WorldCoinIndex Derivatives Report 2020 – Week 35

The last week has been affected by quite a bit of volatility, given the fact that most cryptocurrency prices reached a weekly peak value mid-week, which was quickly followed by a decrease to lower prices. However, this week’s event certainly wasn’t close to the levels of high-scale volatility that we sometimes see on the digital currency market.

In the case of bitcoin, a price peak of $11,823 alongside a minimum price of $11,151. It is important to keep in mind that the $12K resistance was broken around a week ago, yet bitcoin failed to sediment itself above this threshold.

At press time, BTC is currently trading at $11,446 ETH at $390, XRP at $0.26, LTC at $57.67, EOS at $3.04, DOT at $5.72, and BCH at $268.16.

The total cryptocurrency market cap is currently reported at $358.17 billion.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

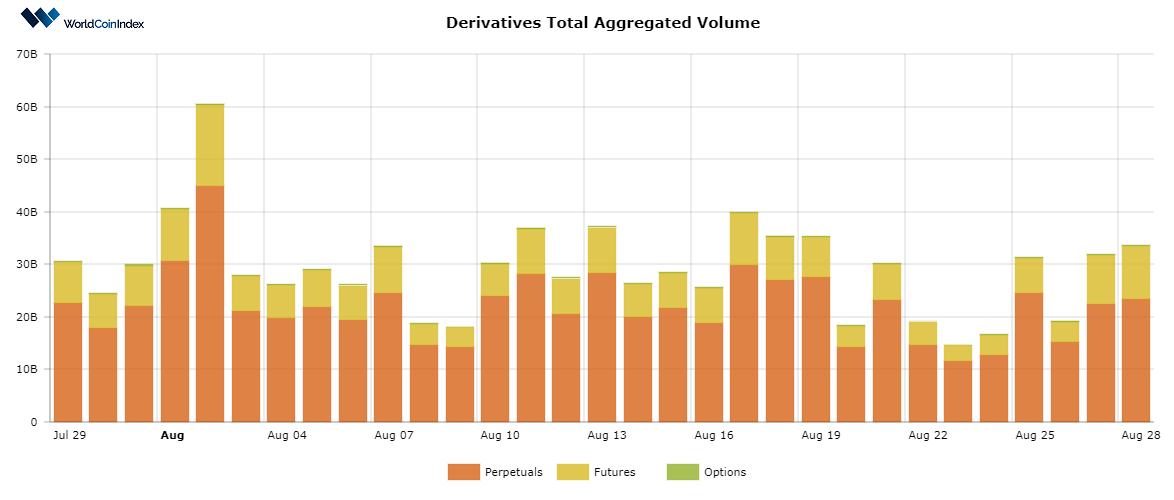

First off, the crypto derivatives aggregated volume has gone through a considerable increase from last week’s low of $19.82B to $44.87B today.

Here’s a brief look at trading volumes by derivatives category:

