WorldCoinIndex Derivatives Report 2020 – Week 34

During the last week, the cryptocurrency market has undergone a relative level of volatility. Price drops and spikes affected most digital currencies, especially bitcoin.

In the case of BTC, a price peak of $12.450 was reported this week. Many analysts believed that this was supposed to mark the end of the $12,000 resistance, thus pushing bitcoin beyond this value threshold. Unfortunately, a correction quickly followed suit and the prices dropped below the $12K mark, albeit higher comparing to previous values. At press time, BTC is trading at $11,790.

The total cryptocurrency market cap is currently reported at $370.4 billion, slightly higher comparing to last week.

ETH currently holds the market’s largest trading volume, above that of bitcoin. It is currently trading at $408. XRP is valued at $0.28, LTC at $62.11, Omnisego at $6.9, Qtum at $4.26, EOS at $3.49, and BCH at $295.85.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

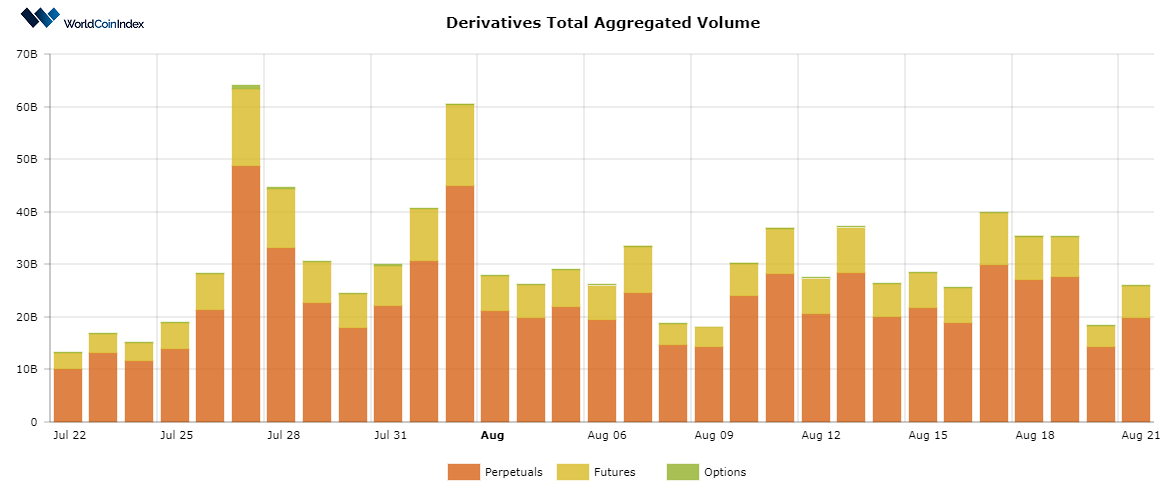

First off, the crypto derivatives aggregated volume has dropped quite a bit, from $34.11B last week, to $19.82 today. Drops like this are fairly normal nowadays, thus they do not represent a reason for alarm.

Here’s a brief look at trading volumes by derivatives category:

- The options trading volume is situated at $107.38M, quite lower than last week’s $171M;

- The futures trading volume has also dropped from $8.25B to $4.38B;

- The perpetuals trading volume has decreased from $25.68B to $14.78B.

It is very likely that trading cycles will proceed to further increase these values. However, this is also dependent on the evolution of the worldwide economy as it deals with the Covid19 health crisis.

A quick look into the current open interest rates

At this point in time, the total aggregated open interest volume is situated at $9.03B, quite similar to last week’s value. In other words, while the volume of settled transactions has dropped as highlighted earlier on, the actual money flow into the derivatives market remains considerable.

From a category standpoint, perpetuals report an open interest of $4.32B, followed by $2.74B for futures, and $1.96B for options.

Relevant cryptocurrency exchange derivatives data

At this time, Binance is the world’s leading perpetuals exchange, with a 7d volume of $50.90B and an OI of $969B. OKEX ranks first for futures, with a 7d volume of $27.97B and an OI value of $1.29B. Lastly, Deribit is still leading the options market with a weekly volume of $634M and an OI rate of $1.90B.

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.