Derivatives Volume Increases while Crypto Prices Remain Stable

WorldCoinIndex Derivatives Report 2020 Week 42 - During the 42nd week of the year, cryptocurrency prices remained fairly stable. A brief uptrend was recorded during the mid-week, but no record highs were achieved.

Luckily, bitcoin has officially broken through the $11,000 resistance, and is now officially trading above this threshold. With this in mind, the coin had a 7-day high of $11,718, alongside a low of $11,068 at the beginning of the week. At press time, the cryptocurrency is trading at $11,382, slightly lower than yesterday.

Currently, ETH is trading at $370, XRP at $0.24, LTC at $47.35, EOS at $2.55, Bitcoin Cash at $255.31, and Filecoin at $54.65.

The total cryptocurrency market cap is currently reported at $357 billion.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

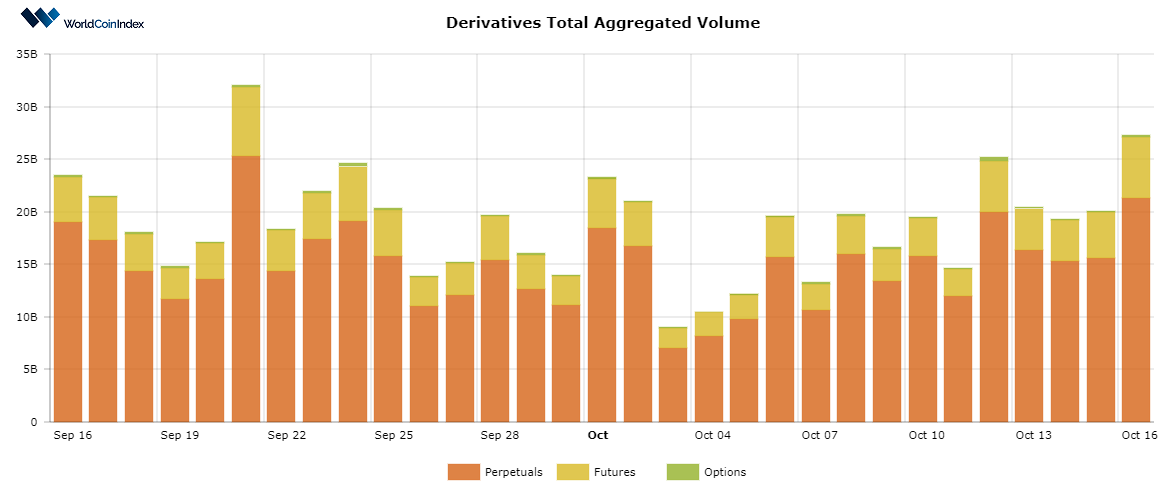

First off, the crypto derivatives aggregated volume has increased from last week’s low of $19.52B to $27.42B.

Indeed, these values aren’t anywhere close to past trading volumes, but we’re always happy to see uptrends. Increased buying pressure from institutional investors entering the market may soon boost these numbers.

Here’s a brief look at trading volumes by derivatives category:

