DeFi Tokens Plunge In A Wide Sell-off, Is This The DeFi Bubble Burst?

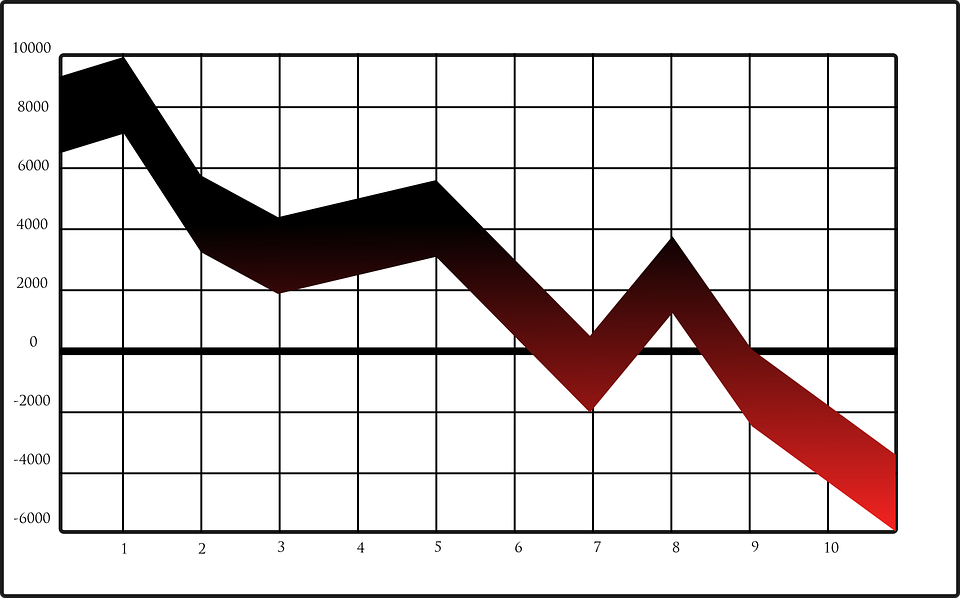

The Decentralized finance (DeFi) sector which witnessed a massive growth this year with DeFi token raging the cryptocurrency market. While cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) are strongly holding their ground, DeFi tokens have plunged faster than the DeFi market over the last week.

The total value locked (TVL) in DeFi has declined by nearly 10% as per DeFi pulse. TVL is usually regarded as a metric that hints at the overall health of the DeFi sector. Over the last week, almost all of the top-ten DeFi tokens have lost anywhere between 10-50%.

Chainlink (LINK), the top DeFi token by market cap has lost 12.1% of its value over the last week. However, since September 1, 2020, LINK has lost nearly 50% of its price. Other DeFi tokens have registered even deeper losses over the last week.

Aave (LEND) has lost 19.5%, Uniswap (UNI) has been hit with a hammer blow losing 32.4%. Yearn.Finance (YFI) losing 44%, Compound (COMP) losing 20%, and UMA losing 33%.

Analysts have already started talking that this is just the start of the DeFi bubble burst. Many analysts have also been previously warning about the massive craze and rapid surge in DeFi token valuations. Ethereum’s Vitalik Buterin also warned about the frenzy around the Yield Farming tokens.

Some of the popular DeFi tokens like Uniswap UNI and SUSHI have already entered the zone of negative returns. It looks like DeFi is still in the very early stages and under the strong dominance of traders seeking quick profits instead of HODLers and long-term investors.

Despite the latest crash, most of the top DeFi tokens are having positive returns year-to-date and in multiples of 100 percentages. Aave (LEND) is positive by 2278% whereas Yearn.Finance (YFI) is positive by 1105%.

The total market cap of the top 100 DeFi tokens is nearly $12 billion which is like 4% of the overall cryptocurrency market cap. Also, since the start of 2020, the total value locked across DeFi platforms has surged by over 1500%.

The total value locked in DeFi is currently $10.3 billion with Uniswap protocol dominating 22% shares. However, the UNI governance token launched in mid-September has seen its price going down and is currently down by 20% since launch. The UNI token price is $2.80 at press time.