Cryptocurrency Prices Drop but Remain Above the Key Resistance Levels

WorldCoinIndex Derivatives Report Week 3, during this week of the year, the cryptocurrency market has seen significant volatility. Price dips were well expected following the recent bull run, but many trading analysts are pointing out that most popular cryptocurrencies are positioned in the accumulation phase, prior to another price boost.

With this in mind, bitcoin has seen the largest volatility, with its price dropping from $38,000 at the beginning of the week, to $28,862 today. Luckily, the $28K price saw significant resistance, thereby encouraging an upwards price move. At press time, bitcoin seems to be recovering, but it is too early to predict whether it’s on its way to the $40,000 mark. Trading at $31,629, bitcoin finds itself around $10,000 under its previous all-time high achieved earlier this month.

The cryptocurrency market cap is estimated at $886 billion, dropping from the previously-attained values surpassing the $1 trillion threshold. Trading enthusiasts are now wondering if the altcoin season is scheduled to kick off anytime soon.

ETH is currently trading at $1,209, XRP at $0.26, LTC at $139, EOS at $2.63, DOT at $17.42, and BCH at $432.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

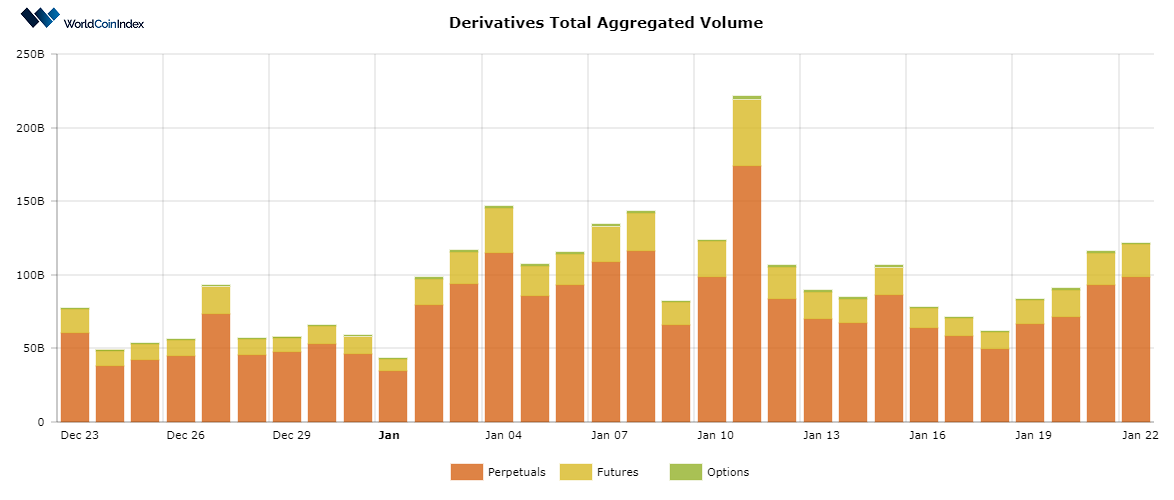

First off, the crypto derivatives aggregated volume has increased from $83.84 billion last week to $123.28 billion today. This is normally the case as we near the month’s end, as seen in previous reports.

Here’s a brief look at trading volumes by derivatives category:

