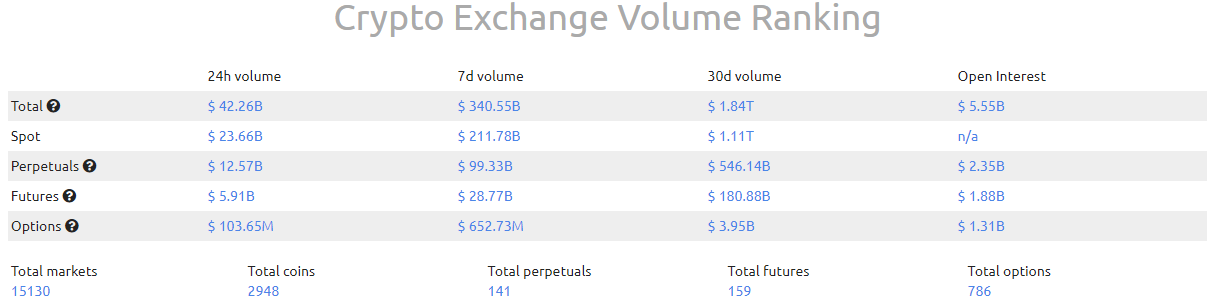

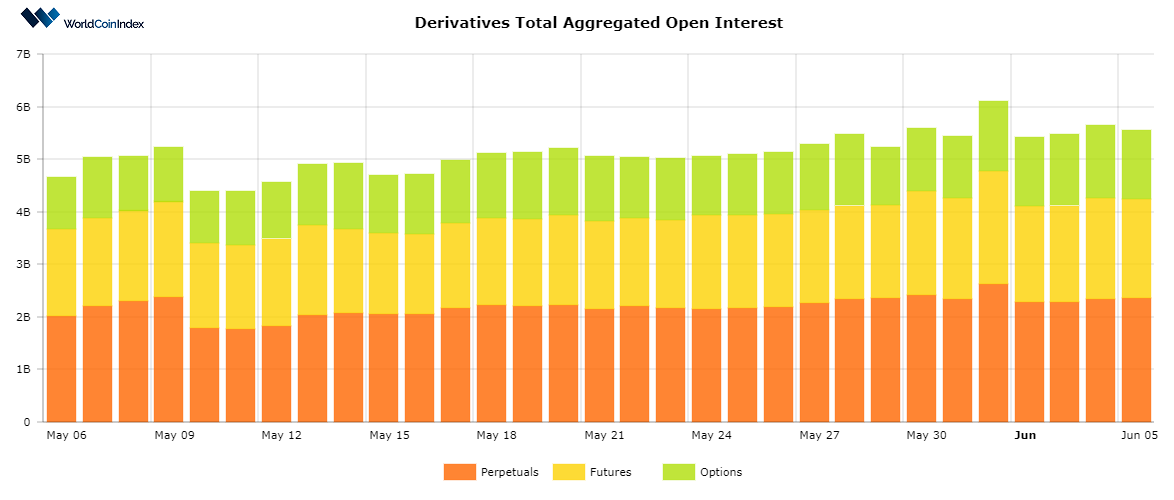

At this moment, the total volume of the crypto derivatives market is situated at $20.39B. On the other hand, the total derivatives aggregated open interest value is situated at $5.58B, on the rise when compared to last week’s $5.12B value.

A quick look into the current open interest rates

At the time of writing, the perpetuals open interest is estimated at $2.38B, at a slight difference when compared to last week’s $2.36B value. The open interest of options has increased from $1.11B to $1.31B, whereas the futures open interest is also seeing a rise, from $1.77B to $1.89B.

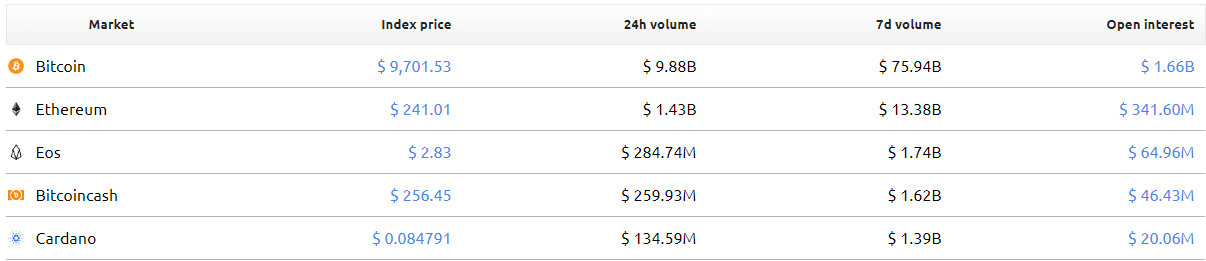

In terms of the open interest rates for the top 5 cryptocurrencies by 24H volume, Bitcoin is currently reporting $1.66B, followed by Ethereum with $34.6M, EOS with $64.96M, Bitcoin Cash with $46.43M, and lastly, Cardano with $20.06M.

Relevant cryptocurrency exchange derivatives data

A $340.55B 7-day volume has been recorded during the past week across all cryptocurrency exchanges. In terms of perpetuals, Huobi continues to rank first in terms of 24H and 7-day volume, followed by Binance and Bitmex in terms of perpetuals.

The recent price swings on the cryptocurrency market do showcase that bitcoin derivatives are holding strong, despite worldwide economic slowdown during the last couple of months. Regardless, most experts do agree that more bull runs are likely to occur once overall spending increases again.

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.