Negative Price Volatility Takes Crypto Market by Storm

WorldCoinIndex Derivatives Report 2020 Week 48. During this week of this year, the cryptocurrency market has once again shown us that negative price volatility can occur at any moment whatsoever, especially after considerable bull runs. With this in mind, most cryptocurrencies are currently in the red and bitcoin is no exception.

In the case of bitcoin, a price peak of approximately $19,500 was reported this week, followed by a low of $16,281. With over $3,000 down, bitcoin has made a few attempts at price recovery. At press time, the cryptocurrency is trading at $16,584. Historical analysis has shown that its price will likely rebound, especially as this wasn’t a market collapse. What will really happen remains to be seen.

At this time, ETH is trading at $505, XRP at $0.52, LTC at $66.73, EOS at $2.82, BCH at $261, and Chainlink at $12 The total cryptocurrency market cap is reported at $307 billion, approximately $200 billion less than last week.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

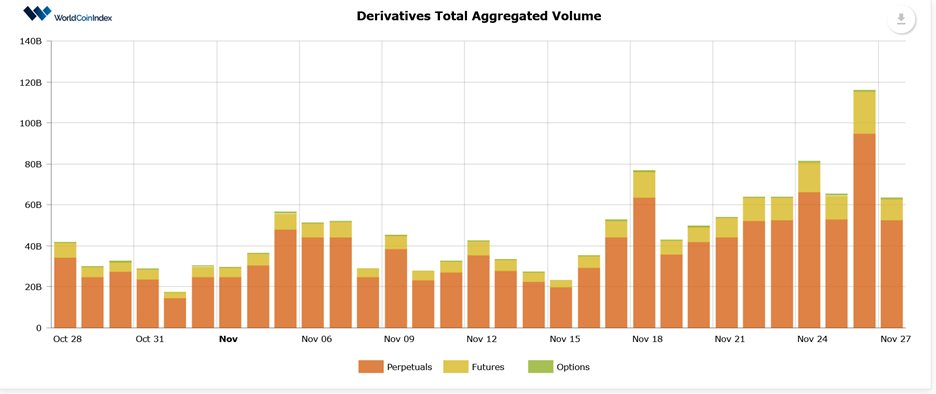

First off, the crypto derivatives aggregated volume has increased from $46.27B to $61.99B. This is an important step for the derivatives market, as it’s getting closer to previous records. The volume growth makes perfect sense as we’re nearing the end of the month.

Here’s a brief look at trading volumes by derivatives category:

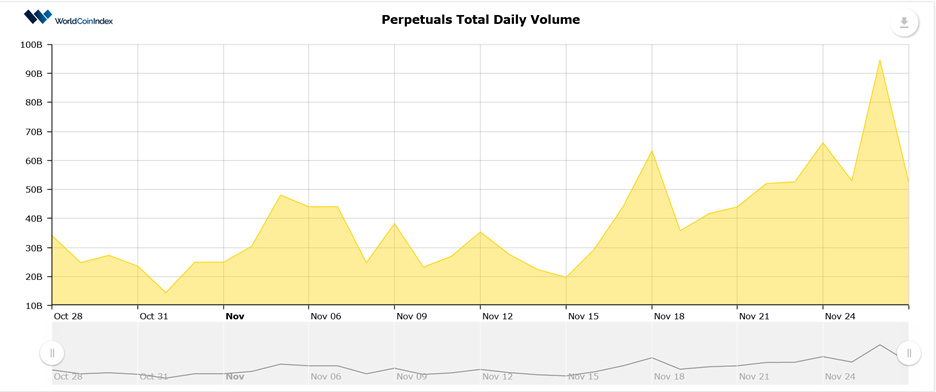

- The perpetuals trading volume is situated at $51.77B, on the rise from last week’s $38B

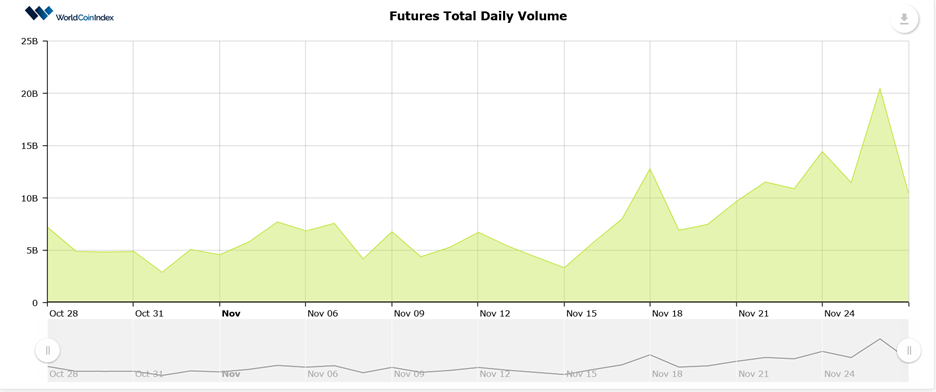

- The futures trading volume has increased from $7.32B to $10.22B

- The options trading volume has also risen from $507M to $577M.

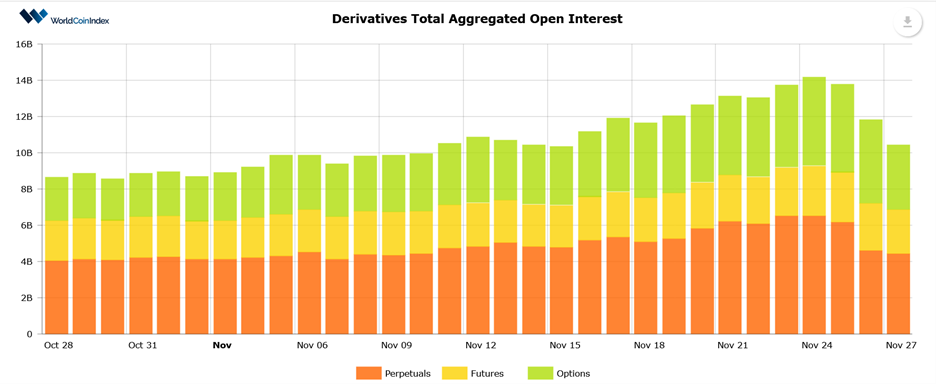

A quick look into the current open interest rates

At this point in time, the total aggregated open interest volume is situated at $6.74B, a value that’s much lower when compared to the $12.22B reported last week.

From a category standpoint, perpetuals report an open interest of $4.36B, followed by $2.34B for futures, and $3.55B for options.

Relevant cryptocurrency derivatives news

- Thanksgiving slump brings forth $1.9B worth of crypto derivative liquidations

- Pantera Capital backs derivatives exchange Globe to launch worldwide derivatives exchange for institutional investors

- Chinese users from OKEX may migrate to other platforms after withdrawals are blocked.