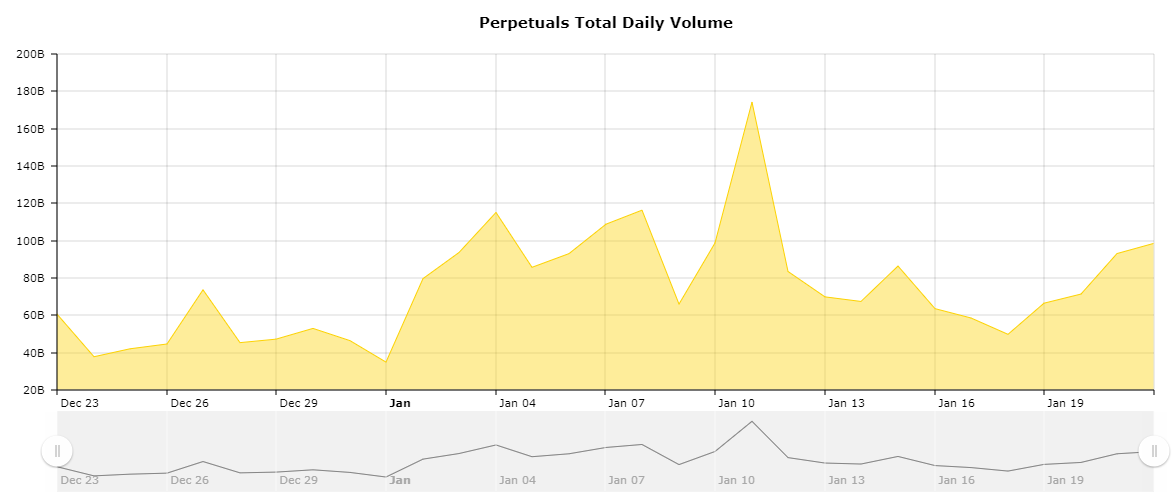

- The perpetuals trading volume has now reached $99.72B, compared to last week’s $67.40B.

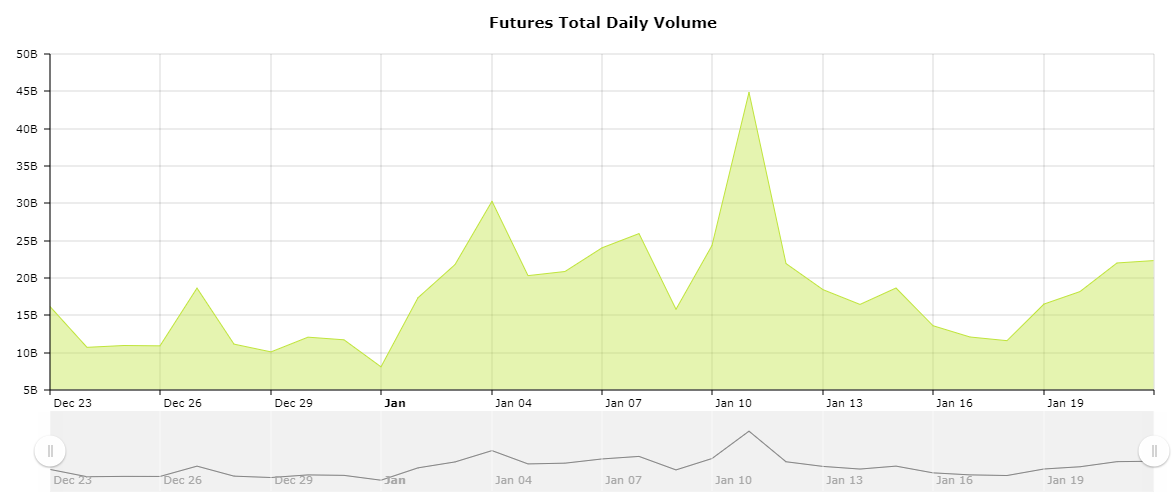

- The futures trading volume has also risen from $15.44B to $22.67B today.

