WorldCoinIndex Derivatives Report 2020 - Week 22

General weekly stats

A wave of volatility has gone through the cryptocurrency market this week, thus leading to an overall price dip, which was quickly followed by an abrupt increase in prices. At the time of writing, Bitcoin is trading at $9,458 Ethereum at $220, Ripple at $0.19, and Bitcoin Cash at $237.

Here’s a quick preview of last week’s changes on the derivatives market:

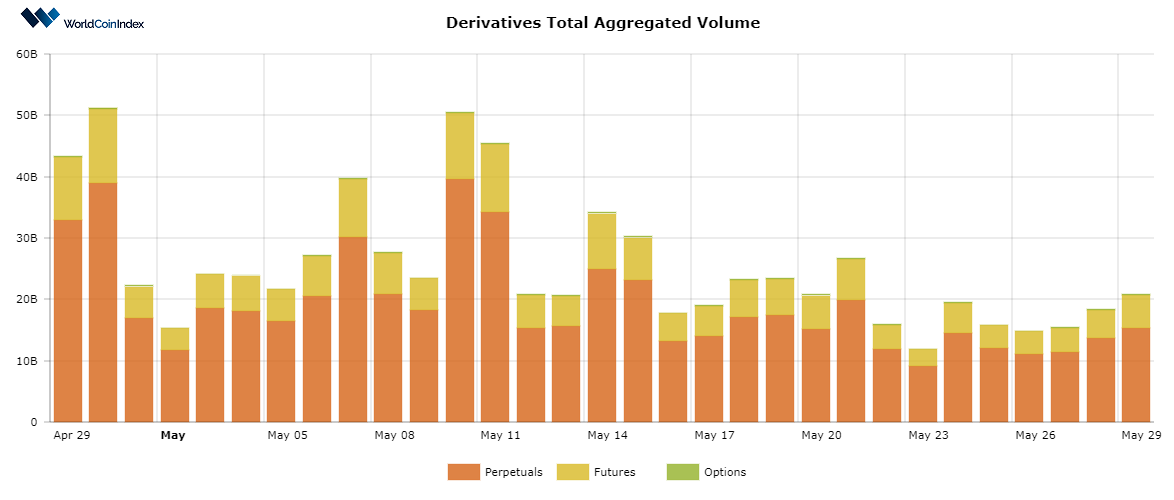

Between the 22nd and 29th of May, options have gone through significant volatility, which commenced with a huge dip on the 23rd when options fell from $122.77 million to $60.46M within 24 hours. Over the next few days, however, the value regained and reached the current threshold at $146.32M. Futures increased from their initial value of $3.98 billion, all the way up to $5.39B. Lastly, perpetuals also leveraged the bull market given their ascension from $11.85B to $15.25B on the 29th of May.

