WorldCoinIndex Derivatives Report 2020 – Week 26

Over the last week, the cryptocurrency market has seen an unexpected fall in prices, thus leading to increased volatility amongst most digital currencies and derivatives trading.

As such, the highest impact was caused by bitcoin’s price decrease from $9,660 on the 24th of June, all the way down to $9,035 on the 25th. Most other top-tier coins followed the same trend, similar to this rapid price decrease. Since that moment, the market managed to gain more value, given the fact that BTC is trading at $9,324 at press time. ETH is trading at $232, LTC at $42.66, EOS at $2.45, XRP at $0.18, and BCH at $231.

Derivatives volume summary

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

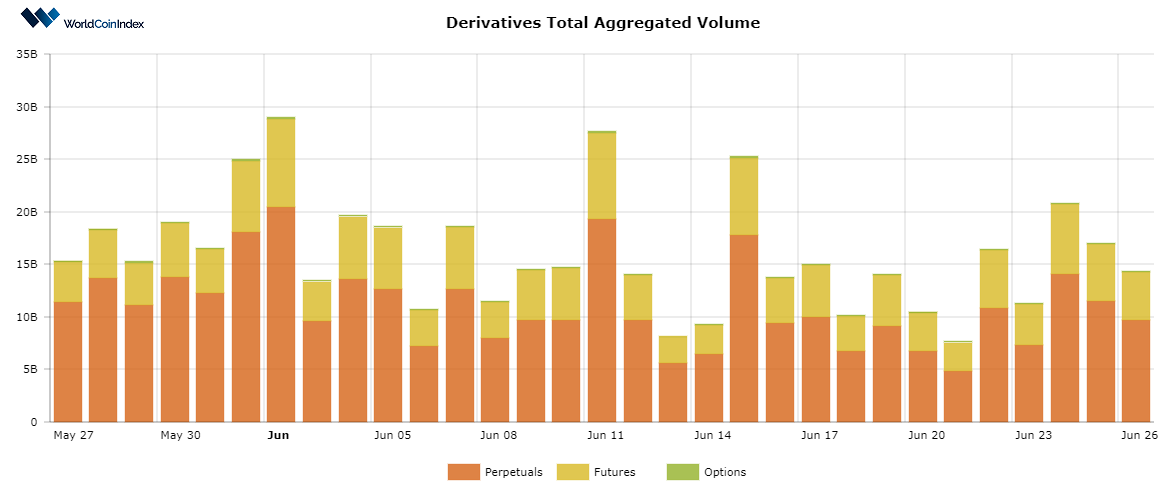

To kick things off, the total aggregated trading volume has increased when compared to last week’s numbers:

- The options trading volume increased from last week’s $90.24M to $122.43M today;

- The futures trading volume slightly increased from last week’s $4.43B to $4.56B;

- Perpetuals also benefit from a volume increase, as levels have risen from $9.1B to $9.67B.

While this increase is most definitely appreciated, significantly higher volumes have been witnessed in the past across all derivative categories.

At press time, the total crypto derivatives aggregated trading volume is situated at $14.35B.

