WorldCoinIndex Derivatives Report 2020 – Week 27

Over the last 7-days, the cryptocurrency market has been fairly stable. As such, in the case of bitcoin, a short price dip was reported on the 27th of June, when the value fell to $8,882, yet the price quickly recovered and continued on a fairly-stable pathway, alongside values that the market is used to.

At this point in time, bitcoin is trading at $9,088, with a 24H high of $9,133 and a 24H low of $9,071. A similar trend is present in the case of most other cryptocurrencies. As such, ETH is trading at $227, LTC at $41, BCH at $222, EOS at $2.41, and XRP at $0.17.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

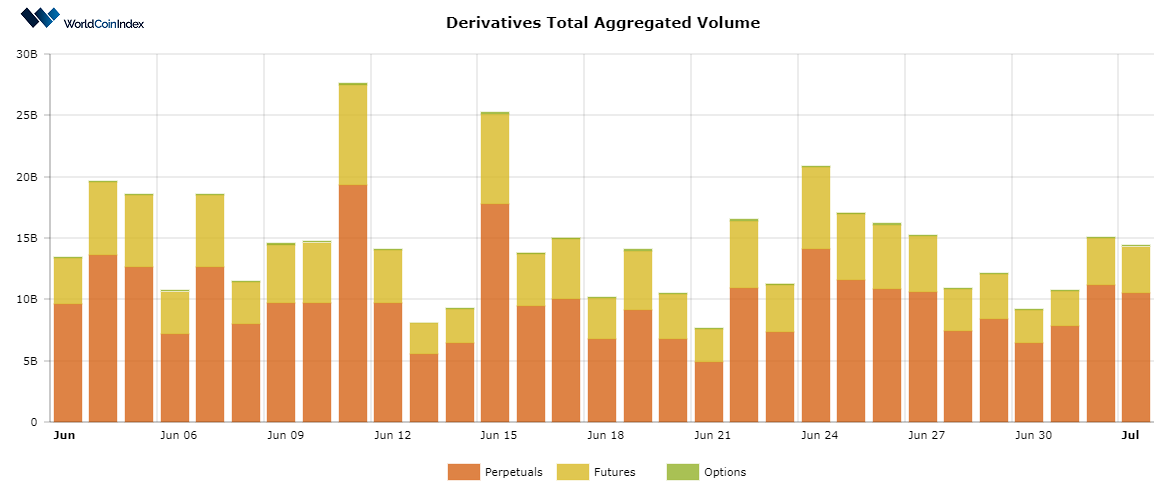

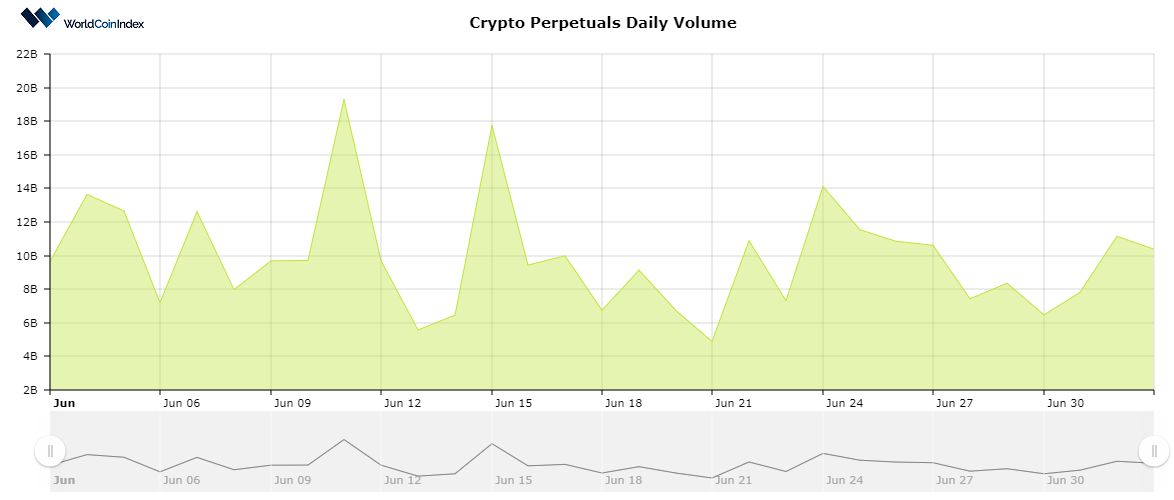

To kick things off, the total aggregated trading volume has remained fairly similar when compared to last week’s numbers. Thus, $14.59B is being reported at press times, whereas we registered a $14.35B value last week.

