WorldCoinIndex Derivatives Report 2020 – Week 32

The past week has been marked by a slight degree of volatility on the cryptocurrency market, given the fact that prices dropped abruptly between the 1st and 2nd of August. However, right after the drop, a slow but steady uptrend began, thus bringing prices back to their previous higher values.

In the case of bitcoin, the digital currency is now trading at $11,817, and had a weekly high of $12,000, and a low of $10,722.

The total cryptocurrency market cap is currently reported at $ 359.11 billion.

ETH is currently trading at $396, XRP at $0.3, LTC at $60.45, EOS at $3.21, Cardano at $0.144, and BCH at $322.

Weekly derivatives summary analysis

Here’s a quick preview of the main events that have occurred on the cryptocurrency derivatives market.

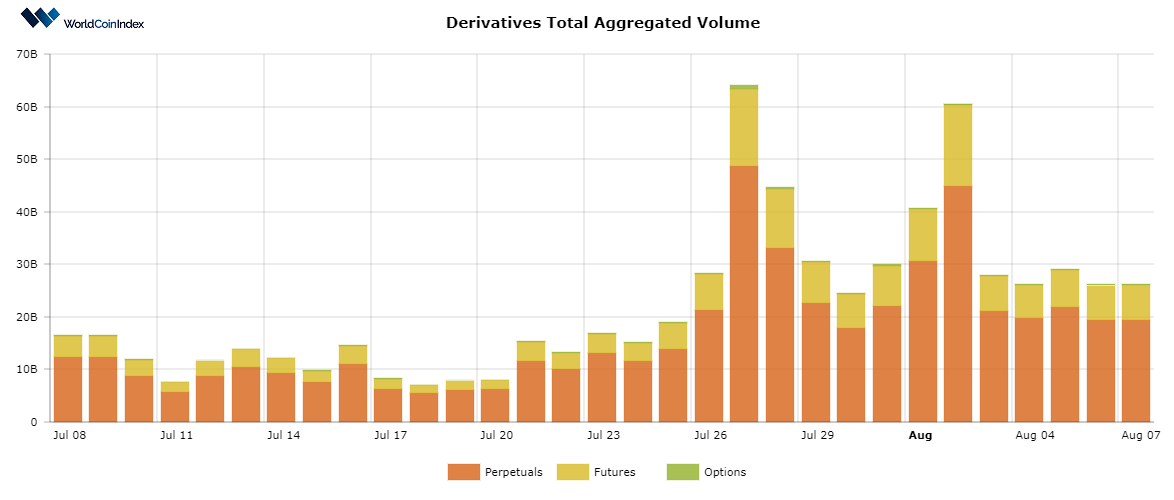

First off, the crypto derivatives aggregated volume has remained fairly steady when compared to last week’s values. As such, the volume is currently estimated at $26.40B.

Here’s a brief look at trading volumes by derivatives category:

- The options trading volume is estimated at $188.49M, lower than last week’s $265M;

- The futures trading volume is estimated at $6.69B, higher than last week’s $6.07B;

- The perpetuals trading is estimated at $19.51B, even higher than last week’s whooping $17.77B.

Thus, while the aggregated derivatives trading volume has mostly remained stable, we are seeing a noticeable increase in the case of perpetuals. The derivatives market is well-stimulated at this point in time, therefore predictions indicate that this uptrend will continue in a steady manner.

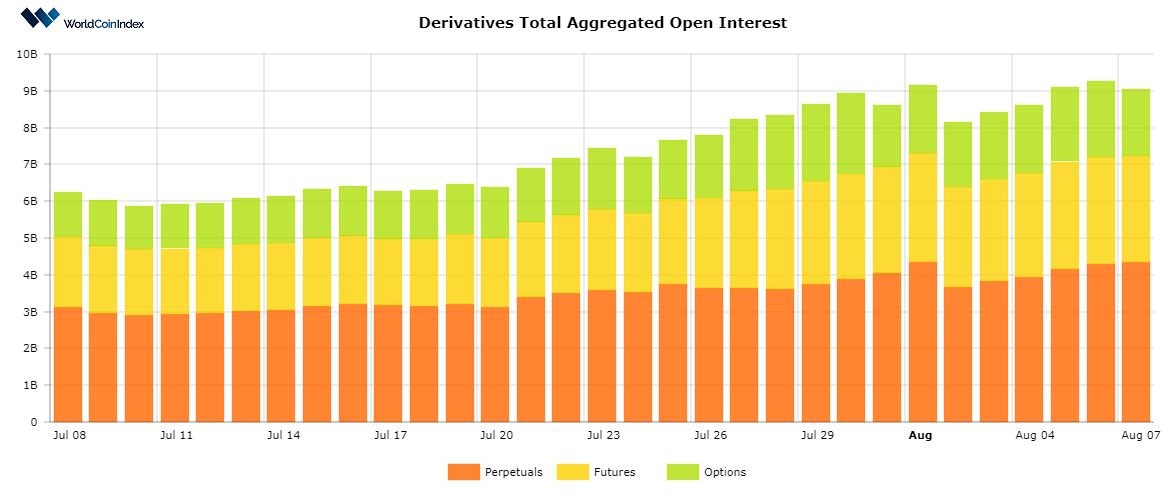

A quick look into the current open interest rates

At this point in time, the total aggregated open interest volume is situated at $9.05, which is almost a billion more when compared to the OI of $8.33B recorded last week.