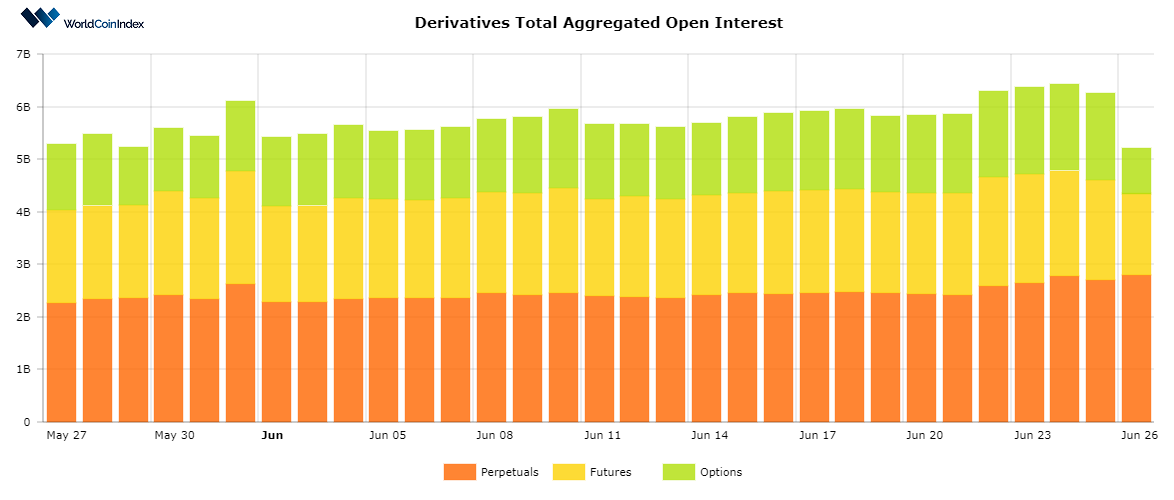

A quick look into the current open interest rates

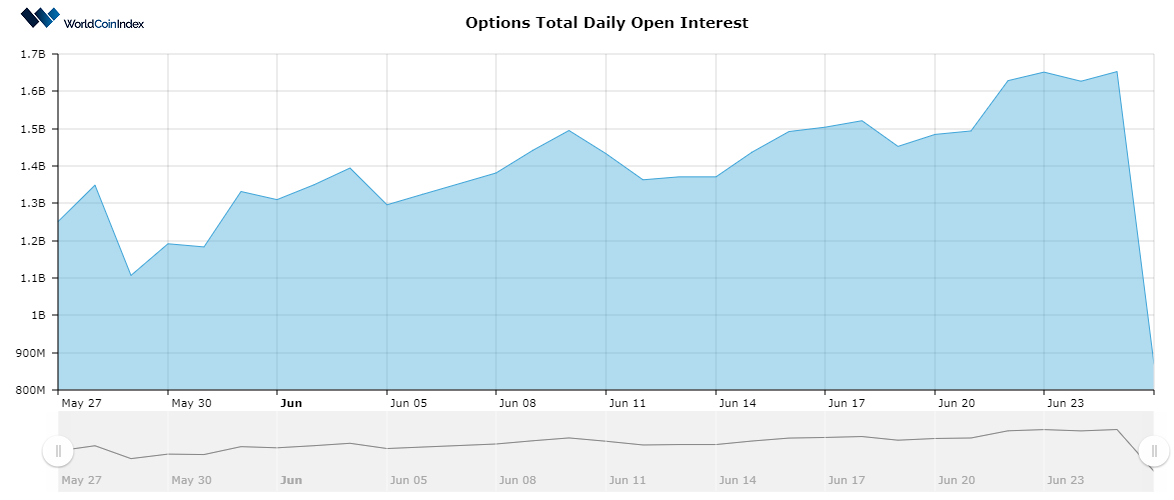

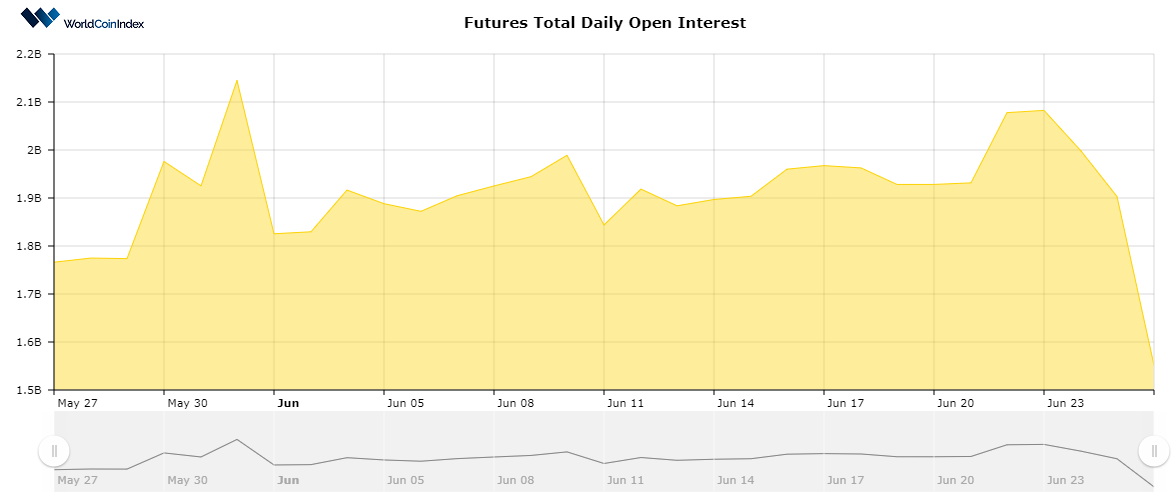

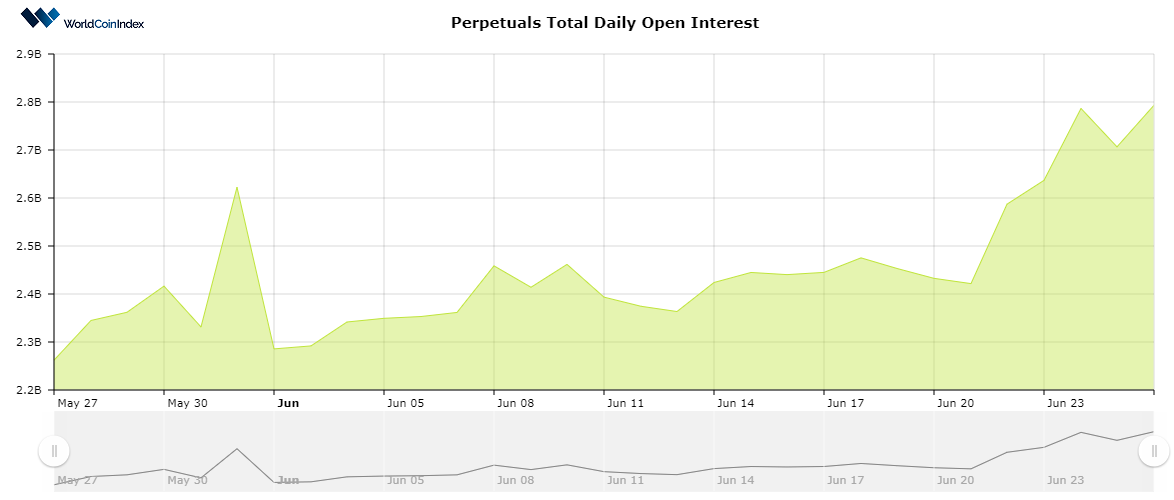

Right now, the total open interest rate is situated at $5.21B, which is $600M less when compared to the numbers registered last week. Open interest rates are bound to continue decreasing, given the fact that we’re nearing the end of the month, when numerous derivative contracts will expire.

With this in mind, the open interest rate for futures, options and perpetuals are already tanking in anticipation for the expiration date. Last week, we reported an OI of $1.41B for options, whereas today, WCI showcases an OI of $0.86B.

