Bitcoin Hits Another Yearly High as Derivative Trading Volume Increases

WorldCoinIndex Derivatives Report 2020 Week 45. During this week of this year, the cryptocurrency market has witnessed a high degree of positive volatility, with coin prices reaching new yearly record highs.

For instance, bitcoin has seen a massive growth, from only $13,300 at the beginning of the week, all the way to a record of $15,958. In fact, the coin traded above the $16,000 threshold on a number of higher-priced exchanges.

As expected, most altcoins followed bitcoin’s lead, thereby attaining higher values. At press time, ETH is trading at $444, XRP at $0.25, LTC at $62.83, EOS at $2.52, LINK at $11.56, and BCH at $255.

The total cryptocurrency market cap is currently reported at $433 billion, eyeing an increase of almost $100 billion since our report two weeks ago.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

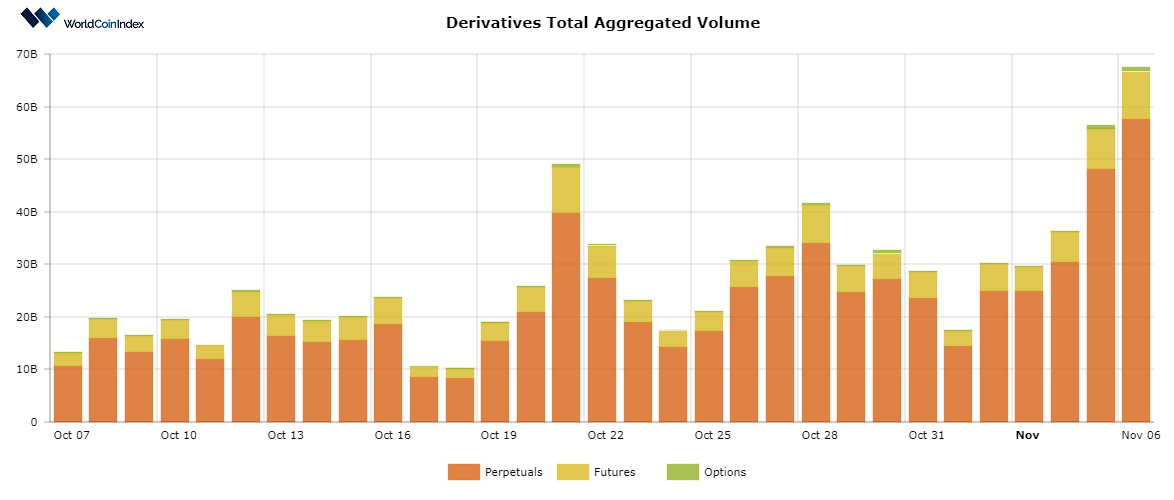

First off, the crypto derivatives aggregated volume has more than doubled since our last report. Two weeks ago, the volume was reported at $29.70, but at this point in time, the derivatives volume is approximated at $68.51B. It’s quite likely that the coin prices, increased spot trading volumes, and the derivatives volume have all positively influenced one another, thereby boosting the recent growth.

Here’s a brief look at trading volumes by derivatives category:

