Intel to Discontinue Manufacturing of Bitcoin Mining Chips Affecting the Miner Community

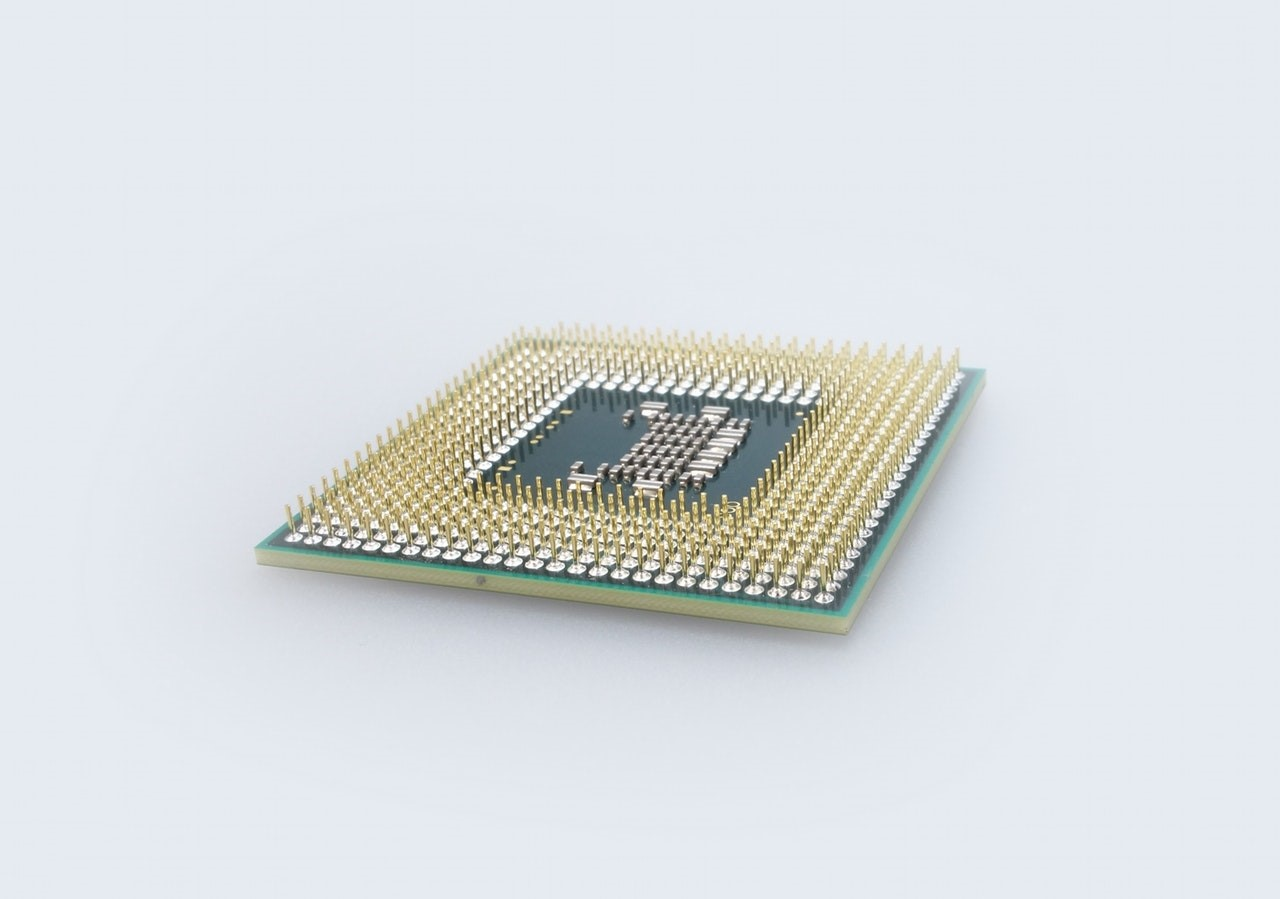

On Tuesday, April 18, the US-based chip manufacturing giant Intel announced that it plans to discontinue the manufacturing of first-gen Blockscale 1000-series chips quite popularly used for the Bitcoin mining activities.

It was just last year in April 2018 that Intel had launched its Bitcoin mining ASICs into the market. As reported by Reuters, Intel shall stop the manufacturing of its Blocksale 1000 Series ASICs by Oct. 20. Additionally, it also plans to stop the shipping roughly by April 2024.

Last year when Intel launched its Blocksale chips, it stated that the ASIC hardware would have a hashrate of up to 580 gigahash per second. Intel also stated that each of the Blocksale chips would be capable of being combined and merged into a single mining unit.

The launch of these ASICS had garnered strong inquiries from some of the top crypto mining firms such as Argo Blockchain, Block, Hive Blockchain Technologies and GRIID Infrastructure who had already integrated the technology into their operations.

The sudden decision by Intel to stop manufacturing these Blockscale 1000-series comes as Intel is planning to put more focus on its IDM 2.0 operations. This move is also in line with the company’s trend of exiting several businesses amid a company-wide plan of restructuring and reorganizing processes.

Speaking to popular tech publication Tom’s Hardware, Intel said: “As we prioritize our investments in IDM 2.0, we have end-of-lifed the Intel Blockscale 1000 Series ASIC while we continue to support our Blockscale customers.”

With IDM 2.0, Intel plans to increase the number of clients for who it is currently producing semiconductors. Furthermore, it also plans to increase the output of smaller and faster chips.

As all landing sites for Intel’s Blockscale ASIC chips go offline, Intel has not disclosed any plans of the next-generating Bitcoin mining equipment. Does this mean that Intel is looking to entirely exit the Bitcoin mining sector? Well, not so. When asked by Tom’s hardware, Intel said: “We continue to monitor market opportunities.”

The Bitcoin mining sector faced severe headwinds during last year’s crypto winter of 2022. Several miners faced massive losses as the BTC price tanked and they had to liquidate their BTC holdings to cover the operational costs.