In the case of futures, the current OI is situated at $1.54B, lower than last week’s $1.90B.

Last but not least, the open interest for perpetuals is currently situated at $2.80B, a higher threshold than last week’s $2.47B.

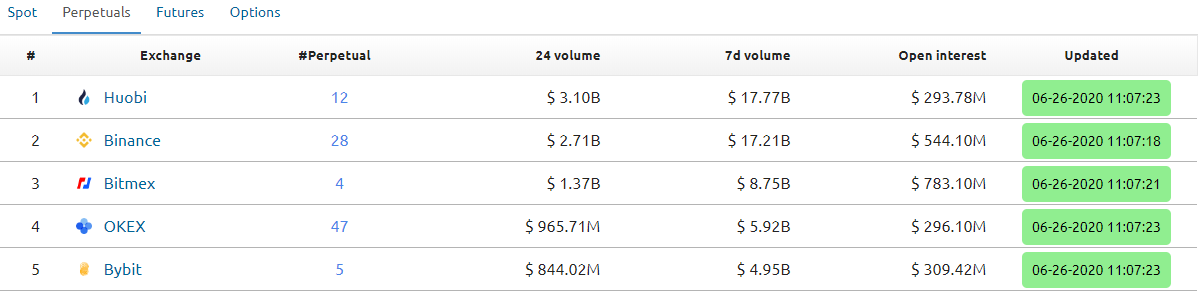

Relevant cryptocurrency exchange derivatives data

In the case of perpetuals, Huobi continues to hold the largest daily trade volume, estimated at $3.1B, and followed by Binance with $2.71B and Bitmex with $1.37B.

In the case of futures, OKEX and Huobi are very close to one another, with OKEX holding $2.23B, and Huobi $2.15B. Options trading are mostly controlled by Deribit, with a volume of $114.78M.

These numbers may likely face increased volatility during the next few days, as most contracts expire.

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.