Cryptocurrency crunch Wipes Off $60 Billion Market Cap, Bitcoin Slips Below $8,000

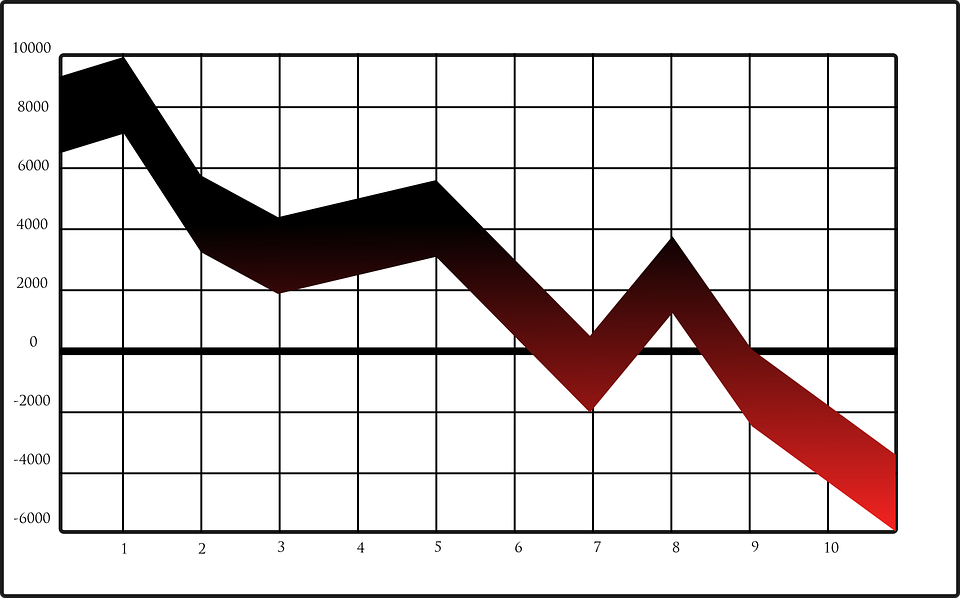

Well, it clearly seems that all is just not well in the crypto markets at the moment. On Wednesday, March 14, the price of Bitcoin took a sharp nose-dive after it plunged by more than 10% in just a matter of 24-hours slipping below $8,000 levels. Bitcoin which has been on a major correction since the beginning of 2018 is seen yet again in the control and grip of the bears over the bulls.

In addition to Bitcoin, the overall crypto market was swept with a major correction as all of the top 20 cryptocurrencies were seen correcting by more than 10-15% on the indices. Ethereum also slipped considerably below $600 but has managed to recover now along with Bitcoin which is seen trading at above $8,000 levels.

There was an overall bloodbath in the crypto market that wiped off nearly $60 billion in just a span of 24 hours. The overall crypto market valuations went to as low as $310 billion.

There are multiple reasons that are attributed to the fall. Just yesterday, Google announced to put a ban on cryptocurrency ads sighting issues of increasing amount of fraudulent advertisements appearing on its platform luring and misguiding users.

While other reasons for the fall could be the extreme criticism expressed by the representatives and government official during the U.S Congress Hearing which took place on Wednesday. Many expressed growing concerns about the existing states of cryptocurrencies as well as the imminent need to introduce right regulatory measures to tackle the menace of crypto use in illicit activities.

Also, another report coming from investment firm Allianz said that Bitcoin has got absolutely no intrinsic value and the bubble will burst anytime. Allianz’s global economics and strategy head Stefan Hofrichter said: “In our view, its intrinsic value must be zero. A bitcoin is a claim on nobody – in contrast to, for instance, sovereign bonds, equities or paper money – and it does not generate any income stream. Bitcoin’s demise would have few spillover effects on the ‘real world,’ since the market for this cryptocurrency is still quite small in size. As a result, we believe that the risks to financial stability stemming from bitcoin are negligible — at least as of today.”

Many analysts also say that the negative sentiment surrounding Bitcoins is majorly due to the huge $400 million sell-off in Bitcoins by defunct exchange Mt. Gox which went bankrupt back in 2014. The Bitcoin sell-off by the exchange was initiated after consultations with the court in order to repay the company’s creditors.