WorldCoinIndex Derivatives Report 2020 - Week 21

General weekly stats

This week is theoretically being influenced by the recent bitcoin halving event, which has led to increased volatility on the cryptocurrency market.

Here’s a quick preview of last week’s changes on the derivatives market.

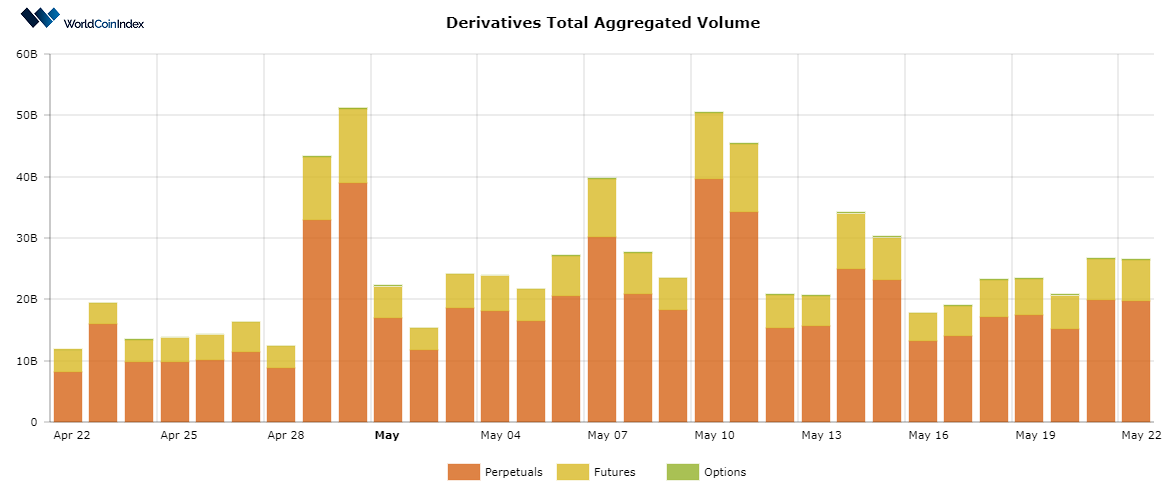

Between the 15th and 22nd of May, the derivatives total aggregated volume has done through several changes. Options decreased from $140.7M to $132.51M, futures went from $6.87B to $6.59B, whereas perpetuals saw a fall from $23.21B all the way down to $19.63B.

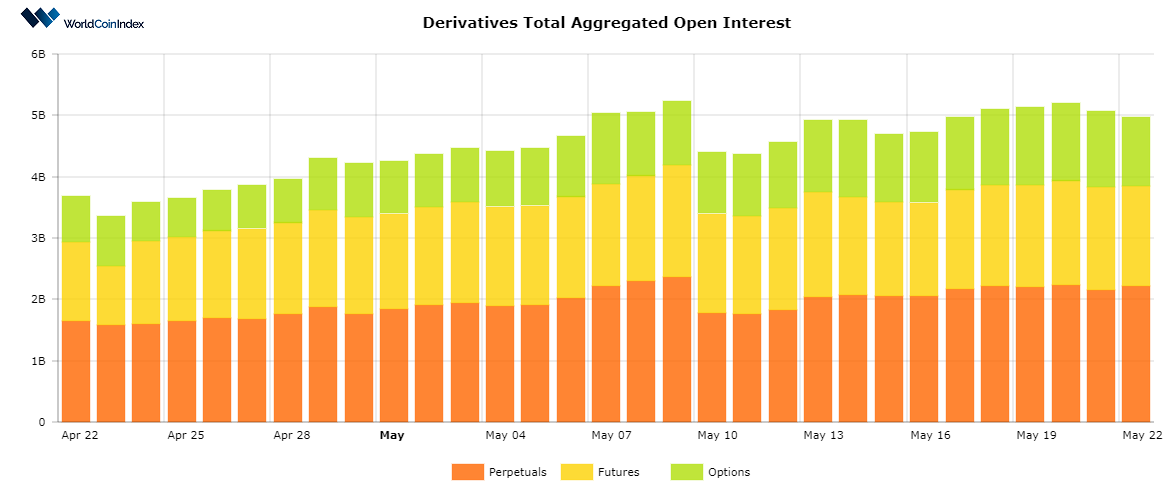

During the same timeframe, the total aggregated open interest for options has increased from $1.1B, up to $1.12B. Futures have increased from $1.53B to $1.61B, whereas perpetuals have risen from $2.06B to $2.2B.

At the time of writing, the total open interest is estimated at $4.93 billion.