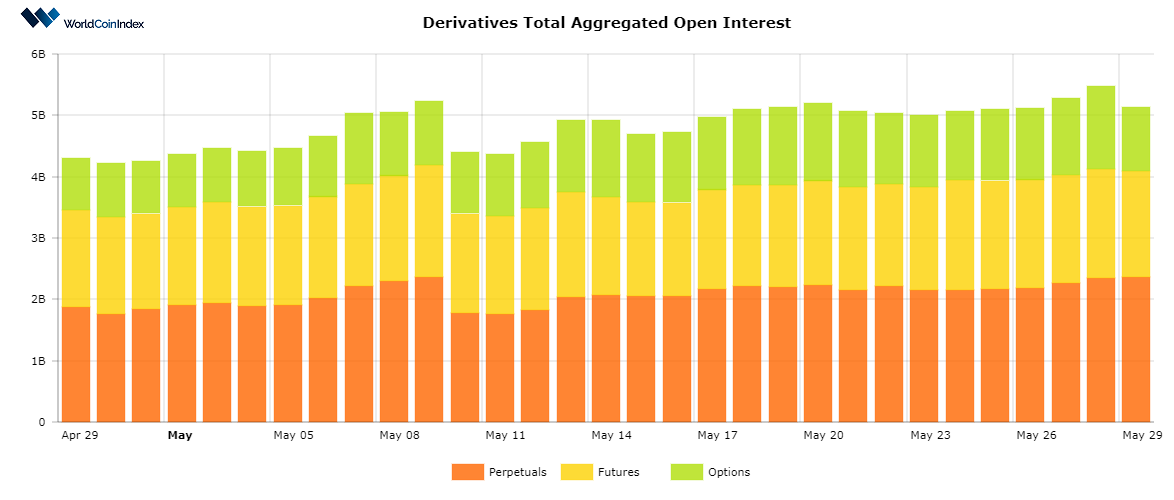

At this moment, the total value of the crypto derivatives market is situated at $20.78B. On the other hand, the total derivatives aggregated open interest value is situated at $5.12B, on the rise when compared to last week’s $4.93B value.

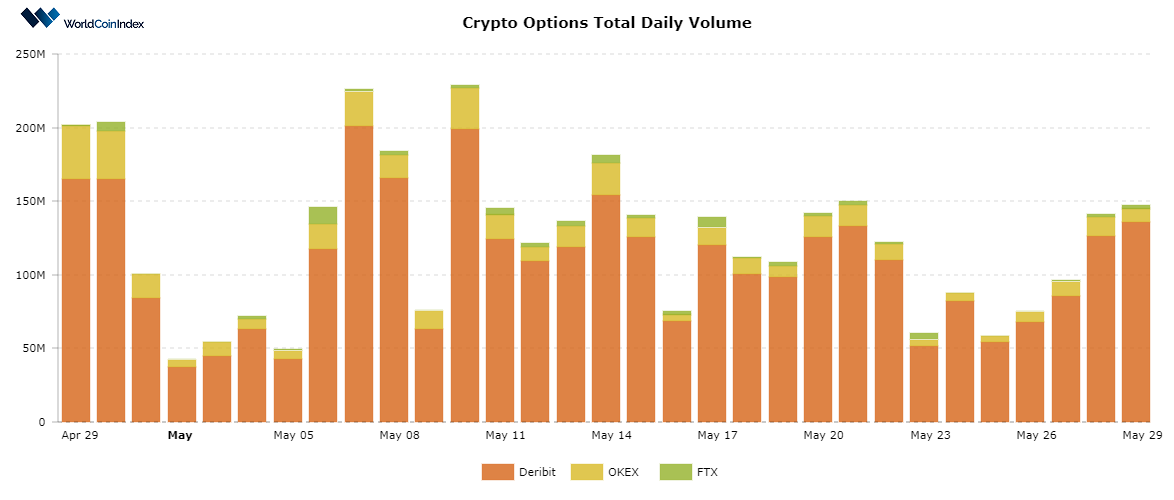

A closer look into the rapidly-increasing total daily volume for options

On the 23rd of May, the options total daily volume was estimated at $60.46M, following a rapid volume markdown. However, after an attempted price rise and another successful short-term price dip, the options total daily volume commenced on a rising path. As such, between the 25th of March and 29th of March, the options volume went from an unimpressive $58.54M all the way up to $146.32M daily volume.

