Cryptocurrency Market Nears Previous Peak; Derivatives Recover

WorldCoinIndex Derivatives Report Week 10 2021, during this week of the year, the cryptocurrency market has entered yet another bull swing, rapidly recovering from its previous corrections. With institutional investors worldwide gearing up to purchase bitcoin and other digital currencies, more and more business entities hold crypto-exclusive allocations within their investment portfolio.

In the case of bitcoin, a price peak of $58,053 was reported this week, a value that is incredibly close to its previous all-time high. This leads numerous experts to predict that BTC will soon break through the $60K resistance points, surpassing all logarithmic predictions and positioning itself on the clear path to $100K and beyond.

The total cryptocurrency market cap is currently reported at $1.58T, with bitcoin holding a $1.05T market cap.

At press time, bitcoin is trading at $56,495, ETH at $1,721, CHZ at $0.5, LTC at $209, BNB at $276, and ADA at $1.07.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

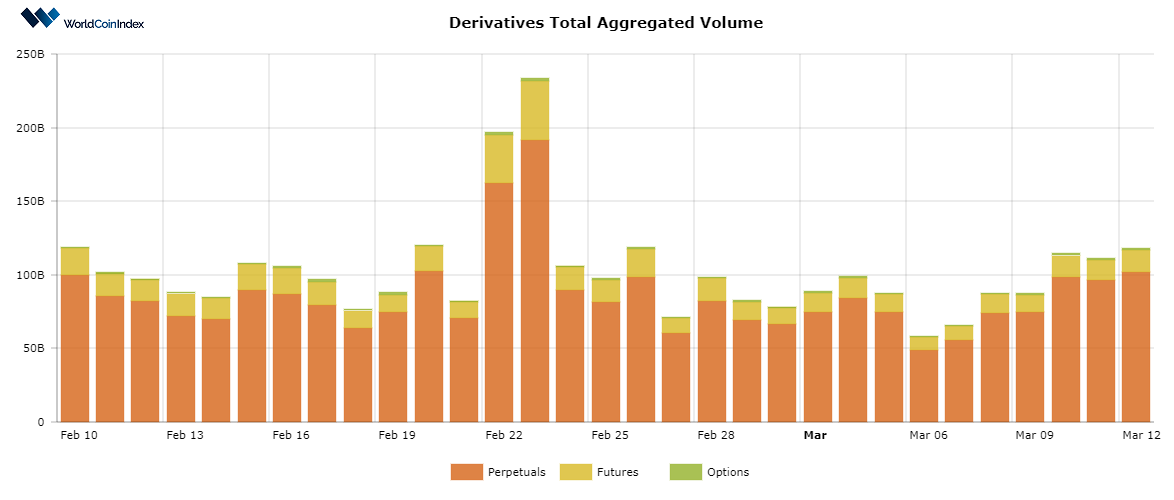

First off, the crypto derivatives aggregated volume has seen a considerable increase from last week’s low of $71B to $110.68B today, marking an almost double increase in the trading volume.

