Cryptocurrency Prices Drop Amidst Lesser Market Momentum

WorldCoinIndex Derivatives Report Week 8 2021, during this week of the year, most of the market’s cryptocurrencies have seen a sharp drop in prices, mostly caused by decreasing momentum and traders worldwide taking profits. In fact, the initial downtrend commenced after a miner decided to sell several millions USD worth of bitcoin. While the digital currency market did partially recover for a day or two, the temporary bear market doesn't seem to be over yet.

Of course, this does not translate to sell your crypto. On the contrary, professional traders worldwide see this as an excellent time to further increase their holdings by buying in the red. This also isn’t anywhere close to a market collapse. Since the price dropped by a few percent, people panic sold as it usually happens on the cryptocurrency market.

Bitcoin saw the hardest value drop, falling from its all-time high value of above $58,000 to $46,000 in a matter of days. At press time, the digital currency is trading at $47,061.

ETH is currently trading at $1,492, XRP at $0.43, LTC at $174, ADA at $1.13, BNB at $228, and DOT at $31. The total cryptocurrency market cap is currently reported at $1.32 trillion.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

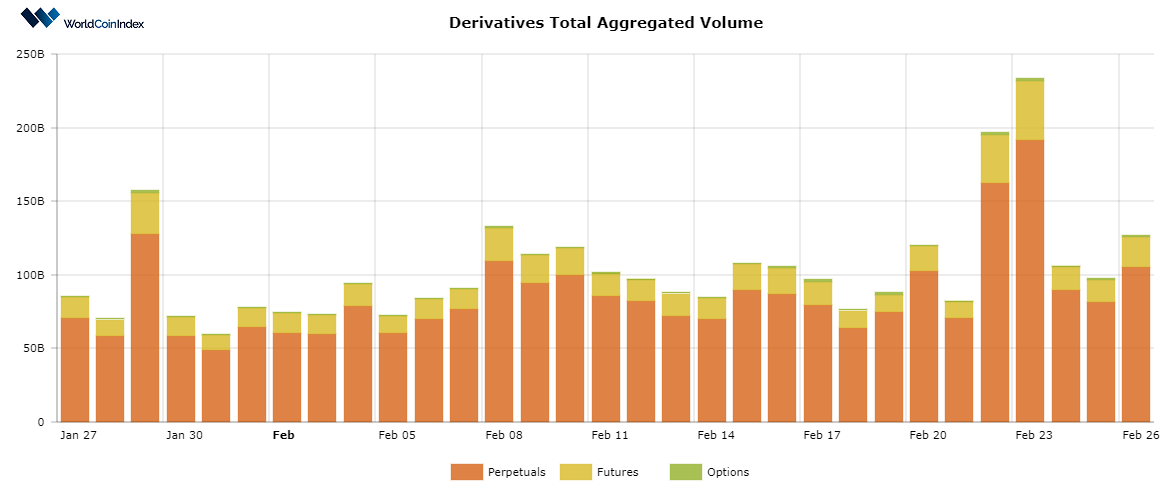

First off, the crypto derivatives aggregated volume has seen quite a noticeable increase, from $83B last week to $125B today.