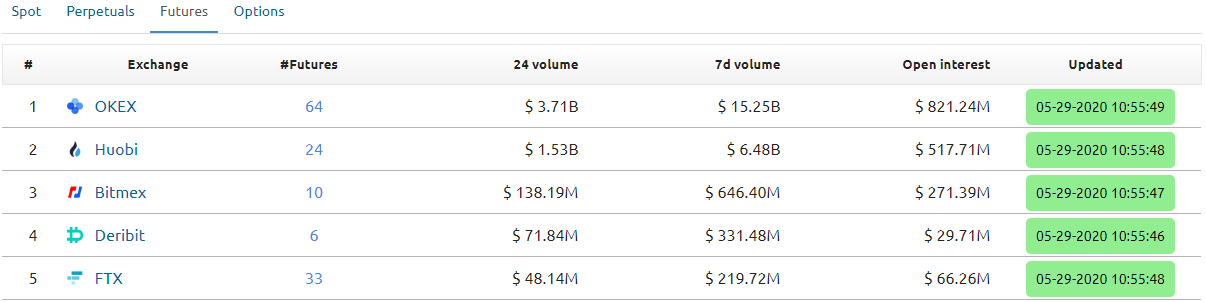

Relevant weekly exchange data

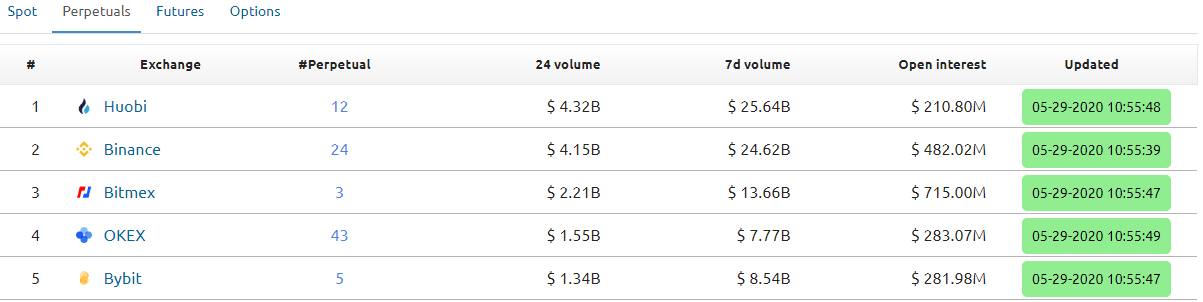

In terms of exchange-based perpetuals trading, Huobi ranks first with a $4.32B 24H volume, and a $25.64B 7-day volume. Currently, the exchange holds an open interest of $210.80M.

Regarding futures, OKEX is strongly holding its top position, with a $3.71B 24H volume, alongside a $15.25B 7-day volume, and $821.24M open interest.

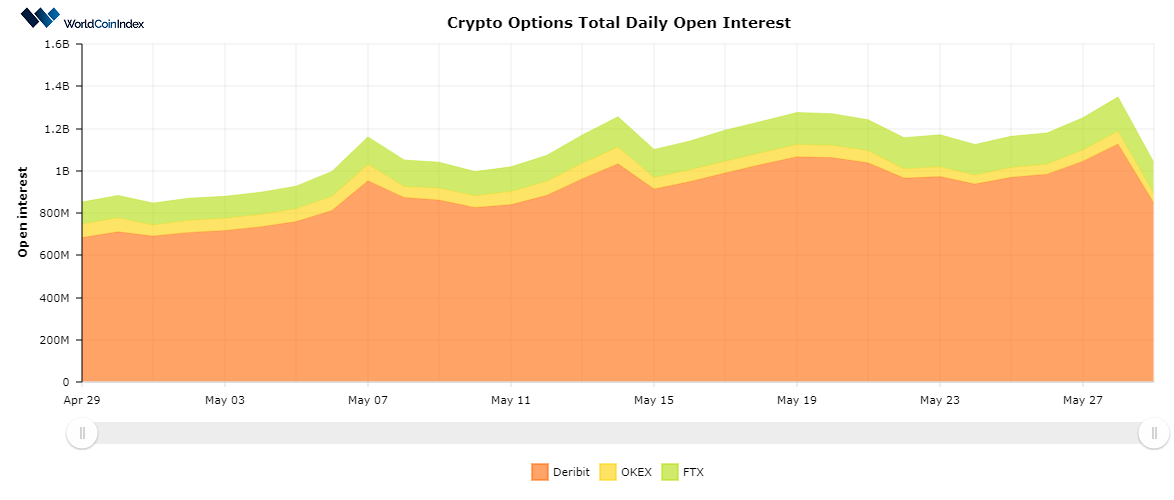

Options trading is also faring well, as Deribit holds a $135.83 million 24H volume, a $274.10M 7-day value, and open interest worth $839.74M.

Inside Deribit’s huge open interest BTC options

On the 29th of May, Deribit had an open interest value of 119K BTC ($1.13B). At 10AM UCT, the options expired and the open interest dropped with a value of 33K BTC ($313M), thus encompassing 25% of the total open interest in options.

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

https://www.worldcoinindex.com/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.