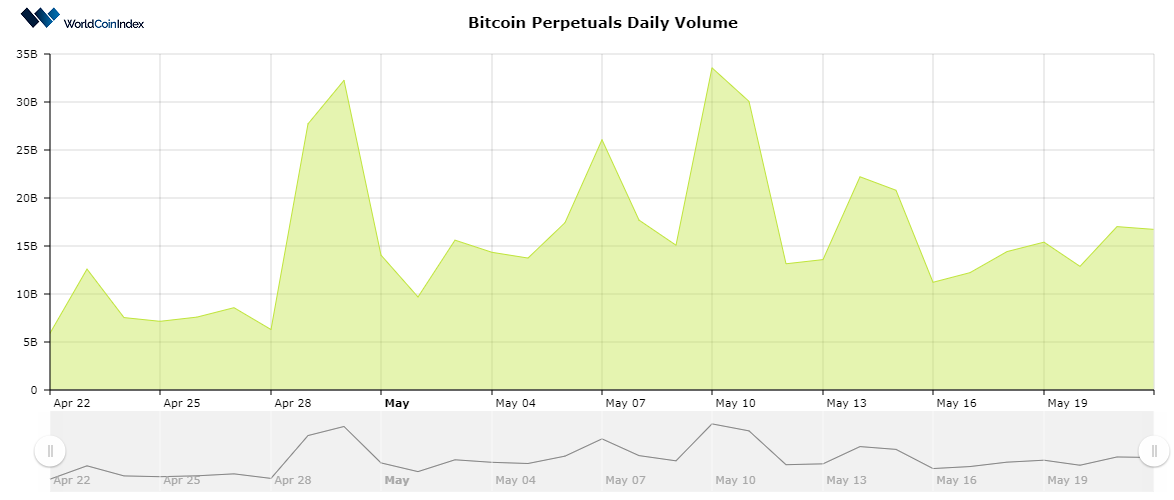

A closer look into the markdown in perpetuals’ total aggregated volume

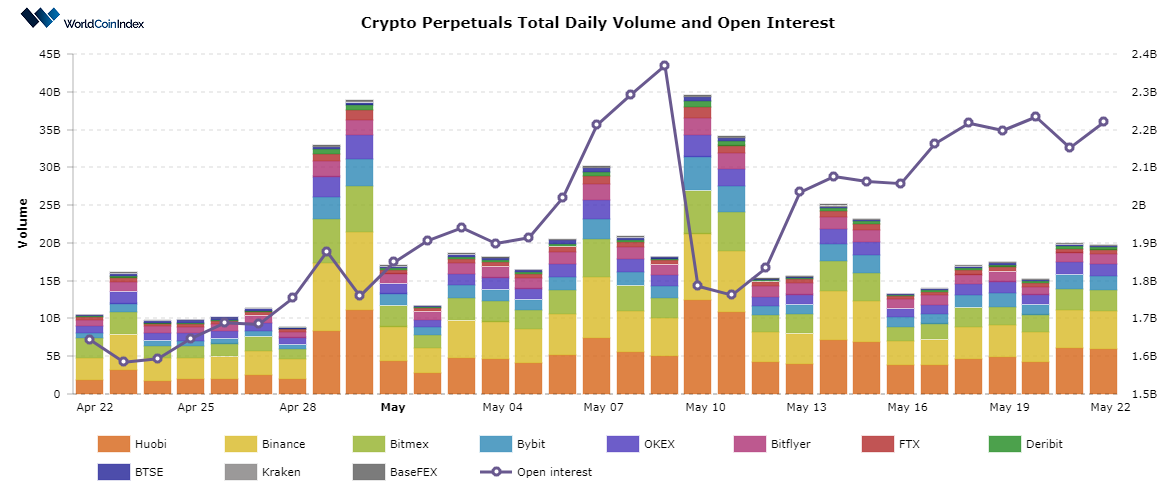

Perpetual volumes have decreased considerably during this week, as reported by most exchanges. Similarly, the daily volume is witnessing considerable volatility. The most-relevant event occurred on the 15th of May, when the perpetuals daily volume dropped from $23.21B to $13.26B on the 16th.

Afterwards, the 13.26B volume was followed by an abrupt increase to $17.49B on the 19th, followed by yet another short markdown and a quick volume hike to $19.93B on the 21st of May.