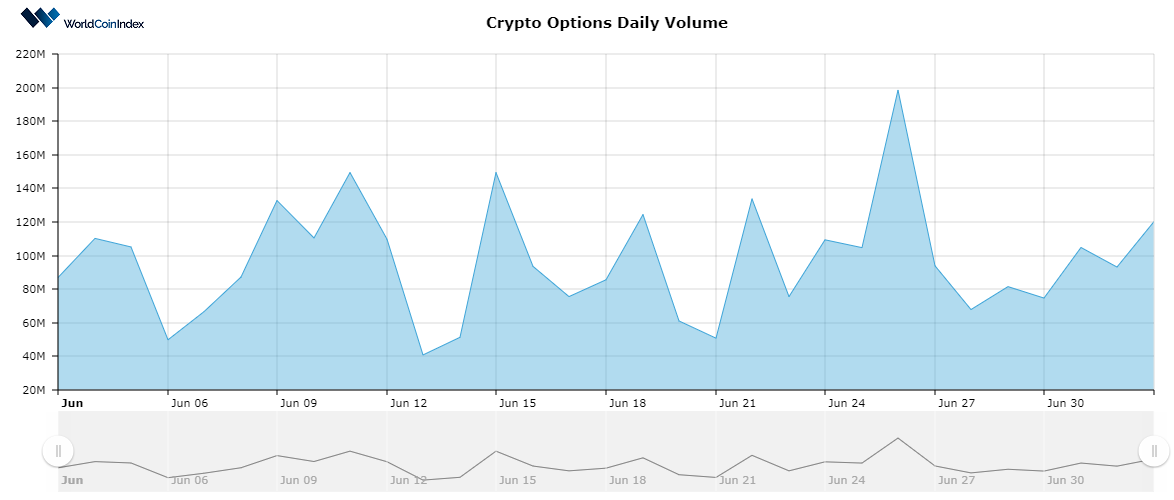

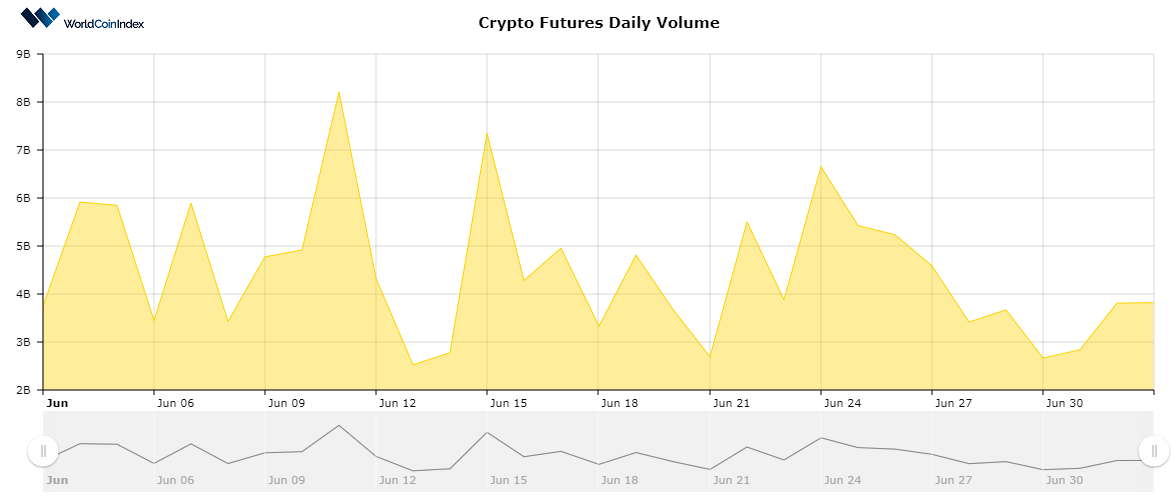

Here’s a brief look at trading volumes by derivatives category:

The options trading volume decreased from last week’s $122.43 to $115.43today

The futures trading volume has seen a stronger decrease from last week’s $4.56B to $3.82B, a fairly-low value when considering macro trends

Perpetuals do benefit from a volume increase, as levels have risen from $9.67B to $10.66B.