From a category standpoint, perpetuals report an open interest of $4.35B, followed by $2.66B for futures, and $1.81B for options. Thus, perpetuals and options are seeing a slightly-increased OI rate, whereas futures have decreased negligibly.

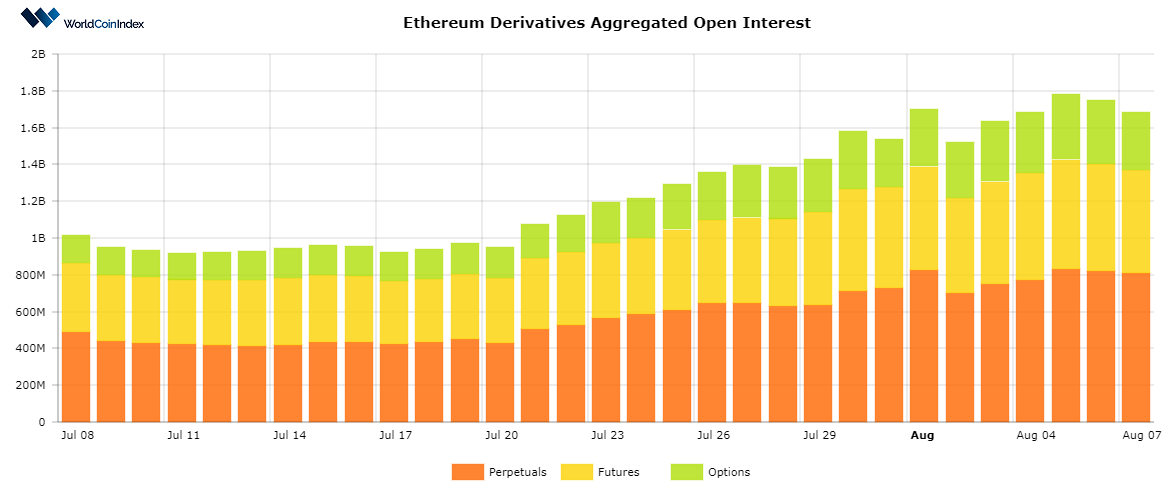

Market data also seems to suggest that Ethereum open interest have managed to set an all-time high two days ago.

Relevant cryptocurrency exchange derivatives data

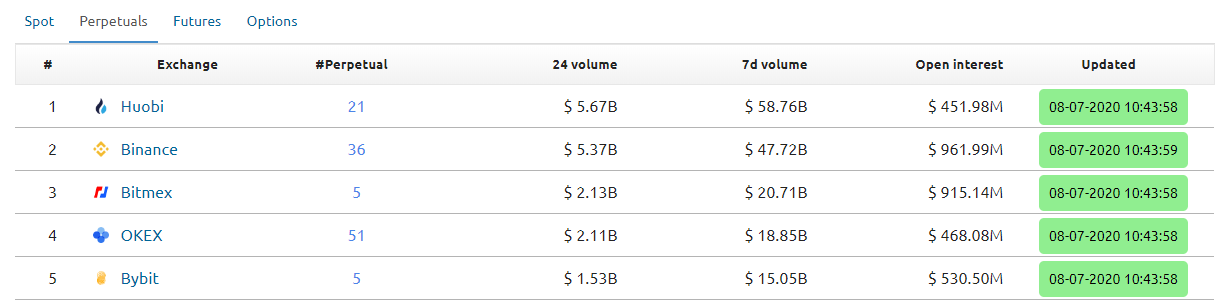

At press time, cryptocurrency exchanges report a standard 24h volume of $48.81B.

In the case of perpetual derivatives, Huobi remains the top-ranking exchange, with a 7d volume of $58.72B. Futures are led by OKEX with a 7d volume of $30.98B, whereas options are trading almost exclusively on Deribit, with a weekly volume of $792.01M.

Soon enough, the crypto derivatives market will see another high-potential exchange, given the fact that the upcoming Alpha5 market has managed to raise over $1.5 million in seed funding.

Resources

https://www.worldcoinindex.com/derivatives

https://www.worldcoinindex.com/openinterest

https://www.worldcoinindex.com/perpetuals

https://www.worldcoinindex.com/futures

https://www.worldcoinindex.com/options

https://www.worldcoinindex.com/exchange/perpetuals

https://www.worldcoinindex.com/exchange/futures

https://www.worldcoinindex.com/exchange/options

Risk Disclaimer

This article includes information about cryptocurrencies, derivatives and other financial instruments. Both cryptocurrencies and derivatives are complex instruments and trading digital assets involve significant risk and can result in the loss of your invested capital. All data and information is provided “as is” for personal informational purposes only, and is not intended for trading purposes or advice. Please consult your broker or financial representative to verify pricing before executing any trade.