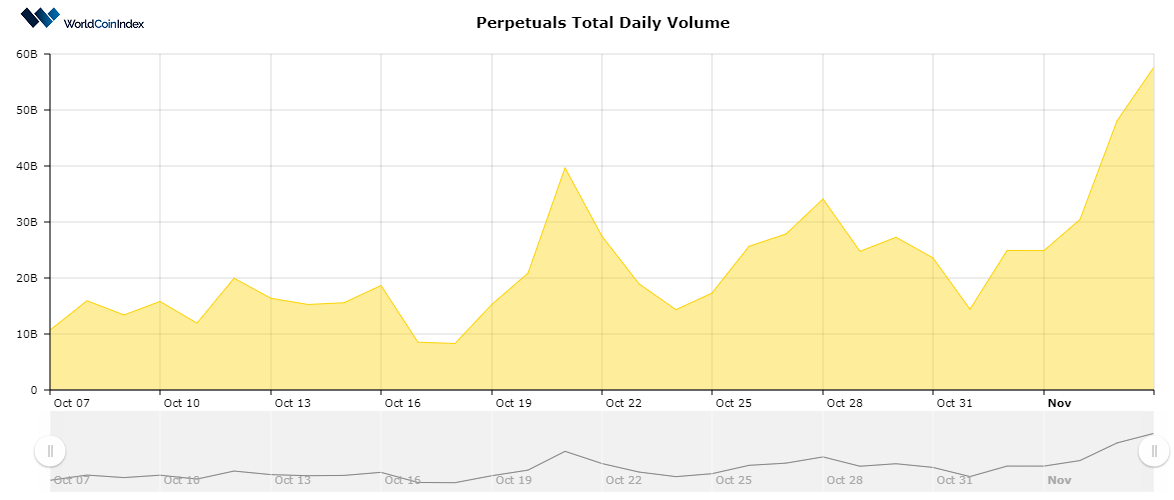

- The perpetuals trading volume is situated at $58.54B

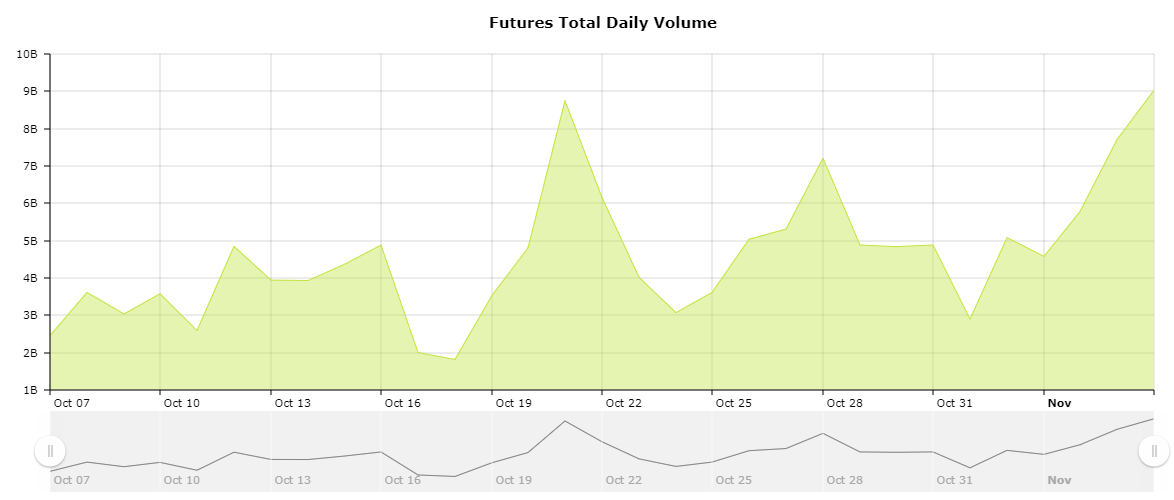

- The futures trading volume is approximated at $9.14B

- The options trading volume has grown to $822.01M

A quick look into the current open interest rates

At this point in time, the total aggregated open interest volume is situated at $9.70B, somewhat higher than last week. However, this is not a considerable growth, which is an interesting phenomenon given the vast increase of the aggregated derivatives trading volume.

From a category standpoint, perpetuals report an open interest of $4.45B, followed by $2.32B for futures, and $2.93B for options.

Relevant cryptocurrency derivatives news

- Deribit sees an all-time high bitcoin options trading volume, due to bullish bets and OTM call options

- Bitmex cofounders are now accused of looting approximately $440 million before the Fed intervened

- The US Securities and Exchange Commission will likely amend its derivatives regulatory framework

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.