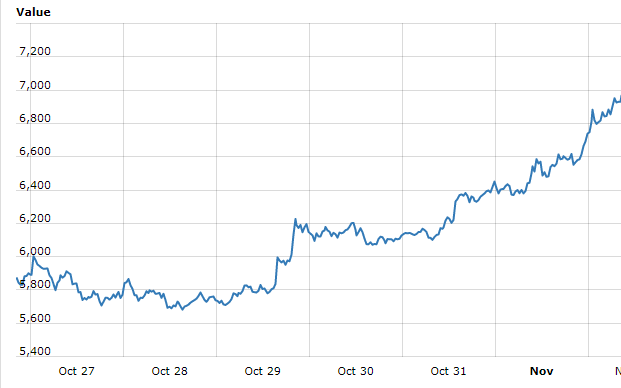

Bitcoin reaches new all-time high, and close to hitting $7,000

Regardless of the negative events present on the market, the Bitcoin price continues to soar, following a bullish month when the value of the digital currency has hit record after record.

On Wednesday evening, the no. 1 digital currency has managed to hit another all-time high by reaching the value of $6,900 for the first time. Until Thursday morning, the price continued to increase, with bitcoin reaching an all-time high of $6,989 and currently trading at $6,986.10 according to WCI.

The continuous increase in price has led market analysts to speculate what the causes for the price increase are. Most believe that there are three main reasons, responsible for the recent bull run of BTC.

- CME announces Bitcoin futures

The CME Group, which is the world’s biggest derivatives operator has recently announced that they are preparing to introduce bitcoin futures contracts. Introducing such a product would help bring more institutional investors onto the market, hence a higher pour of capital on the digital currency. The CME group declared that the futures contracts will be settled via cash, and that the price will be based on the CF Bitcoin Reference Rate. Additionally, futures coming from an incumbent exchange are capable of bringing the coin into the so-called regulatory fold. This will then facilitate the creation of complex financial products based on the digital currency. Most analysts believe that this is the number one cause for the price increase.

- Rumours that trading might resume in China

Not long ago, China decided to crack down on digital currencies by effectively banning Initial Coin Offerings and the activity of digital currency exchanges, thus basically reducing China’s digital currency trading volume to 0. Theoretically this is bad news, yet the actual announcement did not have a negative impact on the price. Additionally, rumours saying that China may soon allow trading on exchanges have the potential of boosting the price even further. If this indeed happens, it’s likely that bitcoin will break the $7,000 threshold and resistance point that it’s trying to reach.

- The ICO trend

The last couple of months have also fuelled the Initial Coin Offering trend, where start-ups hold crowdfunding campaigns to raise capital by selling digital tokens, which investors can then use to take advantage of the services at a cheaper price, and/or sell for a profit. There’s been a lot of word in the media about ICOs, hence leading to an increasing amount of money being invested in various tokens, therefore increasing the overall digital currency market cap, now situated at over $188 billion.

If things continue like this, we will likely see even higher values hit before the end of the year. Analysts have the $10,000 mark in sight.