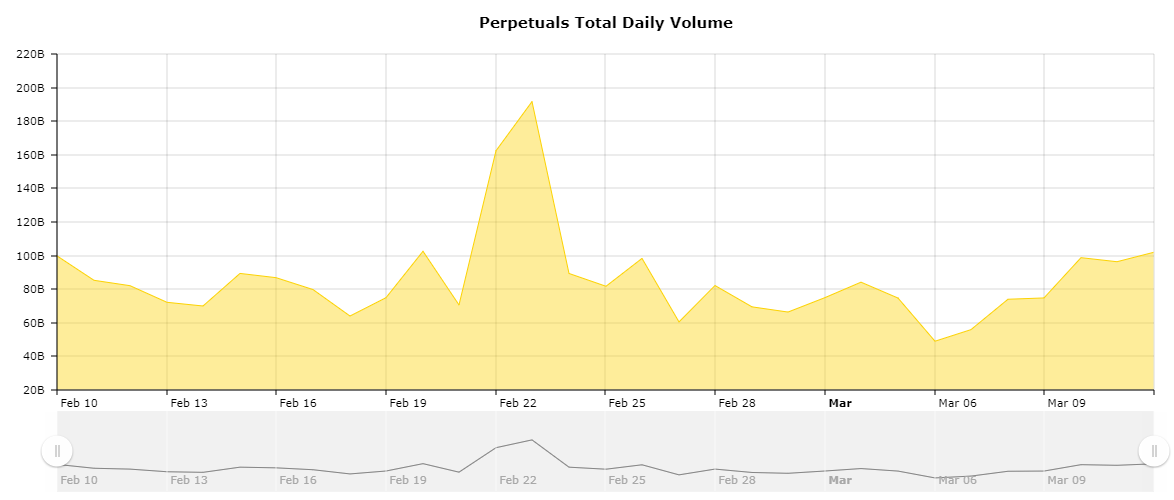

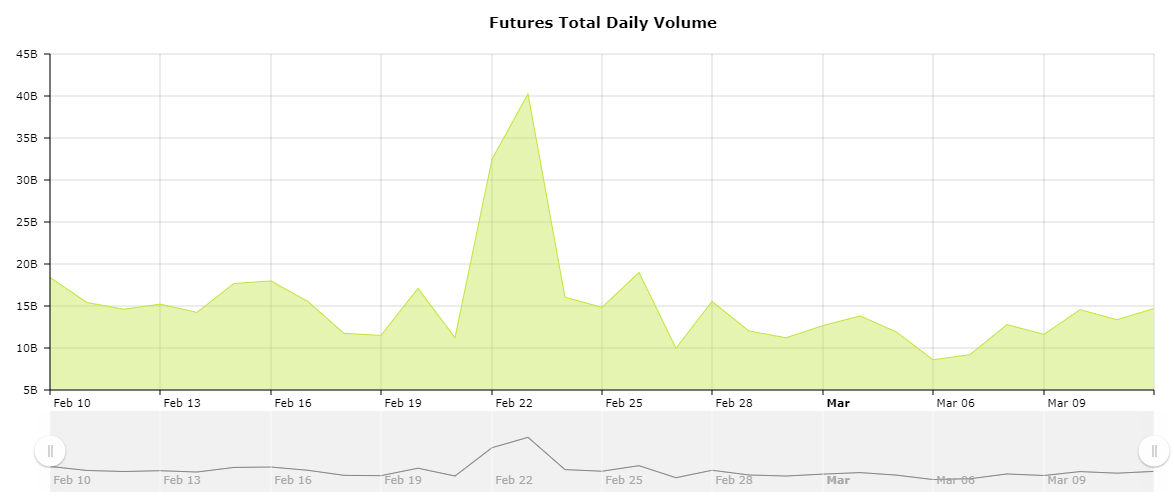

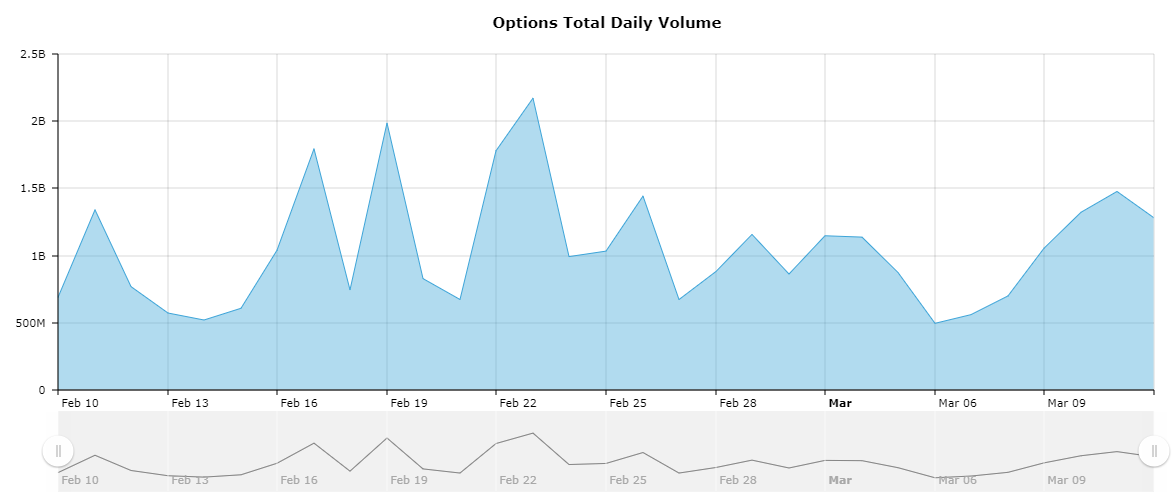

This evolution makes sense given the rising crypto prices, as derivatives enthusiasts rush to set forth their intentions of purchasing crypto at predetermined prices.

Here’s a brief look at trading volumes by derivatives category:

- The perpetuals trading volume has increased from $61.07B last week to $95.83B today

- The futures trading volume has increased from $10B in the previous week to $13.43B today

- The options trading volume has increased from almost tripled, from $515M last week to $1.41B today.

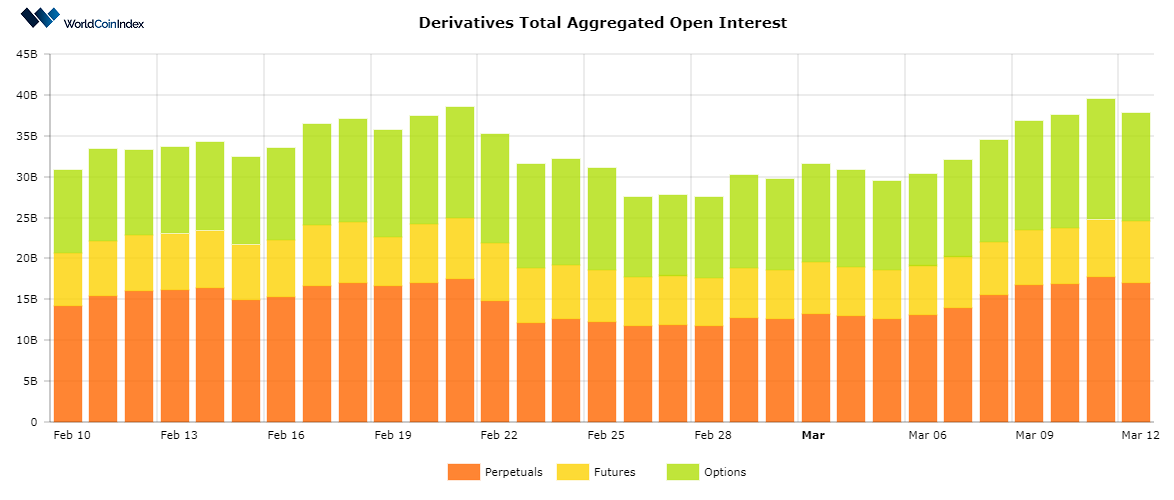

A quick look into the current open interest rates

At this point in time, the total aggregated open interest volume is situated at $38.37B, roughly $10 billion more in 7-days time.

From a category standpoint, perpetuals report an open interest of $17.39B, followed by $7.63B for futures, and $13.34B for options.

Relevant cryptocurrency derivatives news

- Open interest for bitcoin futures has managed to hit a new all-time high

- FTX derivatives platform announces PayPal deposits integration

- IG UK broker decides to halt retail crypto derivatives altogether.

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.