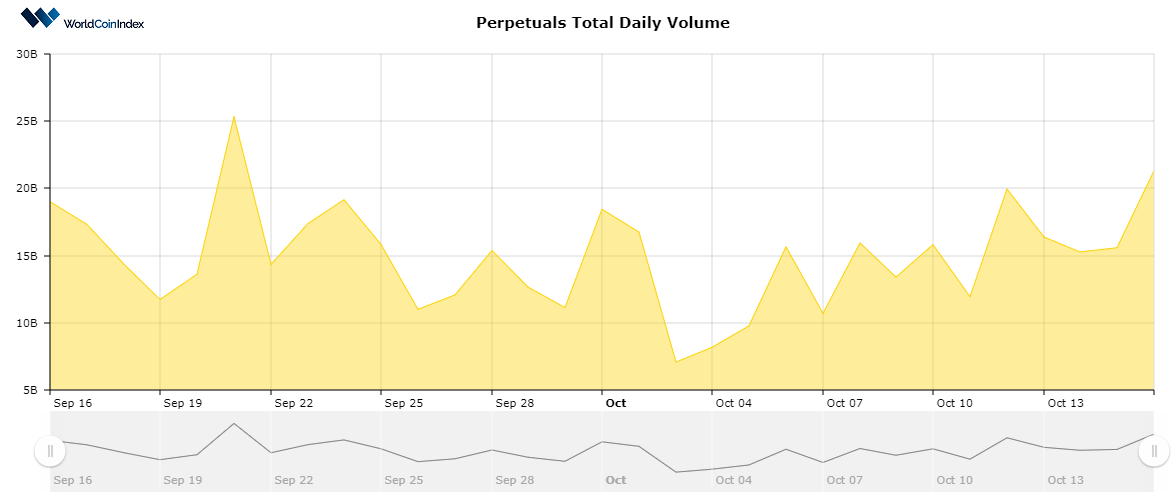

- The perpetuals trading volume is situated at $21.39B, higher than last week’s $15.76B

