Crypto Market Shows Great Opportunity for Swing Traders; Derivatives Volume Sees Slight Drop

During this week of the year, the cryptocurrency market has seen quite a bit of volatility, expressed by abrupt price rises followed by prices settling down to slightly lower levels. Resistances have been tested, however, and it looks like the market’s bull run is still in swing.

Bitcoin has seen intensive levels of volatility, yet there’s nothing to panic about. At the start of the week, the coin reached yet another all-time high, this time $61,632. However, traders everywhere rushed to take profits, so the coin understandably dropped to a low of $53,421. Luckily, recovery came shortly afterwards, with yet another uptrend leading to $60,000. At press time, bitcoin is trading at $58,232.

ETH is currently trading at $1,802, ADA at $1.25, CHZ at $0.7, LTC at $202, XRP at $0.46, and BNB at $265.

The total cryptocurrency market cap is currently reported at $1.65 trillion.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

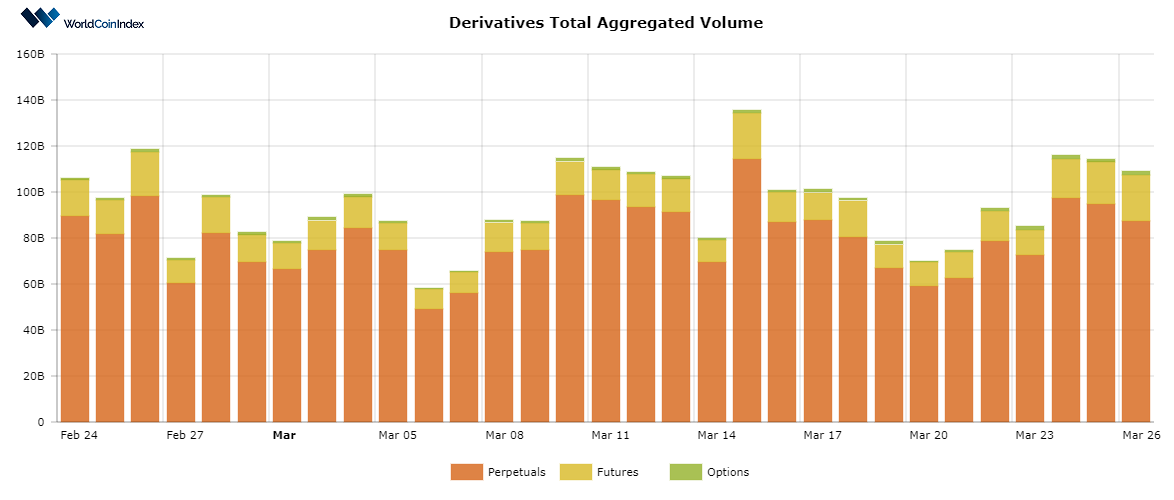

First off, the crypto derivatives aggregated volume has decreased from $110B to $95B, a fall that’s only normal in mid-month since volumes generally rise towards the end of the month.

Here’s a brief look at trading volumes by derivatives category:

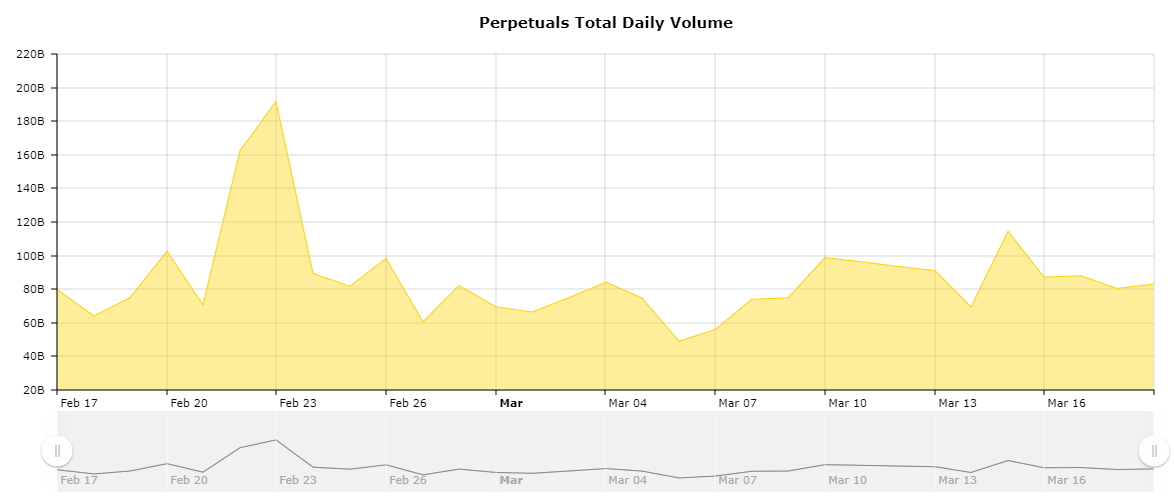

- The perpetuals trading volume is reported at $83.29B, slightly lower than last week’s $95B.

- The futures trading volume is estimated at $11.79B, as compared to $14.43B seven days ago.

- The options trading volume has dropped to $830M from $1.41B last week.

A quick look into the current open interest rates

At this point in time, the total aggregated open interest volume is situated at $39.98B, keeping itself incredibly stable over the previous week’s values.

From a category standpoint, perpetuals report an open interest of $17.64B, followed by $7.89B for futures, and $14.44B for options.

Relevant crypto derivatives news

- US CFTC financial regulator starts investigation into Binance’s BTC-USD price trading by US residents

- Vega derivatives trading platform raises $5 million in 1st funding round

- Founder of derivatives trading platform BitMEX is facing bank secrecy charges.

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.