Crypto Market Showing Valuable Uptrend, but Derivative Volumes Drop

During the last couple of weeks, the cryptocurrency market has shown significant volatility, albeit most price moves point towards a long-term uptrend, which is a desiderate for most traders worldwide.

Such is the case with the previous week as well, since high-cap coins like Bitcoin, Ethereum, Filecoin, EOS, and BNB have all seen significant percentage growth in light of positive industry news and an ever-growing inflow of capital into the cryptocurrency market.

In the case of bitcoin, a price peak of $60,000 was reported this week, although the coin is now trading at $59,618, a slightly lower price.

ETH is currently trading at $1,997, BNB at $350, Filecoin at $199, EOS at $5.69, DOT at $38, and DOGE at $0.059.

The total cryptocurrency market cap is currently reported at over $1.75 trillion.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

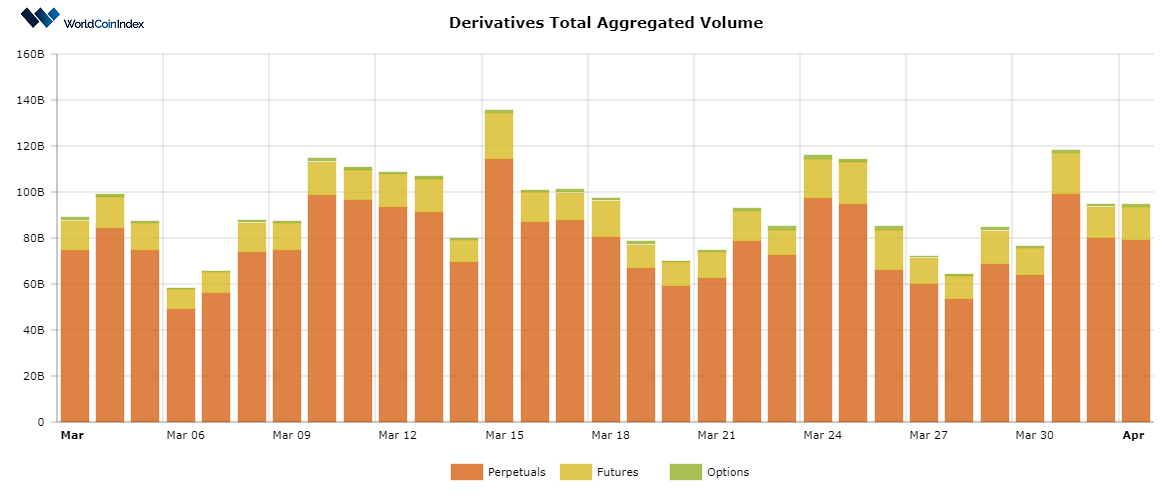

First off, the crypto derivatives aggregated volume has remained mostly unhinged, although it did drop a little when compared to last week’s value.

As such, we can now observe an aggregated derivatives volume of $100B, as opposed to last week’s $110B.

Here’s a brief look at trading volumes by derivatives category:

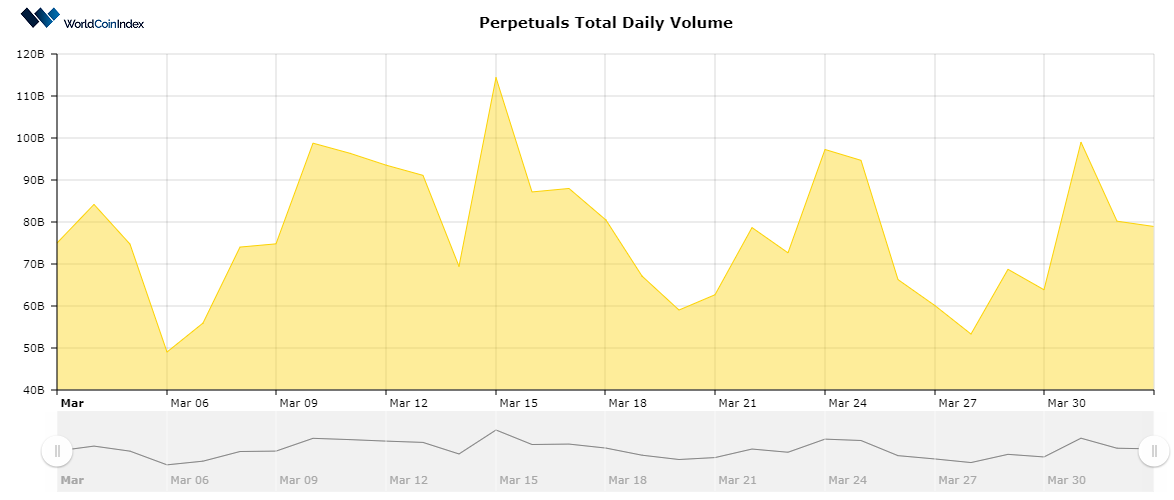

- The perpetuals trading volume is reported at $83B, slightly dropping from last week’s $86B.