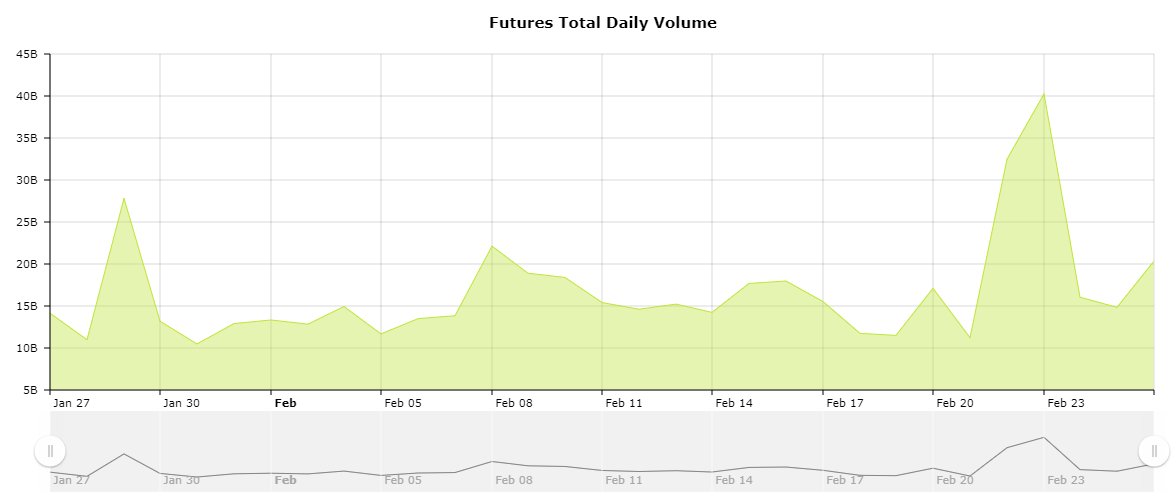

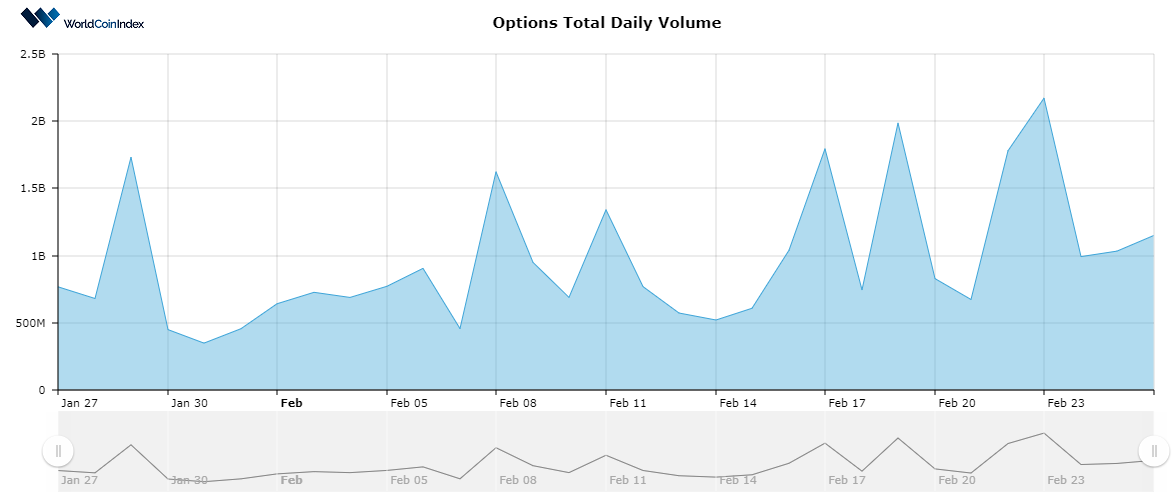

Here’s a brief look at trading volumes by derivatives category:

- The perpetuals trading volume has grown from $70.43B last week to $104.62B today.

- The futures trading volume has risen from $12.18B last week to roughly $20.24B today.

- The options trading volume has also seen a slight increase from $1B last week to $1.12B now.

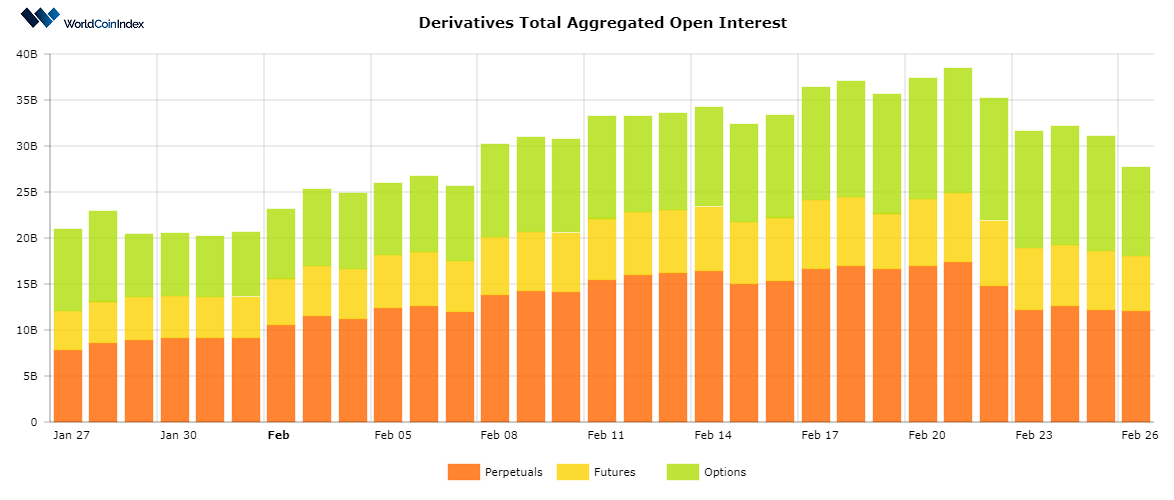

A quick look into the current open interest rates

At this point in time, the total aggregated open interest volume is situated at $27.54B, relatively lower than the previously reported value of $37.09B.

From a category standpoint, perpetuals report an open interest of $11.96B, followed by $5.99B for futures, and $9.59B for options.

Relevant cryptocurrency derivatives news

- FTX digital currency derivatives exchange launches futures trading concerning the potential happening of the 2021 Olympic Games

- Derivatives IG Group officially terminates retail derivatives trading following the unpleasant FCA ban

- BitMEX announces they have successfully surpassed $1tn worth of derivatives trading volume within the last year

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.