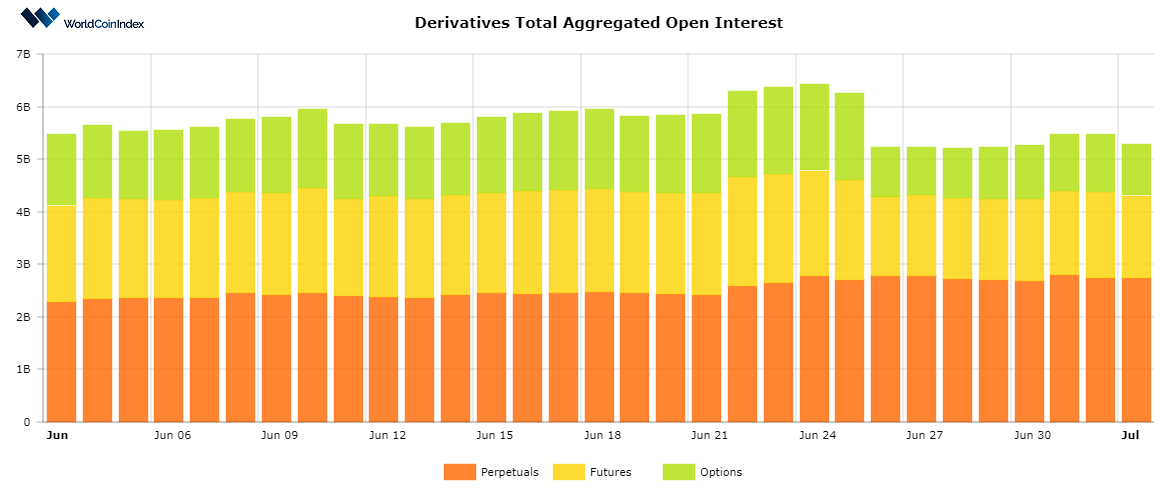

A quick look into the current open interest rates

A slight increase in the aggregated value of open interest has been reported, given the fact that values have risen from last week’s $5.21B to $5.27B today. Numerous derivatives contracts have indeed expired at the end of the month, yet many more were signed, thus keeping the OI rate stable.

From a category standpoint, perpetuals open interest is reported at $2.74B, followed by futures with an OI of $1.56B, and options with an OI of $965.57M.

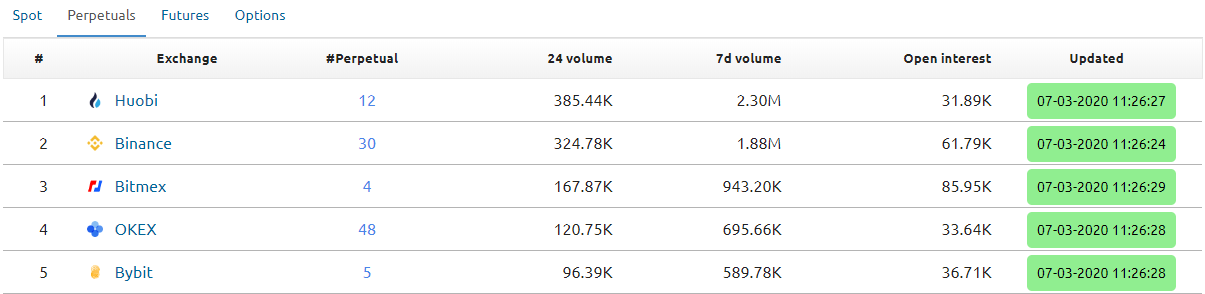

Relevant cryptocurrency exchange derivatives data

In the case of perpetuals, Huobi is currently holding the top position, with $3.52B trading volume, closely followed by Binance with $2.97B. The third spot is being held by Bitmex with $1.53B.

Crypto futures exchange data showcases that Huobi holds supremacy with a volume of $1.94B, whereas OKEX holds $1.73B. Last but not least, the volume for options trading is held strongly by Deribit, with $110M.

Future predictions

During the past week, several discussions were held concerning the impact of crypto derivatives upon the cryptocurrency market. Crypto derivative usage remains fairly-new and attractive to institutional investors, yet many independent investors and cryptocurrency enthusiasts shy away from these trading instruments. While they’re certainly more complicated when compared to standard pair trading, they hold significant profit potential. With this being said, adoption can be stimulated, whereas additional value can be brought onto the cryptocurrency market by raising awareness around digital currency derivatives trading.

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.