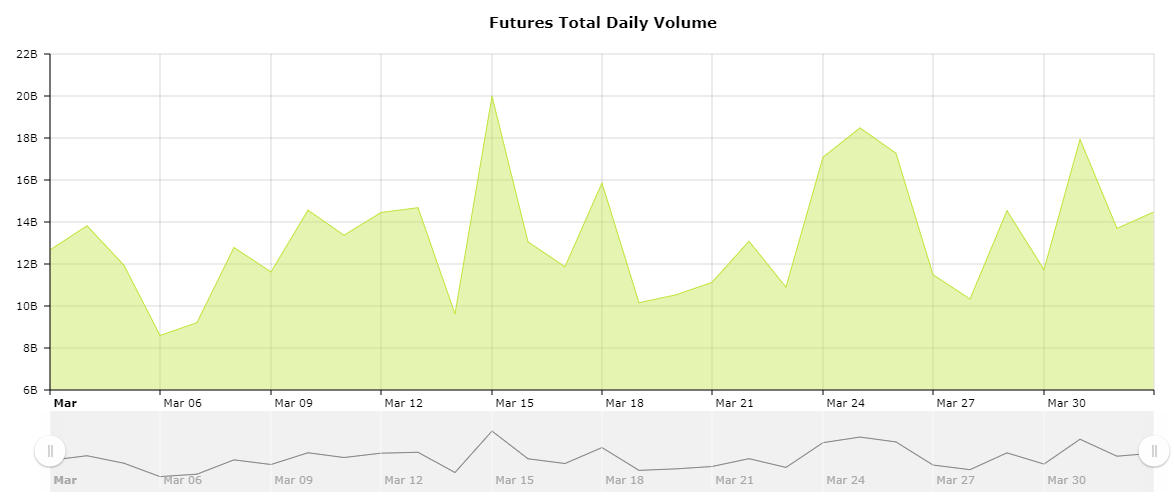

- The futures trading volume is estimated at $14B, quite lower than last week’s $19B.

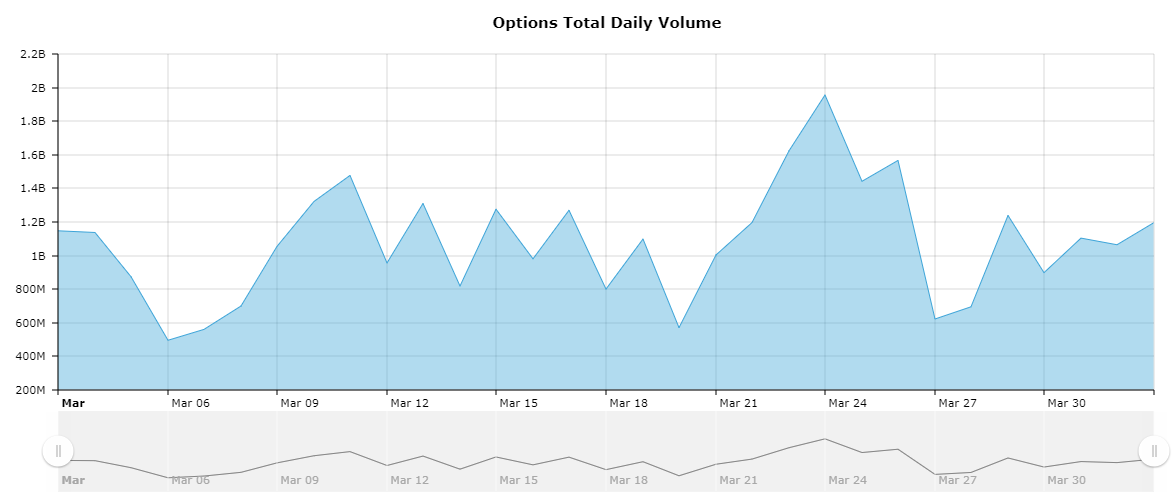

- The options trading volume is set at $1.19B as opposed to $1.59B seven days ago.

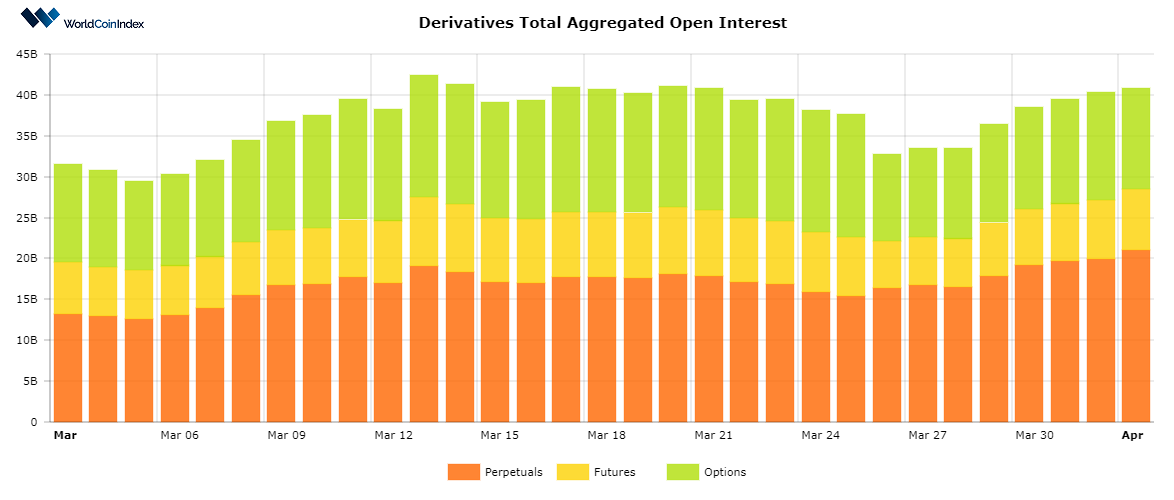

A quick look into the current open interest rates

At this point in time, the total aggregated open interest volume is situated at $40.59B, on the rise from $32B reported last week.

From a category standpoint, perpetuals report an open interest of $20.89B, followed by $7.44B for futures, and $12.25B for options.

Relevant cryptocurrency derivatives news

- The CME Group is announcing the launch of micro bitcoin futures sometime in May

- Delta Exchange is looking to launch liquidity pools for cryptocurrency derivatives, raising $5M

- Deribit derivatives exchange has announced the launch of an index reporting on implied bitcoin volatility.

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.