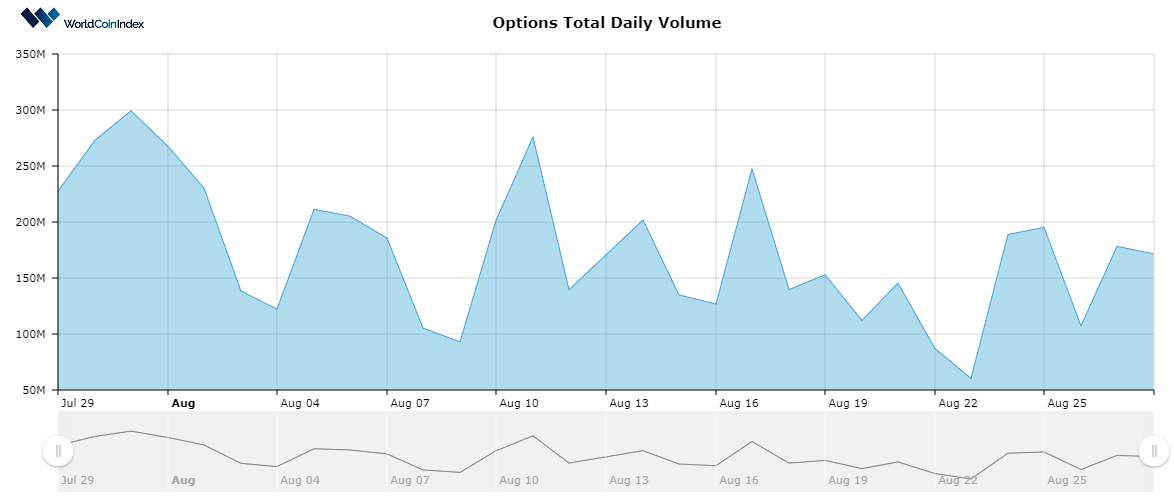

- The options trading volume is situated at $167.72M, about $60 million more than last week;

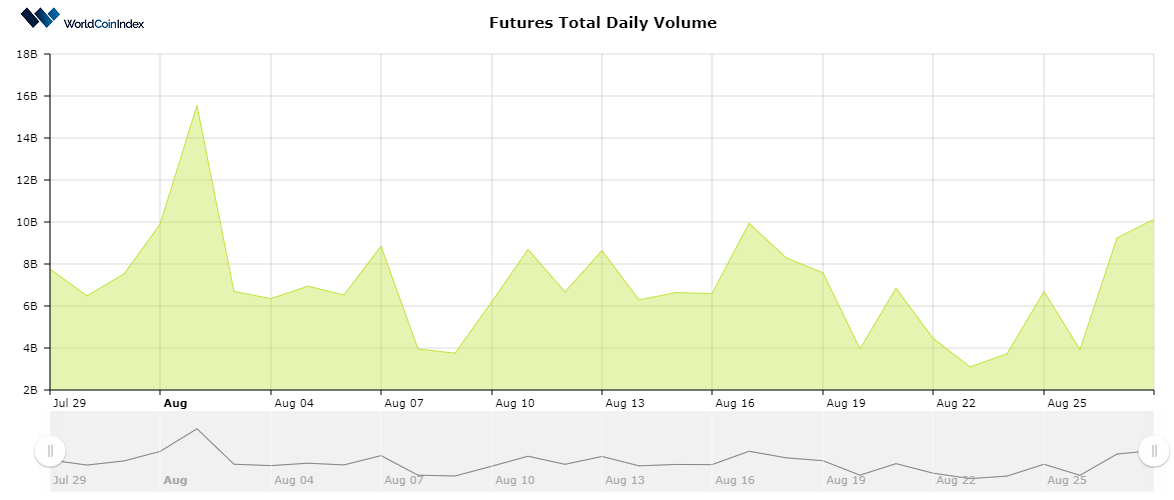

- The futures trading volume has increased to $10.21B from $4.38B;