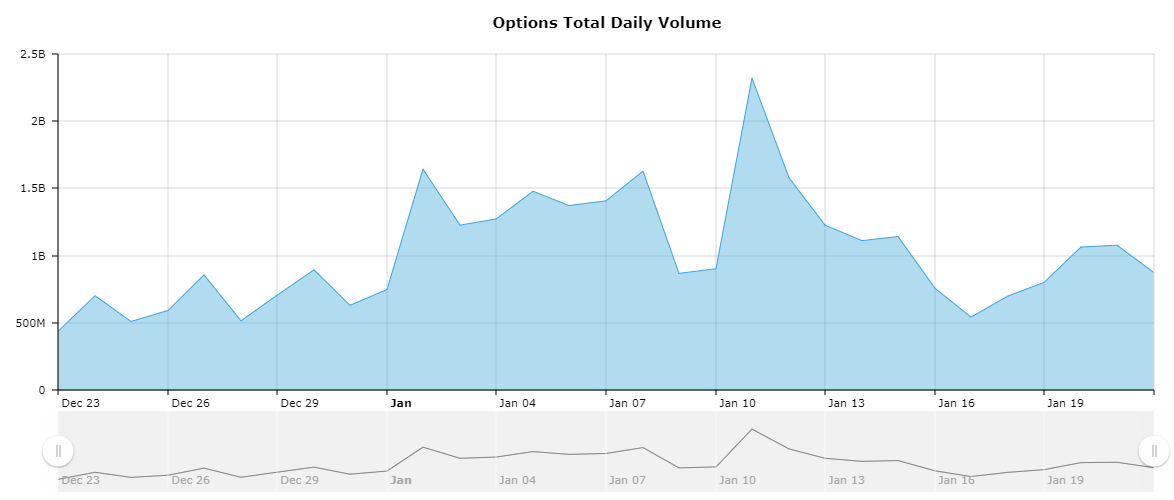

- The options trading volume has dropped from $992.5M last week to $886.89M today.

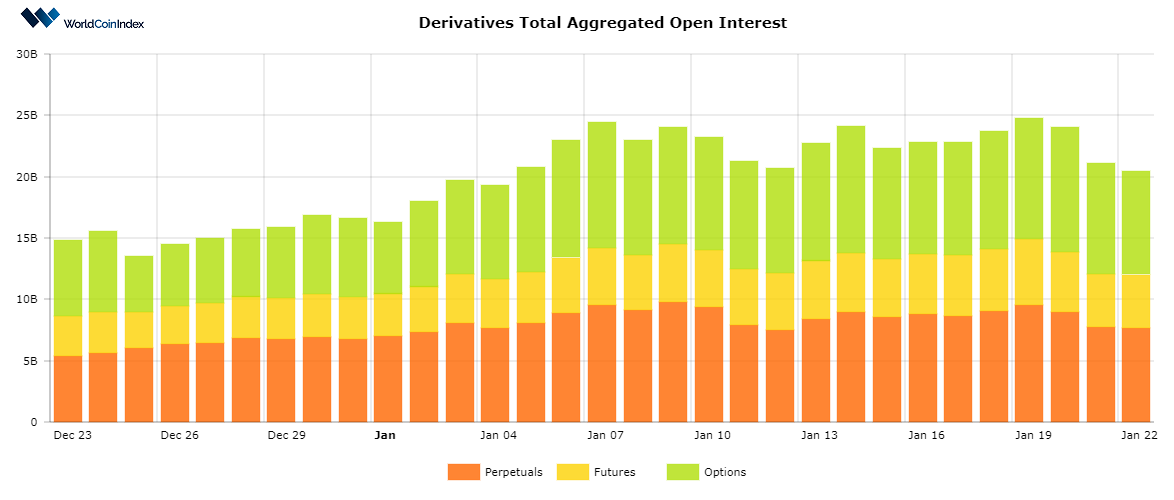

A quick look into the current open interest rates

At this point in time, the total aggregated open interest volume is situated at $20.43B, only a few billion lower as opposed to last week’s OI aggregated value.

From a category standpoint, perpetuals report an open interest of $7.69B, followed by $4.34B for futures, and $8.39B for options - a huge boost for options as it manages to surpass perpetual OI.

Relevant cryptocurrency derivatives news

- Bit.com Lending derivatives exchange planning to support BCH options

- Huobi reports $2.3 trillion trading volume in 2020, surpassing multiple competing exchanges

- Analysts predict that ongoing price drop is normal before the bull rally restarts

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.