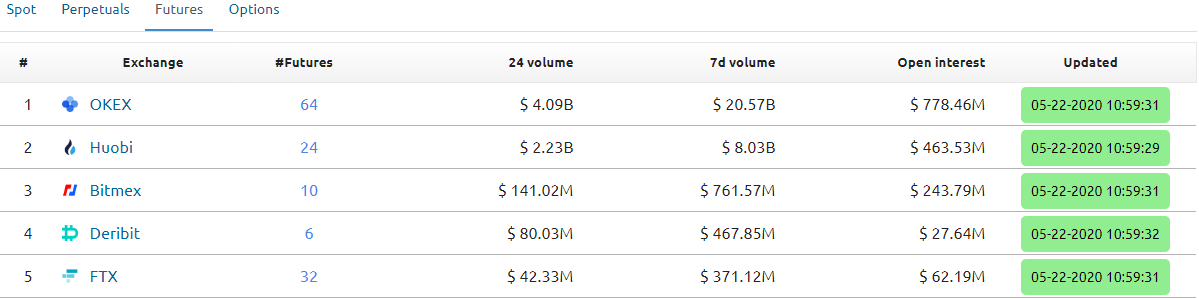

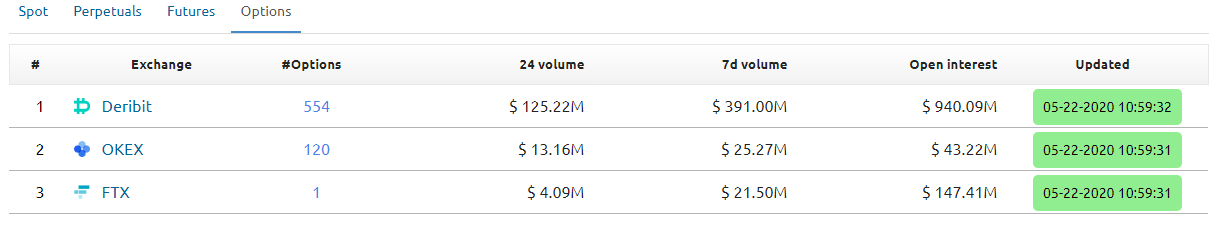

Relevant weekly exchange data

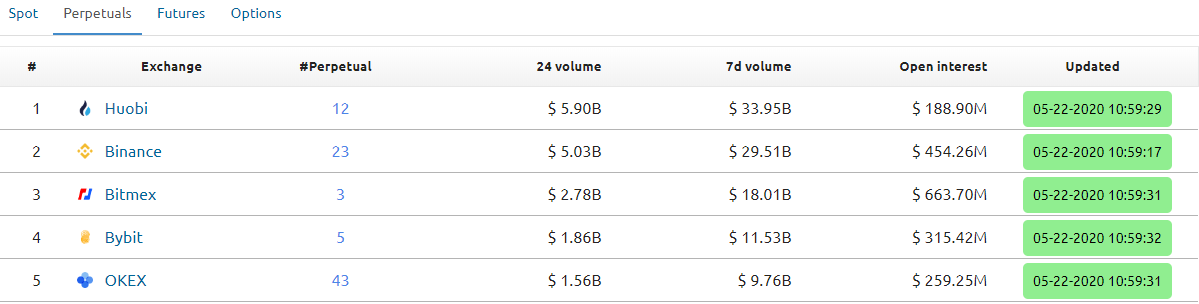

At the time of writing, Huobi has registered a perpetuals $5.87B 24h volume, followed by $5.02B on Binance and $2.77B on Bitmex.

In terms of futures, OKEX continues to rank first with a $4.09B 24h volume, followed by Huobi with $2.23B and Bitmex with $145.30M (considerably less than the first two rankers).

Lastly, when it comes down to options trading, Deribit ranks first with a 24h volume of $119.44M, followed by OKEX with $12.27M and FTX with $4.06M, thus further consolidating Deribit’s supremacy in options.

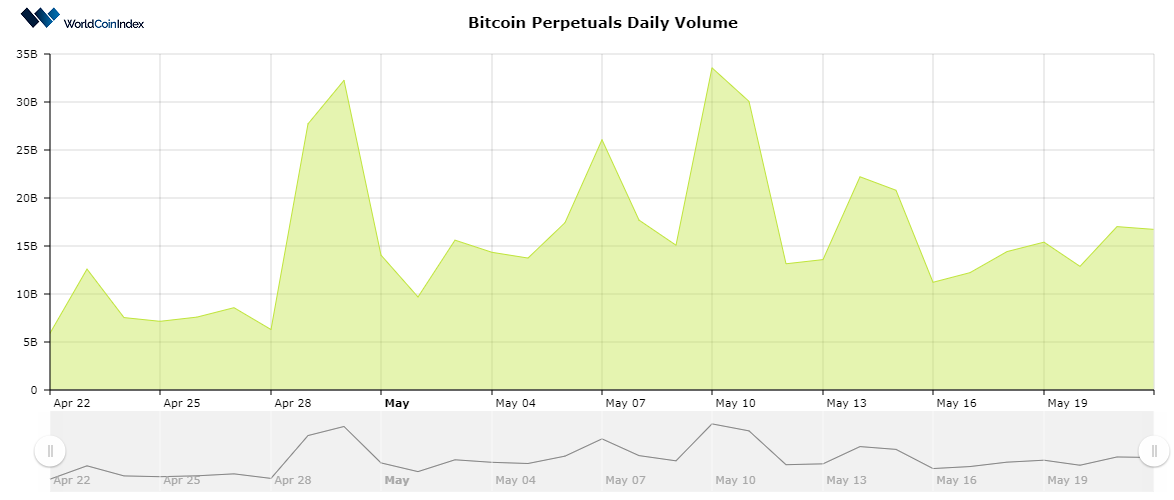

Bitcoin perpetual trading is once again getting up-to-speed

Despite the abrupt fall registered on the 16th of May, when the bitcoin perpetuals daily volume reached the low point of $11.22B, the cryptocurrency is slowly but surely gaining track once more. With this in mind, throughout the week, an almost-constant rise path has been recorded, with short-term falls that were quickly risen above of.

The highest volume was recorded on the 21st, with $17.02B, whereas the current volume today is approximated at $16.73B. Currently, bitcoin has an open interest value of $1.65 billion.

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

https://www.worldcoinindex.com/derivatives/bitcoin

https://www.worldcoinindex.com/openinterest/bitcoin

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.