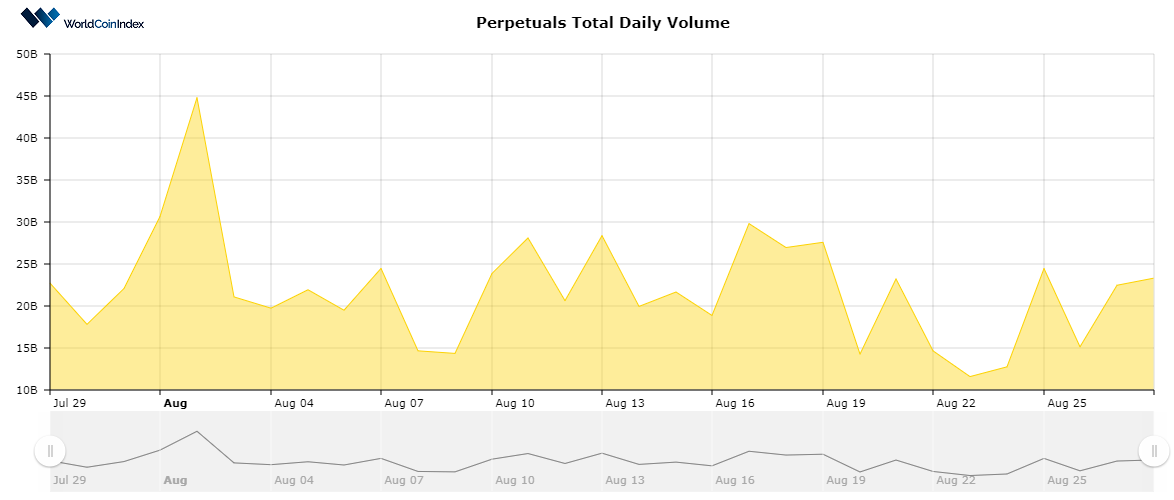

- The perpetuals trading volume has gone through the largest volume change, thus increasing from $14.72B to $23.49B.

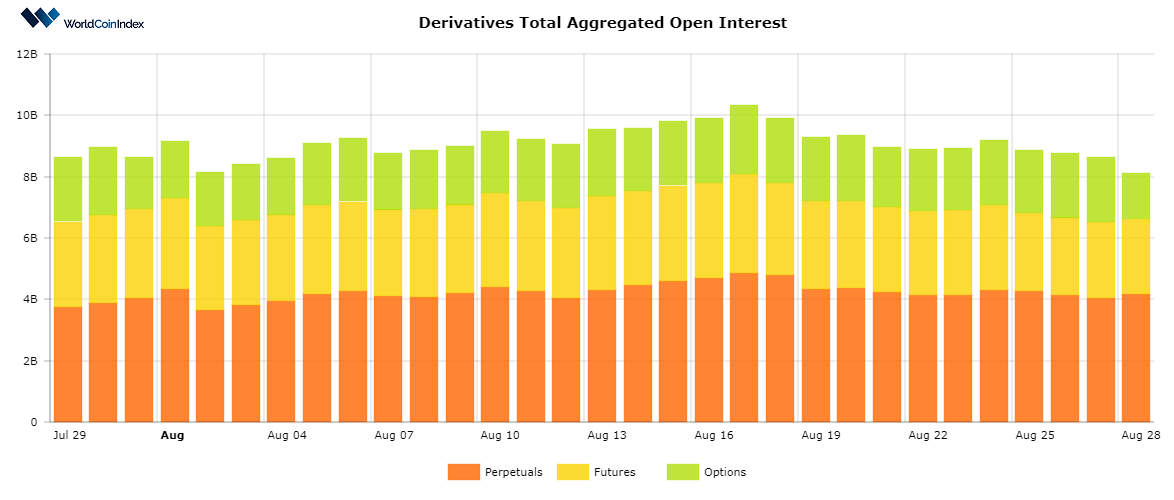

A quick look into the current open interest rates

Despite the larger trading volumes for the derivatives market reported this week, it seems that the open interest volume has actually dropped by a bit. At this point in time, the total aggregated open interest volume is situated at $8.14B, lower when compared to last week’s $9.03B.

From a category standpoint, perpetuals report an open interest of $4.16B, followed by $2.46B for futures, and $1.51B for options.

Newsworthy events on the derivatives market

- Delta Exchange, a growing cryptocurrency derivatives trading platform, has recently launched calendar spread contracts for BTC.

- BitMEX, a popular derivatives exchange, is planning to block traders residing in Ontario, Canada, due to a mandate issues by the Ontario Securities Commission.

- The FTX exchange has acquired the portfolio tracking app Blockfolio for $150M.

- A report showcases that over 95% of the cryptocurrency futures trading volume is actually located in Asia.

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.