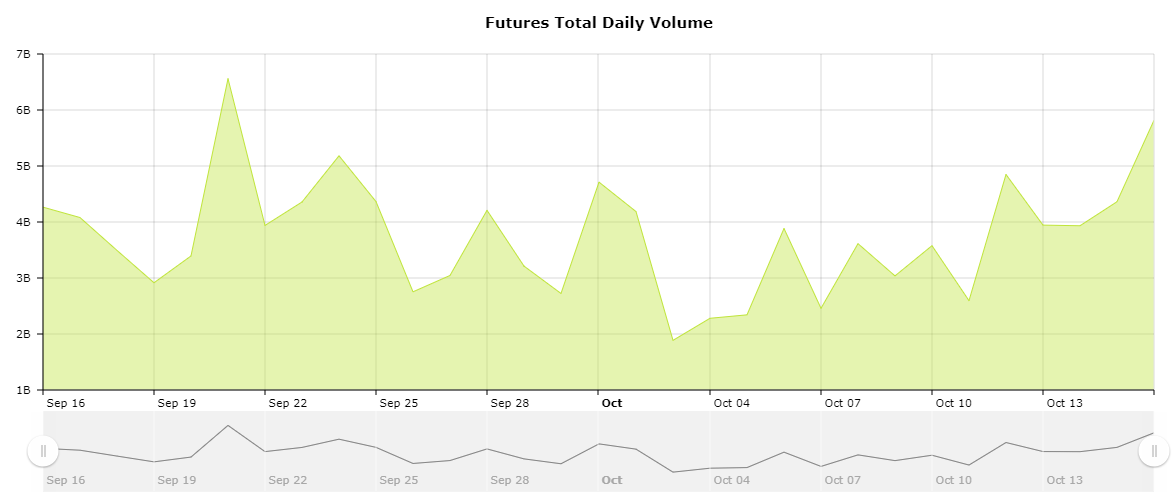

- The futures trading volume has increased from $3.61B to $5.82B

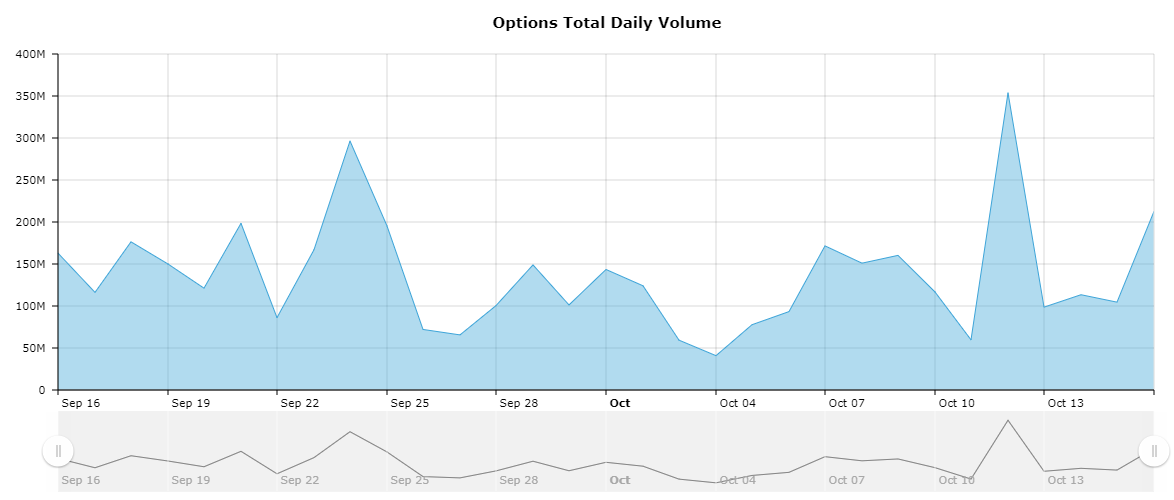

- The options trading volume has increased from $154M to $208M

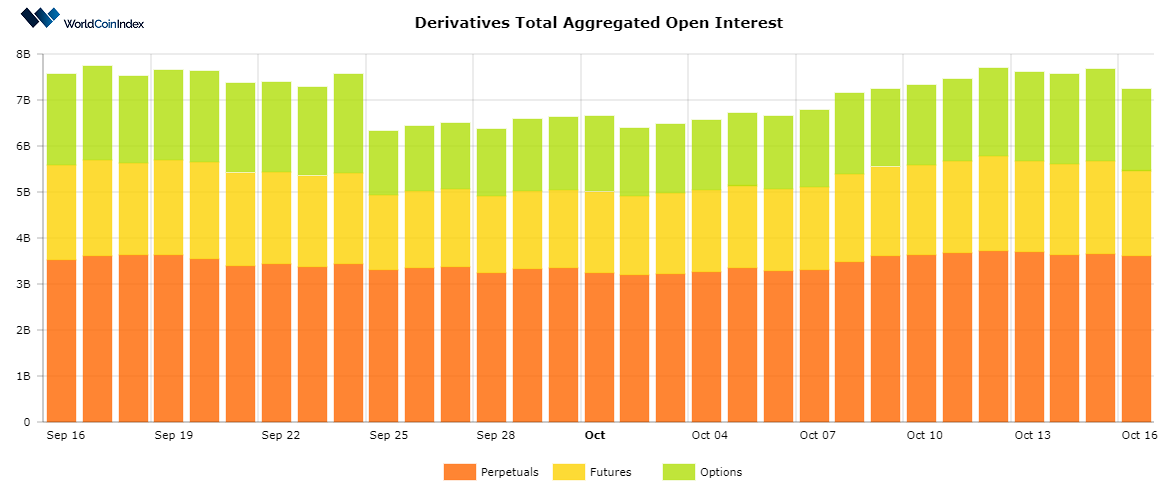

A quick look into the current open interest rates

At this point in time, the total aggregated open interest volume is situated at $7.23B. Despite the rising trading volumes, the OI rate is only slightly higher when compared to the previous week’s $6.99B.

From a category standpoint, perpetuals report an open interest of $3.58B, followed by $1.85B for futures, and $1.78B for options.

Relevant cryptocurrency derivatives news

- Delta Exchange has recently announced the launch of bitcoin turbo options – a derivatives product that facilitates trading with 200x leverage and allows the quick sale of options upon reaching the price barrier

- JPMorgan states that bitcoin’s increased buying pressure is caused by the new stream of financial giants that are buying bitcoin, like MicroStrategy and Square.

- According to a recent report, JPMorgan believes that bitcoin may be a slightly overvalued commodity

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.